District of Columbia Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal document templates that you can download or print.

By utilizing the site, you can access thousands of forms for business and personal uses, categorized by type, state, or keywords. You can find the latest versions of forms such as the District of Columbia Hardship Letter to Mortgagor or Lender to Avoid Foreclosure in just a few seconds.

If you hold a membership, Log In and retrieve the District of Columbia Hardship Letter to Mortgagor or Lender to Avoid Foreclosure from the US Legal Forms library. The Download option will appear on each form you view. You can access all previously obtained forms in the My documents section of your profile.

Complete the purchase. Use a credit card or PayPal account to finalize the transaction.

Select the file format and download the form to your device. Make modifications. Fill out, edit, and print and sign the acquired District of Columbia Hardship Letter to Mortgagor or Lender to Avoid Foreclosure.

Each template added to your account has no expiration date and is yours permanently. Thus, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

Access the District of Columbia Hardship Letter to Mortgagor or Lender to Avoid Foreclosure with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the right form for your city/state.

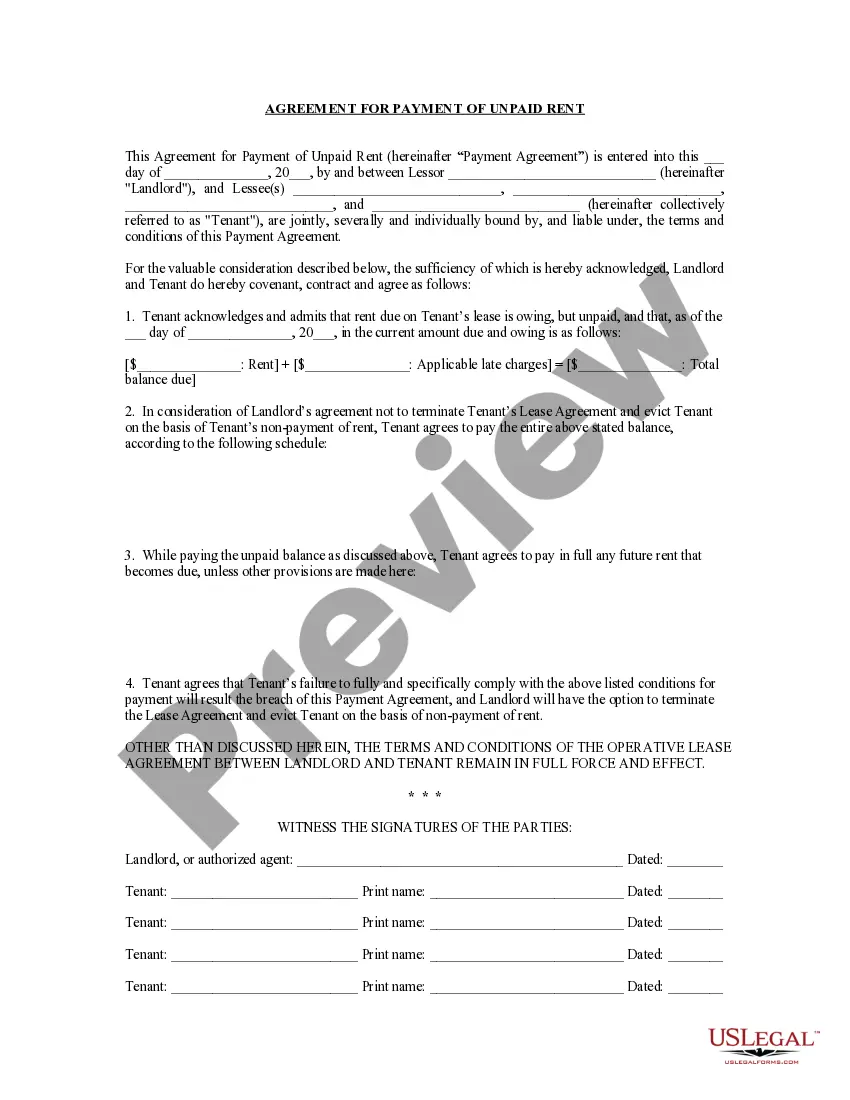

- Click the Review option to verify the form's content.

- Read the form summary to confirm you've picked the right form.

- If the form doesn't meet your requirements, use the Search field at the top of the display to find the one that does.

- Once satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose your pricing plan and provide your details to register for an account.

Form popularity

FAQ

Several factors can influence a lender's decision regarding a deed in lieu of foreclosure. First, if the borrower has not provided a well-prepared District of Columbia Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, the lender may doubt the borrower's financial situation. Additionally, if there are existing liens on the property, the lender may feel uncertain about recouping their investment. It’s essential to communicate effectively and provide necessary documentation to improve your chances of acceptance.

To substantiate financial hardship, you will need to provide documentation that includes income proof, bank statements, and expenses like medical bills or loss of employment notices. These documents help demonstrate the seriousness of your situation. Along with this information, a well-crafted District of Columbia Hardship Letter to Mortgagor or Lender to Prevent Foreclosure can strengthen your request for relief.

When writing a foreclosure hardship letter, clearly describe the financial struggles you face, such as loss of income or unexpected expenses. Explain how these factors have impacted your ability to meet mortgage payments. It is crucial to convey your intention to resolve the situation positively. Your District of Columbia Hardship Letter to Mortgagor or Lender to Prevent Foreclosure should reflect your desire to work together with your lender.

When writing a hardship letter, avoid overly emotional language or irrelevant details that do not pertain to your financial situation. Additionally, do not make threats or serve ultimatums, as this can alienate your lender. Keep your letter focused on factual information that clearly states the reason for your hardship. Remember, the goal is to create a compelling District of Columbia Hardship Letter to Mortgagor or Lender to Prevent Foreclosure.

To write a proof of hardship letter, introduce yourself and explain your current financial situation clearly. Include specific details about your hardships, supported by attached documents, like income statements and medical records, which validate your claims. Be honest and empathetic in your tone, and express your willingness to find a solution. The District of Columbia Hardship Letter to Mortgagor or Lender to Prevent Foreclosure becomes vital in presenting your case effectively.

A hardship letter for a mortgage serves as a formal request to your lender explaining your financial difficulties and requesting assistance to avoid foreclosure. For example, a borrower might write about a job loss or unexpected medical expenses impacting their ability to make mortgage payments. The District of Columbia Hardship Letter to Mortgagor or Lender to Prevent Foreclosure should outline your situation clearly, provide relevant details, and express your willingness to work with the lender on possible solutions. It's essential to convey your commitment to resolving the issue, showing the lender you are taking proactive steps to avoid foreclosure.

How to Write an Effective Hardship LetterPart 1: Explain what happened and why you are applying.Part 2: Specifically illustrate the time and severity of the hardship.Part 3: Back up the reasons traditional remedies won't work.Part 4: Detail why you are stable enough to succeed with a modification.More items...?

Bank statements showing a reduction of income, essential spending and reduced savings. a report from a financial counselling service. debt repayment agreements. any other evidence you have to explain your circumstances.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

The definition of hardship is adversity, or something difficult or unpleasant that you must endure or overcome. An example of hardship is when you are too poor to afford proper food or shelter and you must try to endure the hard times and deprivation.