This due diligence checklist identifies the guidelines and general overview of a corporation by providing information and supportive materials regarding business transactions.

District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview

Description

How to fill out Short Form Checklist And Guidelines For Basic Corporate Entity Overview?

US Legal Forms - one of the largest compilations of legal templates in the United States - offers an extensive selection of legal document templates that you can download or print.

Through the website, you can discover thousands of forms for both business and personal needs, categorized by type, state, or keywords. You can obtain the latest versions of documents such as the District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview in just moments.

If you already have a monthly subscription, Log In and retrieve the District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview from your US Legal Forms library. The Download option will be visible on each form you view. You can access all previously downloaded forms from the My documents tab in your account.

Process the payment. Use your Visa, Mastercard, or PayPal account to complete the payment.

Select the format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview. Each template you add to your account has no expiration date and is yours permanently. Thus, to download or print another copy, simply go to the My documents section and click on the form you require.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

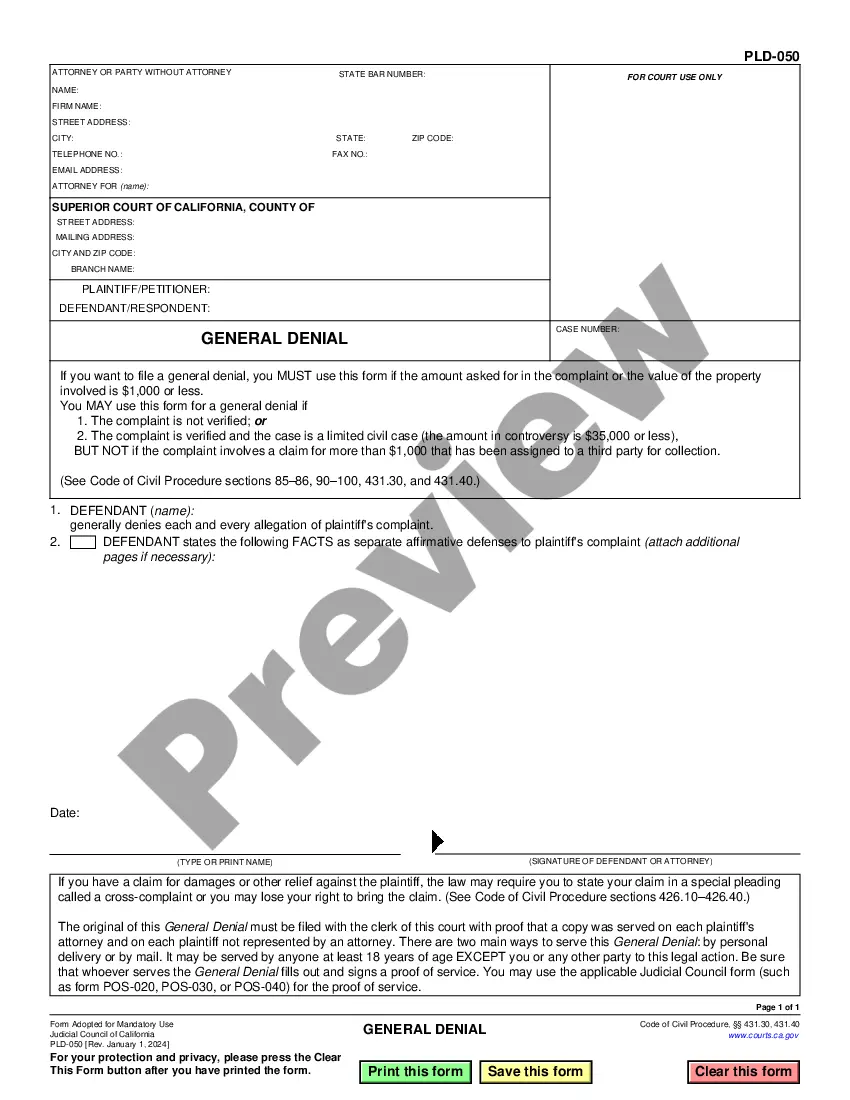

- Ensure you have selected the correct form for your region/area. Click on the Preview option to review the form's content.

- Examine the form summary to confirm that you have chosen the correct template.

- If the form does not fit your needs, utilize the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

To file a DC biennial report, you will need to complete the report form and provide updated information about your corporation. This includes details such as business address, officers, and registered agent. Filing is essential to maintain your corporation's good standing, and using the District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview will ensure you adhere to all necessary steps.

Yes, registering your business in the District of Columbia is typically required. This process not only legitimizes your company but also keeps you compliant with local laws. For a comprehensive understanding of registration requirements and procedures, the District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview can serve as a valuable resource.

Filing the FR 500 in DC involves completing the appropriate forms with accurate financial data. You will need to provide information about your business income, deductions, and any applicable credits. It's important to stay updated with the latest guidelines, and the District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview can help streamline your filing process.

To form a corporation in the District of Columbia, you need to follow a few key steps. First, choose a unique name and ensure it complies with DC naming requirements. Then, prepare and file your Articles of Incorporation with the DC Department of Consumer and Regulatory Affairs. For more detailed assistance, consider consulting the District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview, which provides invaluable insights into the entire process.

To request a copy of your articles of incorporation in Washington, DC, contact the DCRA by phone, email, or through their website. You will need to provide some identification and details about your business entity. By following the District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview, you ensure that you complete your request smoothly. Using uslegalforms can streamline your access to official documents and support your business needs.

To retrieve your articles of incorporation, visit the DCRA or the D.C. Secretary of State's office. You can request a copy of your documents online or in person. The District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview can help you navigate this process effectively. Ensure you have the necessary details ready to facilitate your request.

Yes, articles of incorporation are public documents in the District of Columbia. This transparency allows anyone to access the information held within these documents, including the business's structure and ownership. For a comprehensive review, refer to the District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview. This resource will help you understand what information is included in these articles.

To obtain a DC basic business license, start by visiting the Department of Consumer and Regulatory Affairs (DCRA) website. There, you will find the District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview which will guide you through the application process. Be sure to gather necessary documentation to support your application. Once your application is submitted, you will receive a notification about the approval status.

Form FR-500 is the District of Columbia's business tax registration form. This form is essential for businesses that need to register for various taxes, including sales tax and franchise tax. Understanding the District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview can help you complete this form accurately and efficiently.

Starting an LLC in Washington, D.C., involves several key steps. First, select a unique name for your LLC that complies with DC naming rules. Then, file the Articles of Organization with the Department of Consumer and Regulatory Affairs, and be sure to consult the District of Columbia Short Form Checklist and Guidelines for Basic Corporate Entity Overview for a smooth process.