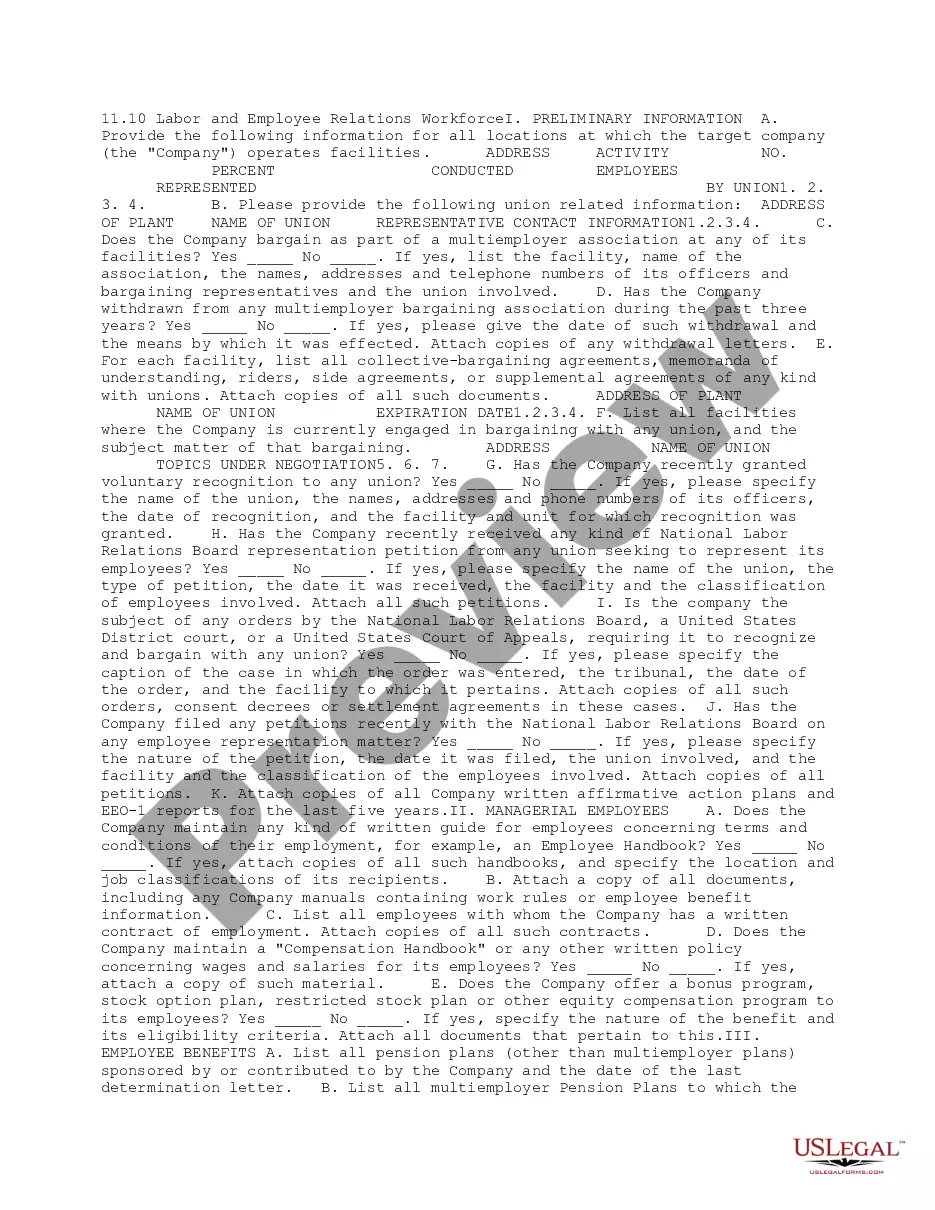

District of Columbia Management Questionnaire Employee Benefit Matters

Description

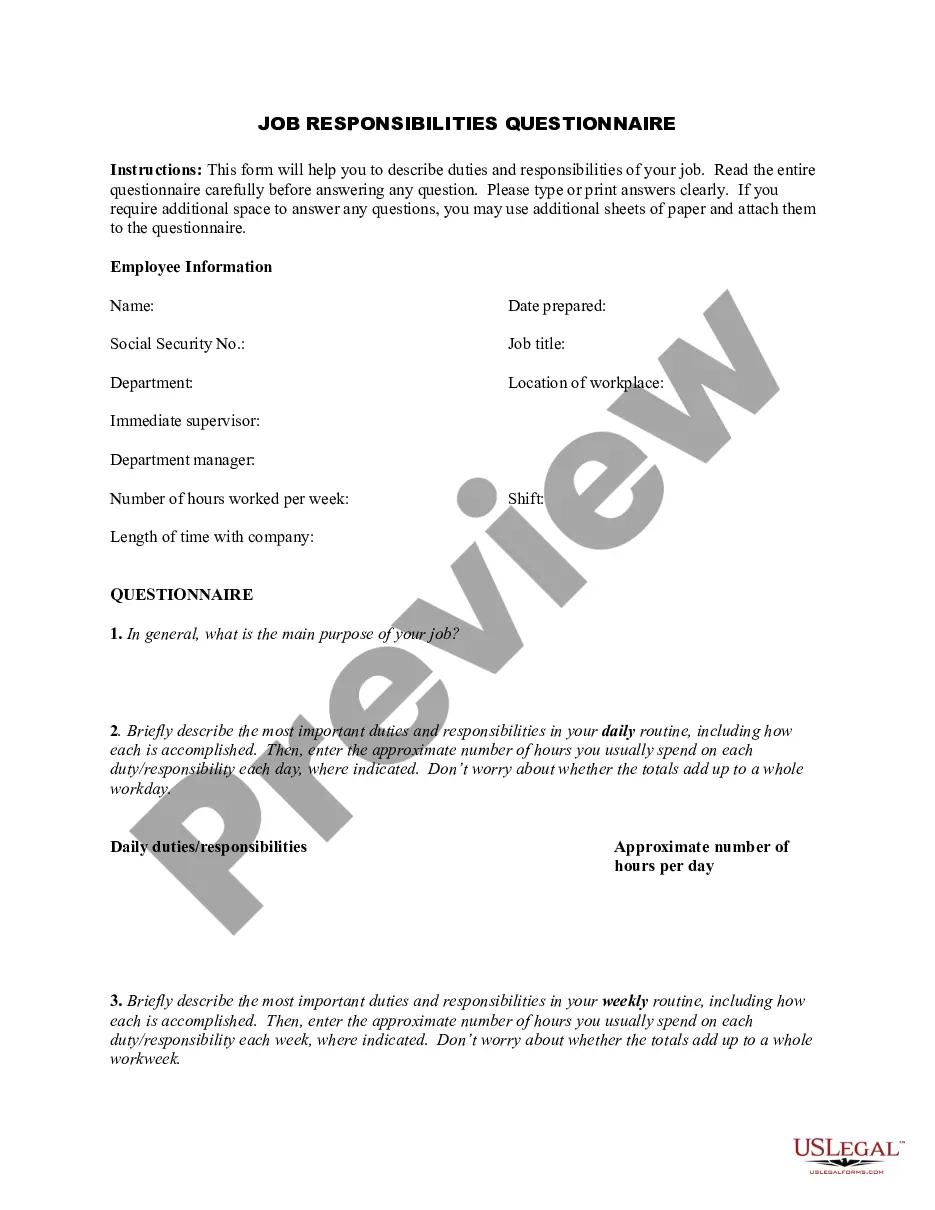

How to fill out Management Questionnaire Employee Benefit Matters?

You can spend hours online attempting to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal forms that are verified by professionals.

You can download or print the District of Columbia Management Questionnaire Employee Benefit Matters from our service.

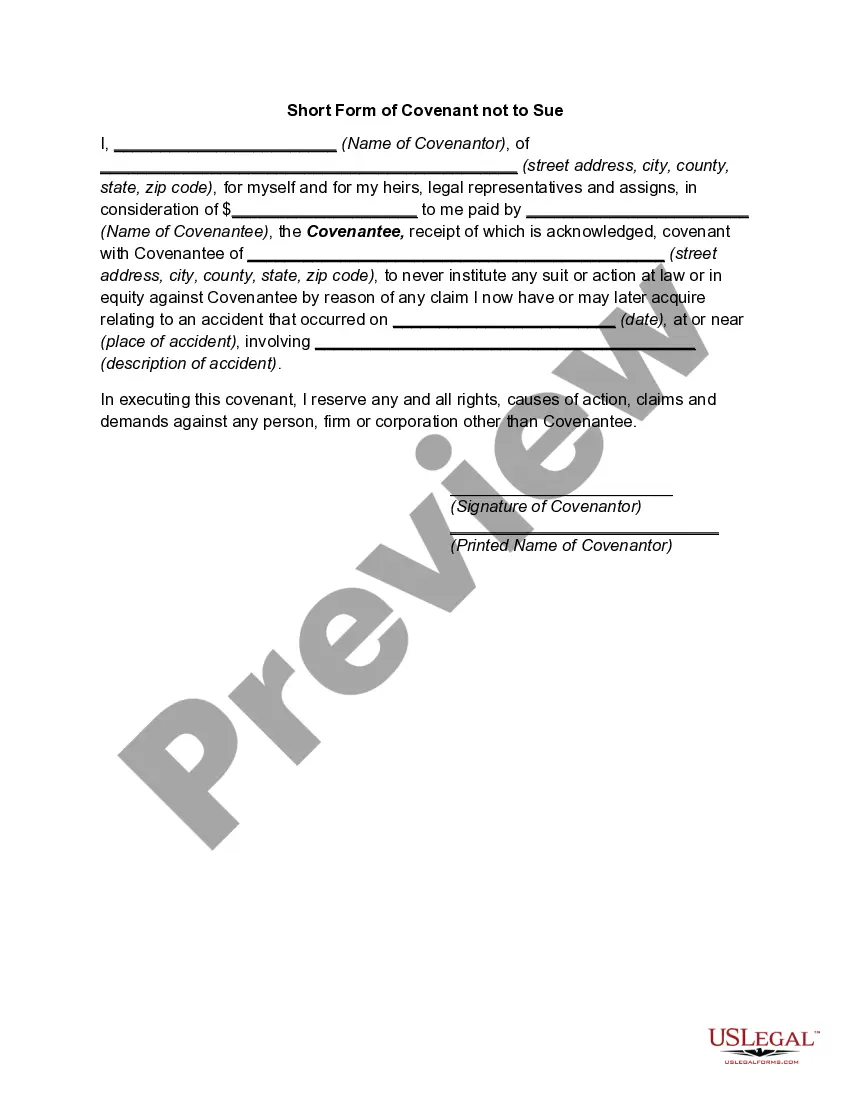

If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can click Log In and hit the Download button.

- After that, you can complete, modify, print, or sign the District of Columbia Management Questionnaire Employee Benefit Matters.

- Each legal document template you purchase is yours for a lifetime.

- To obtain another copy of any acquired form, navigate to the My documents section and click the relevant button.

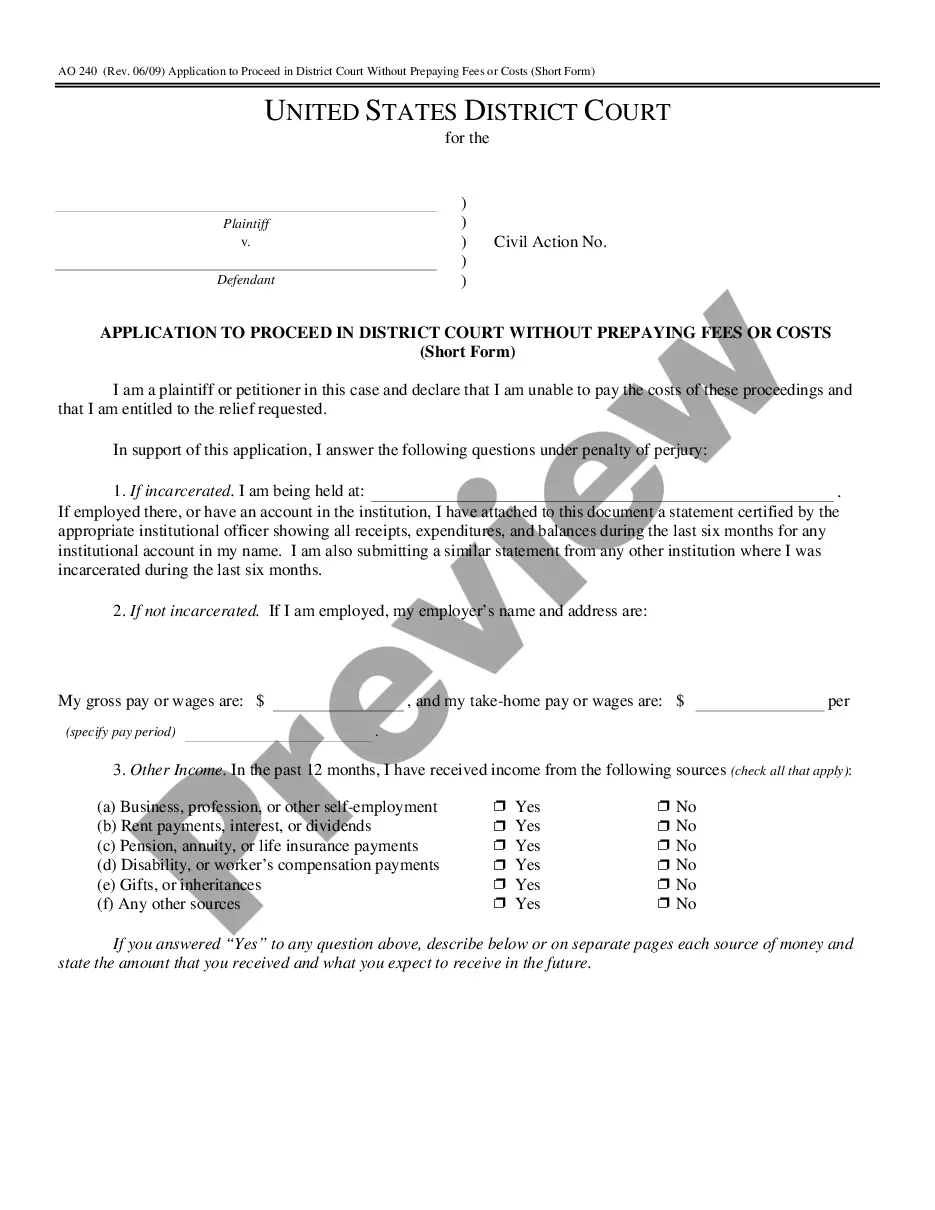

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for the area/city of your choice.

- Review the form description to verify that you have chosen the correct form.

Form popularity

FAQ

You are eligible for Paid Family Leave benefits if you: Spend more than 50% of your time working in DC. Eligible workers must spend a majority of their time working the Districtincluding teleworking or telecommutingfor a covered employer, and must have completed that work during the year prior to needing leave.

Covered employers include all DC employers subject to DC Unemployment Insurance (UI) tax and self-employed individuals who choose to opt in to the program. In general, covered workers include all workers who (predominately) work in DC and no more than 50% in another jurisdiction.

The most common benefits are medical, disability, and life insurance; retirement benefits; paid time off; and fringe benefits. Benefits can be quite valuable.

Changes to D.C. FMLA However, under the amended law, an employee is eligible for D.C. FMLA leave if the individual has been employed by the same employer for at least 12 consecutive or non-consecutive months in the seven years immediately preceding the date on which the leave will begin.

Medicare and social security, unemployment insurance, workers' compensation, health insurance, and family and medical leave are all benefits that the federal government requires businesses to provide. State governments may have other requirements.

Paid-leave benefits are calculated based on an eligible individual's average weekly wage; the total wages in covered employment earned during the highest 4 out of 5 quarters (the base period) immediately preceding a qualifying event, divided by 52.

The Top 5 Types of Employee Benefits1) Health Benefits. When it comes down to it, the quality of health benefits is directly correlated with employee satisfaction in the workplace.2) Retirement.3) Workplace Flexibility.4) Wellness Program.5) Tuition Reimbursement.

Private-sector employers in the District will pay a . 62% tax beginning July 1, 2019, to fund the paid-leave benefit. The Paid Family Leave tax is 100% employer-funded and may not be deducted from a worker's paycheck.

Contact your regional EBSA office to file a complaint or an appeal after exhausting your insurance appeals process. You can also find ERISA information through the U.S. Department of Labor online at .

Here is a list of popular employee benefits in the United States:Health insurance.Paid time off (PTO) such as sick days and vacation days.Flexible and remote working options.Life insurance.Short-term disability.Long-term disability.Retirement benefits or accounts.Financial planning resources.More items...?