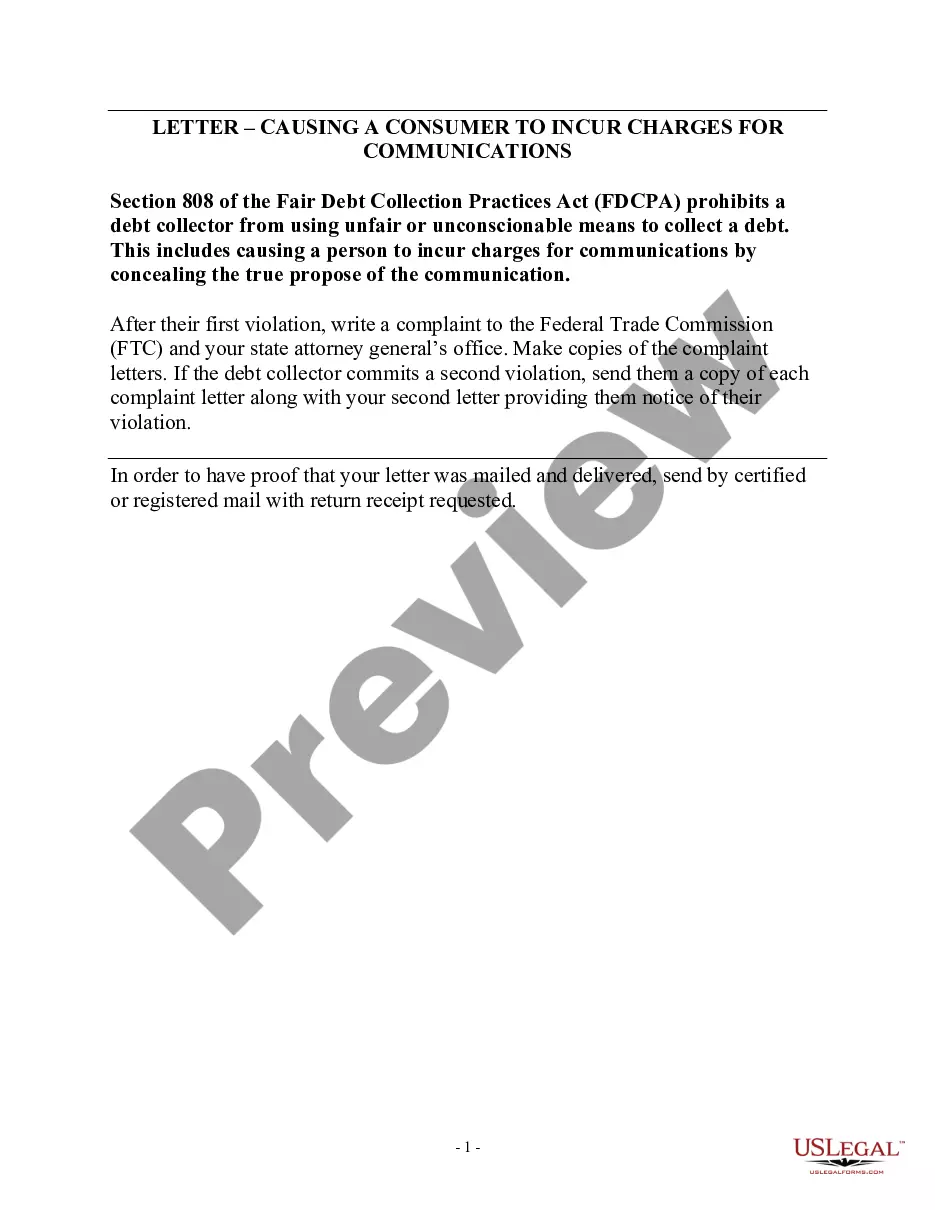

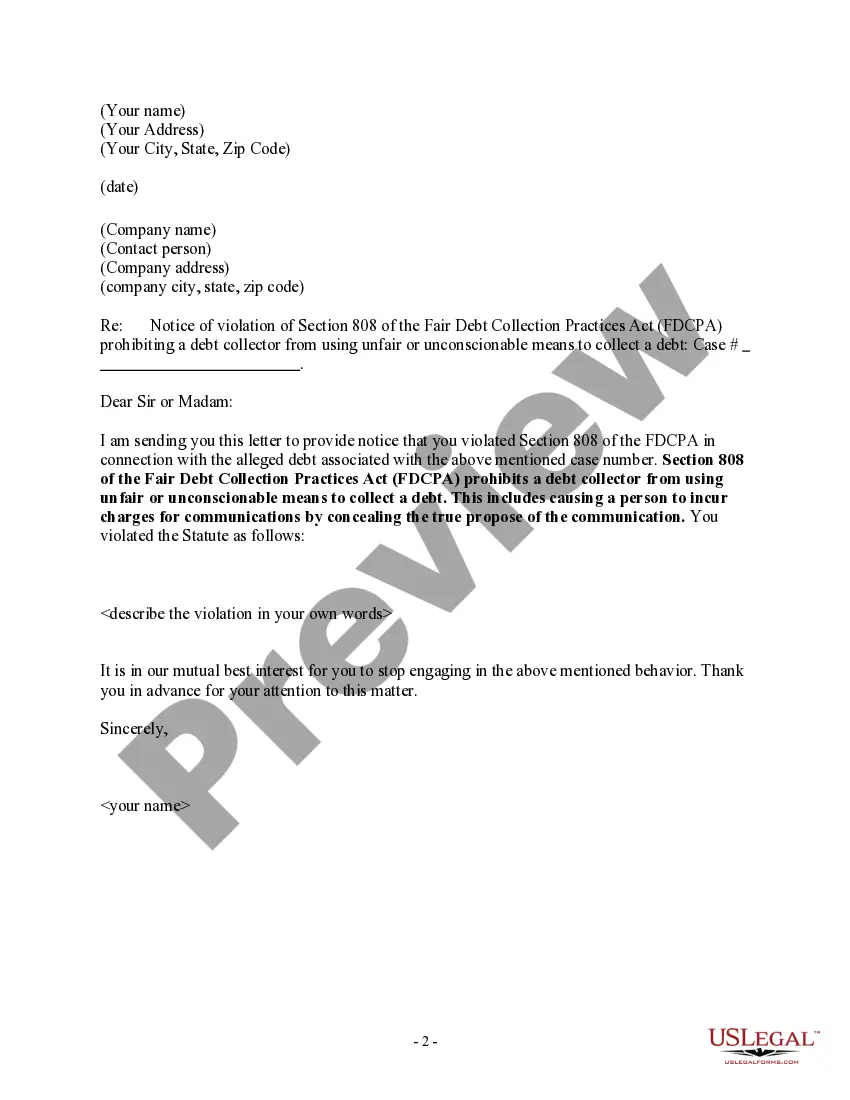

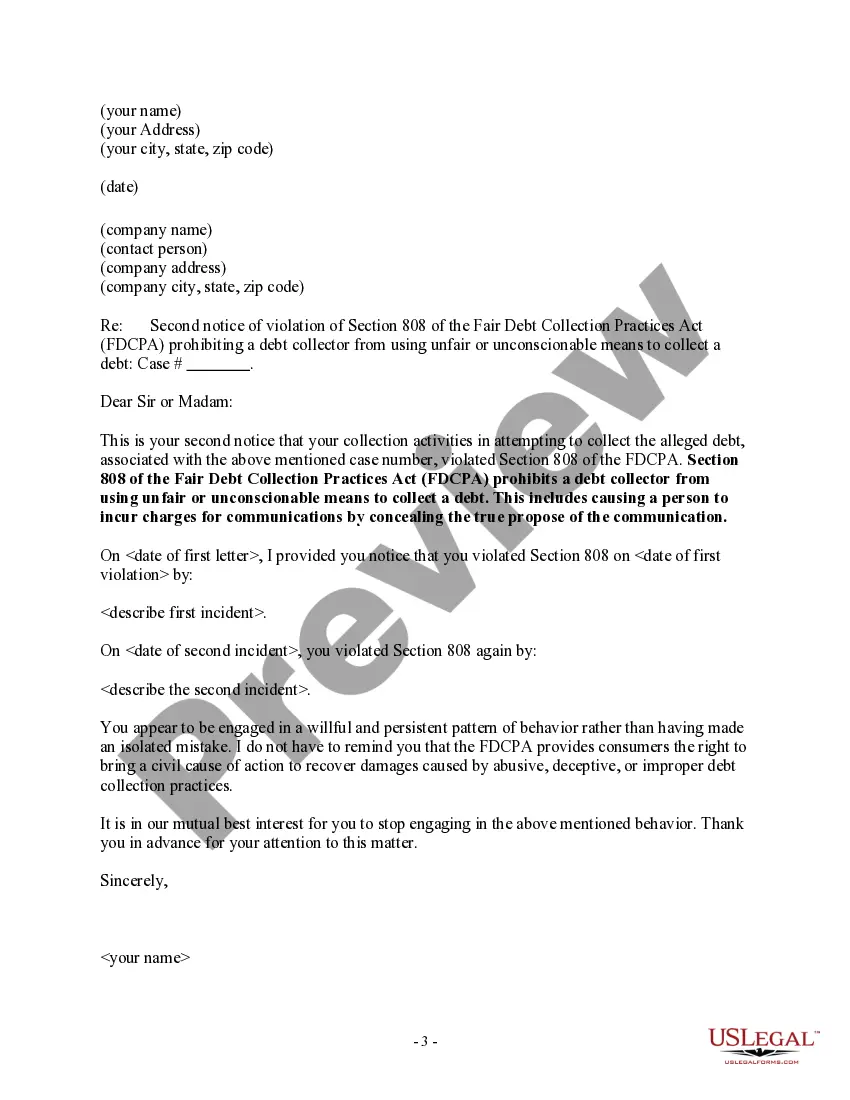

A debt collector may not use unfair or unconscionable means to collect a debt. This includes causing a person to incur charges for communications by concealing the true propose of the communication.

District of Columbia Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication

Description

How to fill out Notice To Debt Collector - Causing A Consumer To Incur Charges For Communications By Concealing The Purpose Of The Communication?

It is feasible to dedicate time online trying to locate the lawful document format that complies with the federal and state requirements you will require.

US Legal Forms offers thousands of legal templates that can be reviewed by experts.

You can download or print the District of Columbia Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication from my services.

If available, use the Review button to go through the document format as well. If you want to find another version of the form, utilize the Search field to discover the format that meets your requirements and preferences.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- Afterward, you can fill out, edit, print, or sign the District of Columbia Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication.

- Each legal document format you obtain is yours indefinitely.

- To get another copy of the purchased form, visit the My documents tab and click the appropriate button.

- If you are accessing the US Legal Forms website for the first time, follow the simple directions below.

- Firstly, ensure you have selected the correct document format for the county/city of your choice.

- Review the form description to confirm you have selected the accurate form.

Form popularity

FAQ

It is well known that a debt collector is only entitled to charge fees that are prescribed by the Debt Collectors Act. The debt collector, and the creditor for that matter, has no discretion whatsoever as to whether they may charge anything else besides the prescribed fees.

Keep a level head and follow these steps.Make Sure You Have Time to Talk.Get a Pen and Paper.Ask the Collector to Send Information About the Debt.Don't Admit to the Debt.Don't Give Information About Your Income, Debts, or Other Bills.Hang Up, If Necessary.After the Call, Decide What to Do Next.

If, within the 30-day period, the consumer disputes in writing any portion of the debt or requests the name and address of the original creditor, the collector must stop all collection efforts until he or she mails the consumer a copy of a judgment or verification of the debt, or the name and address of the original

I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L. Kraninger, took effect Tuesday, Nov.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

party debt collector is permitted to send you electronic messages including texts and emails. Each of these messages must include instructions for a consumer to opt out of receiving those types of messages. Messages must be sent at a reasonable time similar to the 8 a.m. to 9 p.m. limitation for phone calls.

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

A debt collector may state that certain action is possible, if it is true that such action is legal and is frequently taken by the collector or creditor with respect to similar debts; however, if the debt collector has reason to know there are facts that make the action unlikely in the particular case, a statement that

If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) of this section that the debt, or any portion thereof, is disputed, or that the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any