District of Columbia Joint Check Agreement by Contractor

Description

How to fill out Joint Check Agreement By Contractor?

Locating the appropriate legal document template can be a challenge. Clearly, there are numerous templates available online, but how can you identify the legal form you require? Utilize the US Legal Forms website. The platform offers thousands of templates, including the District of Columbia Joint Check Agreement by Contractor, suitable for both business and personal needs.

All forms are reviewed by professionals and comply with federal and state regulations.

If you are already a registered user, Log In to your account and click the Download button to obtain the District of Columbia Joint Check Agreement by Contractor. Use your account to search for the legal forms you have previously purchased. Navigate to the My documents tab in your account to download an additional copy of the form you need.

Complete, edit, print, and sign the downloaded District of Columbia Joint Check Agreement by Contractor. US Legal Forms is the largest library of legal documents where you can find a variety of document templates. Use the service to obtain properly crafted paperwork that complies with state regulations.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

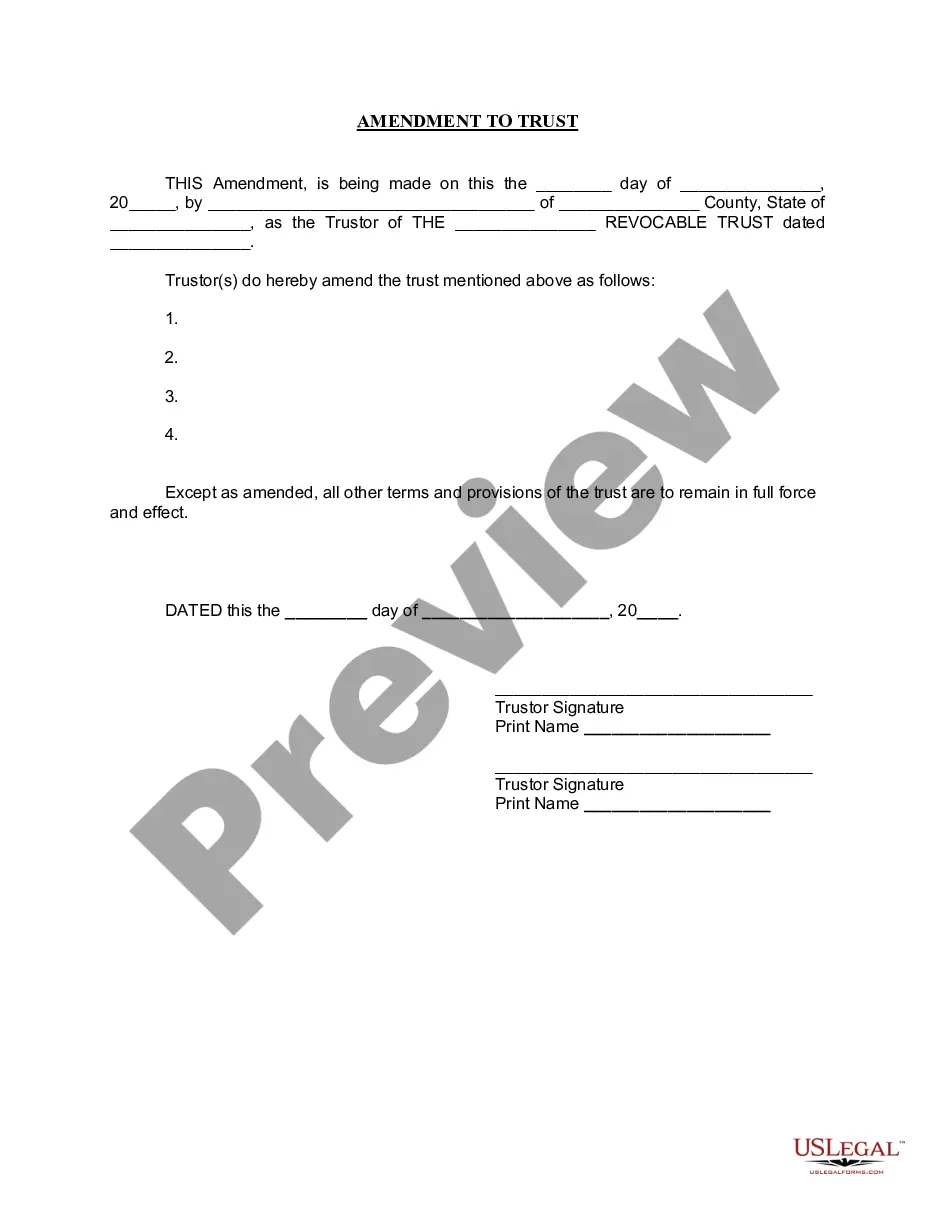

- First, ensure you have selected the correct form for your city/area. You can review the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the right form.

- Once you are certain the form is correct, click the Buy now button to purchase the form.

- Choose the payment plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

To deposit a joint check in construction, both parties named on the check must endorse it. This typically involves both the contractor and the supplier signing the back of the check. Once endorsed, you can take the joint check to a bank or financial institution for deposit. Utilizing a District of Columbia Joint Check Agreement by Contractor simplifies this process, ensuring everyone understands their responsibilities during the transaction and supports smooth financial operations in construction projects.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Elements of a Construction ContractName of contractor and contact information.Name of homeowner and contact information.Describe property in legal terms.List attachments to the contract.The cost.Failure of homeowner to obtain financing.Description of the work and the completion date.Right to stop the project.More items...

In most cases, joint checks are received by subcontractors in the construction industry....Here's how:Go to the Edit menu, at the bottom select Preferences.Select Payments.From the Company Preferences window, put a checkmark beside Use Undeposited Funds as a default deposit to account.Select OK.

Writing a Joint CheckIf it needs to be written to two or more companies, be sure to write out the word and. You may also want to write the words jointly or as joint payees to ensure that bankers notice that the check goes to two parties instead of just one.

When joint checks are involved, two payees must endorse the check in order for that check to be deposited. For example: a contractor may issue a joint check that their subcontractor and their subcontractor's supplier must both endorse before payment can be released.

Joint checks are just that: a check instrument written to your company and somebody else. When everything is going smoothly on a project there usually aren't any problems. These checks come in, they're signed by the parties and deposited by one party according to an agreement.

A joint check is a check made out to two parties that can only be cashed if signed by both parties. Because the check must be signed by both parties before it is cashed, it makes it difficult for Party B to take the money and not pay Party C.

Writing a Joint CheckIf it needs to be written to two or more companies, be sure to write out the word and. You may also want to write the words jointly or as joint payees to ensure that bankers notice that the check goes to two parties instead of just one.

Joint checks are checks paid to more than one person. When a joint check is issued, it is usually made out to the subcontractor as payment for that sub's performance and is also made payable to the supplier from whom the sub obtained his materials.