District of Columbia Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock

Description

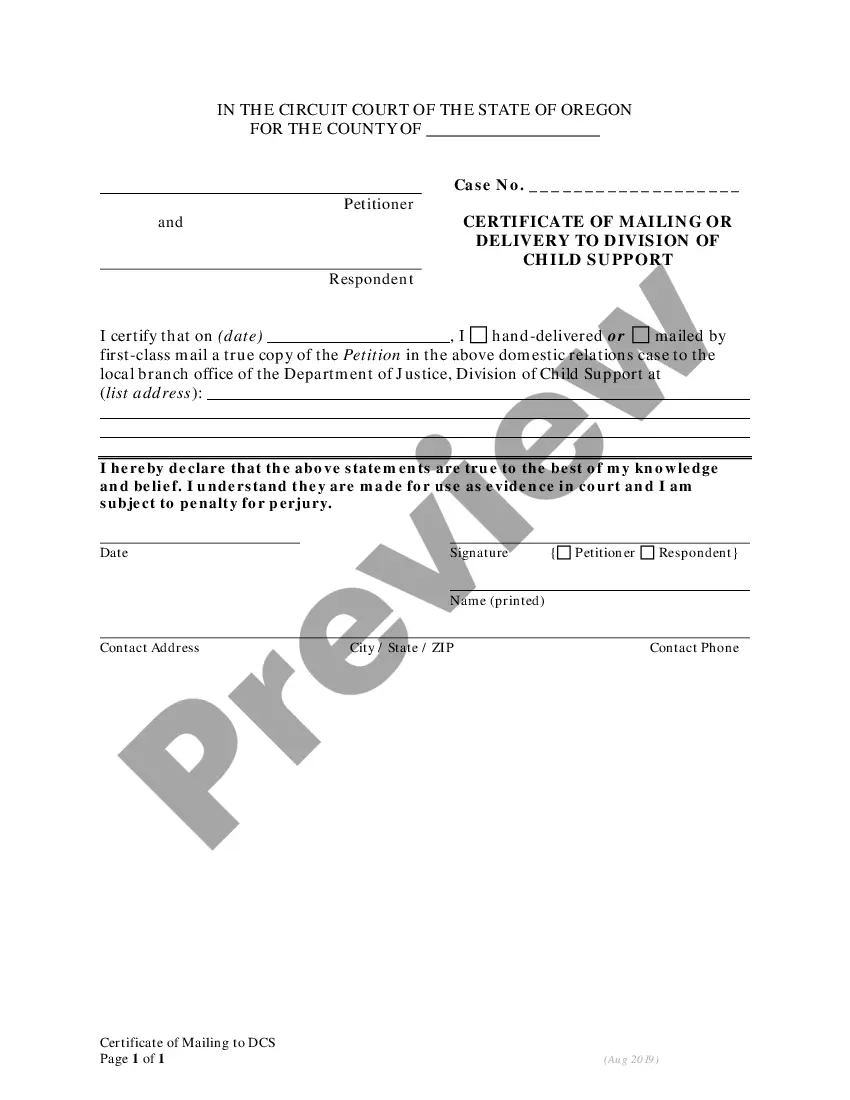

How to fill out Articles Supplementary - Classifying Preferred Stock As Cumulative Convertible Preferred Stock?

US Legal Forms - one of several most significant libraries of legitimate varieties in the USA - provides a wide array of legitimate papers themes you are able to obtain or print out. Utilizing the site, you can find thousands of varieties for enterprise and person purposes, sorted by categories, states, or search phrases.You can get the newest versions of varieties just like the District of Columbia Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock in seconds.

If you already have a monthly subscription, log in and obtain District of Columbia Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock from your US Legal Forms collection. The Down load key can look on each and every kind you perspective. You have access to all earlier downloaded varieties inside the My Forms tab of your own profile.

If you wish to use US Legal Forms initially, listed here are basic recommendations to obtain started off:

- Make sure you have picked out the proper kind for your personal metropolis/region. Click on the Preview key to review the form`s content. Look at the kind description to ensure that you have selected the right kind.

- In the event the kind doesn`t satisfy your needs, utilize the Lookup industry near the top of the display screen to obtain the one which does.

- Should you be satisfied with the form, confirm your choice by clicking on the Buy now key. Then, opt for the prices strategy you want and supply your accreditations to sign up for the profile.

- Approach the transaction. Utilize your bank card or PayPal profile to accomplish the transaction.

- Pick the structure and obtain the form on the system.

- Make adjustments. Complete, change and print out and indicator the downloaded District of Columbia Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock.

Each and every web template you included with your account lacks an expiration day and is your own forever. So, if you want to obtain or print out yet another version, just check out the My Forms segment and click on on the kind you will need.

Obtain access to the District of Columbia Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock with US Legal Forms, the most extensive collection of legitimate papers themes. Use thousands of specialist and state-particular themes that fulfill your small business or person requirements and needs.

Form popularity

FAQ

CCPPO (Cumulative, Convertible, Participating, Preferred-dividend Ordinary) shares are a rare type of equity shares issued by a company, which contain multiple features, including cumulative dividends, participation, convertibility into common shares, and a preferred-dividend feature.

The four main types of preference shares are callable shares, convertible shares, cumulative shares, and participatory shares.

Convertible preferred stock offers the investor the benefits of both preferred stock and common stock. Investors get the stability, liquidation priority, and higher dividends of preferred stock, but they also have the option to convert their shares into common stock later if they believe that the price will go up.

However, convertible preferred stock also has several drawbacks, such as dilution of ownership, lower dividend rates, higher costs, and risk of conversion.

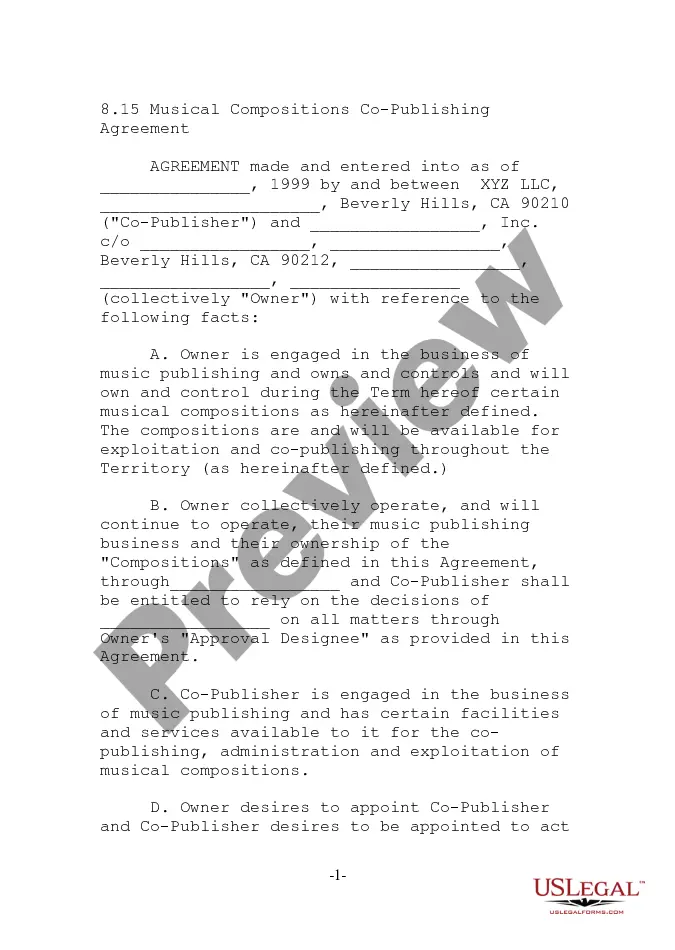

Convertible notes are usually faster and cheaper to negotiate and close than preferred equity, as they involve less legal documentation and due diligence. They also defer the valuation of the startup until the Series A round, which can be beneficial if the startup grows significantly in the meantime.

Issuing convertible preferred stock is one of the many ways companies can raise capital to fund their operations and expansion. Companies will choose to sell convertible preferred stock because it enables them to avoid taking on debt while limiting the potential dilution of selling additional common stock.

When preferred stock is cumulative and the directors either do not declare a dividend to preferred stockholders or declare one that does not cover the total amount of cumulative dividend, the unpaid dividend amount is called dividend in arrears.

Noncumulative describes a type of preferred stock that does not entitle investors to reap any missed dividends. By contrast, "cumulative" indicates a class of preferred stock that indeed entitles an investor to dividends that were missed.