District of Columbia Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement

Description

How to fill out Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing Agreement?

If you need to comprehensive, acquire, or printing authorized record templates, use US Legal Forms, the greatest assortment of authorized varieties, which can be found on the Internet. Utilize the site`s simple and handy research to obtain the files you will need. Different templates for company and person purposes are categorized by types and says, or keywords and phrases. Use US Legal Forms to obtain the District of Columbia Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement within a handful of mouse clicks.

If you are previously a US Legal Forms buyer, log in to your account and click the Acquire option to get the District of Columbia Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement. You can even access varieties you in the past saved inside the My Forms tab of your respective account.

If you use US Legal Forms initially, refer to the instructions under:

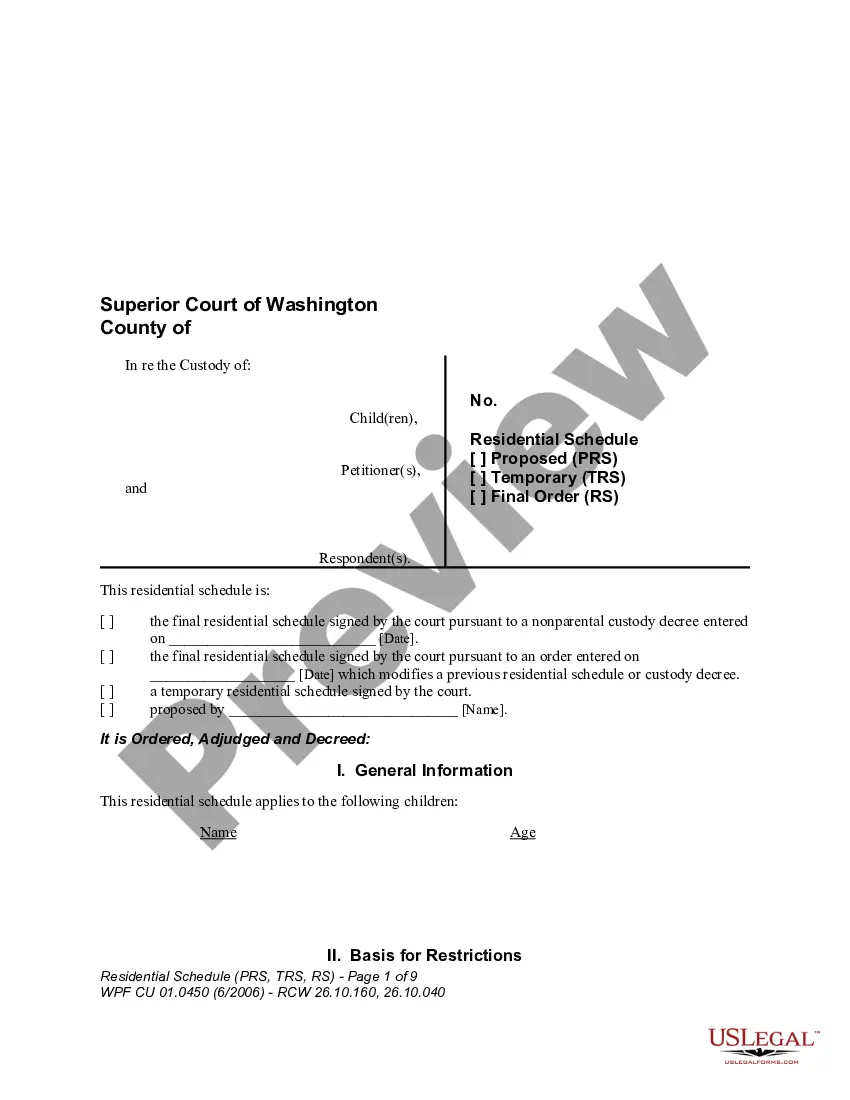

- Step 1. Ensure you have chosen the shape for that right town/nation.

- Step 2. Use the Preview option to examine the form`s content material. Don`t forget about to learn the description.

- Step 3. If you are unhappy using the develop, use the Search area towards the top of the monitor to locate other types in the authorized develop web template.

- Step 4. Once you have identified the shape you will need, click the Get now option. Choose the costs prepare you favor and include your qualifications to sign up for an account.

- Step 5. Approach the financial transaction. You should use your charge card or PayPal account to accomplish the financial transaction.

- Step 6. Pick the formatting in the authorized develop and acquire it in your device.

- Step 7. Full, modify and printing or sign the District of Columbia Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement.

Every single authorized record web template you buy is your own property permanently. You might have acces to each develop you saved inside your acccount. Click on the My Forms section and select a develop to printing or acquire yet again.

Compete and acquire, and printing the District of Columbia Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement with US Legal Forms. There are thousands of professional and status-specific varieties you can utilize for the company or person requirements.

Form popularity

FAQ

Advantages of Filing a Consolidated Tax Return The deferment of taxable losses or taxable sales becomes realized with the ultimate sale to a third party. Capital losses and gains can also be spread out across affiliates. The income associated with one affiliated corporation can also be used to offset any losses.

Comprehensive tax allocation is an analysis that identifies the effect of taxation on revenue-generating transactions during a non-standard reporting period.

A distribution agreement, also known as a distributor agreement, is a contract between a supplying company with products to sell and another company that markets and sells the products. The distributor agrees to buy products from the supplier company and sell them to clients within certain geographical areas.

What is a Tax Sharing Agreement? A tax sharing agreement (TSA) is a contract created to clarify the economic expectations among members of a related group of corporations included in consolidated or combined reporting tax returns.

A consolidated tax return is a corporate income tax return of an affiliated group of corporations, who elect to report their combined tax liability on a single return. The purpose of the tax return allows for corporations that run their business through many legal affiliates to be viewed as one single entity.

Tax allocation agreements are often used by the members of a consolidated group in order to determine how to allocate and distribute such funds.