District of Columbia Private Placement Financing

Description

How to fill out Private Placement Financing?

Have you been in a place that you require papers for both organization or personal reasons virtually every day? There are a lot of authorized record web templates available on the Internet, but finding types you can rely isn`t simple. US Legal Forms offers thousands of type web templates, such as the District of Columbia Private Placement Financing, which can be written to meet state and federal specifications.

Should you be presently acquainted with US Legal Forms site and have a merchant account, just log in. After that, it is possible to acquire the District of Columbia Private Placement Financing design.

Should you not come with an profile and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the type you need and make sure it is for your right city/state.

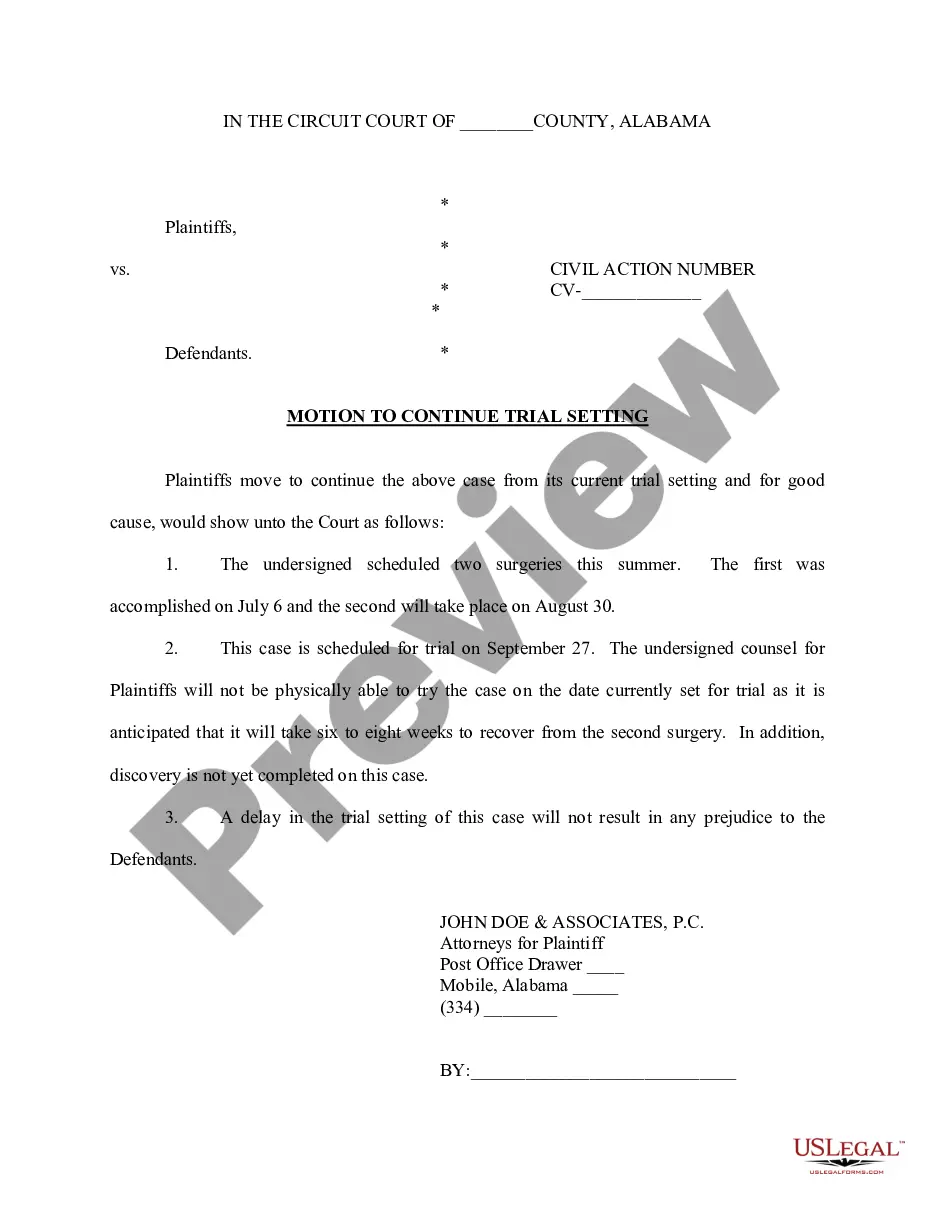

- Make use of the Review switch to analyze the form.

- See the description to actually have chosen the proper type.

- When the type isn`t what you`re seeking, use the Look for area to find the type that suits you and specifications.

- Once you get the right type, click on Get now.

- Select the costs strategy you would like, fill in the required details to create your money, and buy the transaction using your PayPal or bank card.

- Decide on a hassle-free file structure and acquire your backup.

Discover all of the record web templates you might have purchased in the My Forms menu. You can obtain a additional backup of District of Columbia Private Placement Financing any time, if necessary. Just go through the required type to acquire or print out the record design.

Use US Legal Forms, the most considerable collection of authorized kinds, to conserve some time and steer clear of mistakes. The assistance offers appropriately manufactured authorized record web templates which you can use for a variety of reasons. Create a merchant account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

FINRA Rule 5123 (Private Placements of Securities) requires firms to file with FINRA's Corporate Financing Department within 15 calendar days of the date of first sale of a private placement, a private placement memorandum, term sheet or other offering document, or indicate that no such offerings documents were used.

Private placements are unregistered, non-public securities offerings that rely on an available exemption from registration with the Securities and Exchange Commission (SEC).

The sale of these securities is known as a Private Placement. In such cases, unless there is an enumerated exemption, a company (issuer) seeking to raise capital is required by the Securities Act to use an intermediary, such as a broker, to solicit investors.

I) To consider and approve the issue of securities through private placement. ii) To approve Private Placement Offer Letter. iii) to identify the group of persons to whom Private Placement shall be made. iv) to fix the day, date, time, and venue for holding the General Meeting of the Company.

STARTUP FUNDRAISING: HOW TO CONDUCT A PRIVATE PLACEMENT OFFERING OF SECURITIES. ... Step 1 ? Determine Type of Reg D Offering. ... Step 2 ? Draft Offering Documents. ... Step 3 ? Determine Accredited Investor Status of Investors. ... Step 4 ? File Form D. ... Step 5 ? Comply with State Securities Laws. ... Step 6 ? Conduct Offering.