District of Columbia Split-Dollar Life Insurance

Description

How to fill out Split-Dollar Life Insurance?

If you want to total, acquire, or print out legal document themes, use US Legal Forms, the biggest assortment of legal varieties, which can be found on the web. Take advantage of the site`s easy and handy research to discover the papers you will need. Various themes for organization and individual functions are sorted by categories and says, or search phrases. Use US Legal Forms to discover the District of Columbia Split-Dollar Life Insurance in a number of mouse clicks.

When you are previously a US Legal Forms client, log in to the profile and click on the Download option to get the District of Columbia Split-Dollar Life Insurance. You can even access varieties you earlier saved in the My Forms tab of the profile.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Make sure you have chosen the form for your correct city/land.

- Step 2. Make use of the Review choice to examine the form`s articles. Don`t overlook to read through the information.

- Step 3. When you are unhappy together with the kind, use the Research field at the top of the monitor to discover other types from the legal kind web template.

- Step 4. Upon having located the form you will need, click on the Buy now option. Select the prices strategy you prefer and put your qualifications to register for an profile.

- Step 5. Method the purchase. You can utilize your Мisa or Ьastercard or PayPal profile to finish the purchase.

- Step 6. Find the structure from the legal kind and acquire it on your own product.

- Step 7. Comprehensive, change and print out or signal the District of Columbia Split-Dollar Life Insurance.

Each and every legal document web template you acquire is your own property for a long time. You possess acces to every single kind you saved within your acccount. Click on the My Forms area and choose a kind to print out or acquire again.

Contend and acquire, and print out the District of Columbia Split-Dollar Life Insurance with US Legal Forms. There are many expert and condition-particular varieties you can use for your personal organization or individual requires.

Form popularity

FAQ

Life insurance policies can be split in several ways, depending on the type of policy you have. Most policies include equity, or cash value. In some cases, the cash value, as well as the death benefit, can be considerably large.

Yes, you can designate multiple beneficiaries when you purchase your life insurance policy. When doing so, you will assign each beneficiary a percentage of the death benefit.

If the policy has a cash value, you can elect to cash it out and split the proceeds with your ex. If there are children and one spouse takes primary custody and receives alimony or child support, maintaining a life insurance policy on the other ex-spouse can be a good idea.

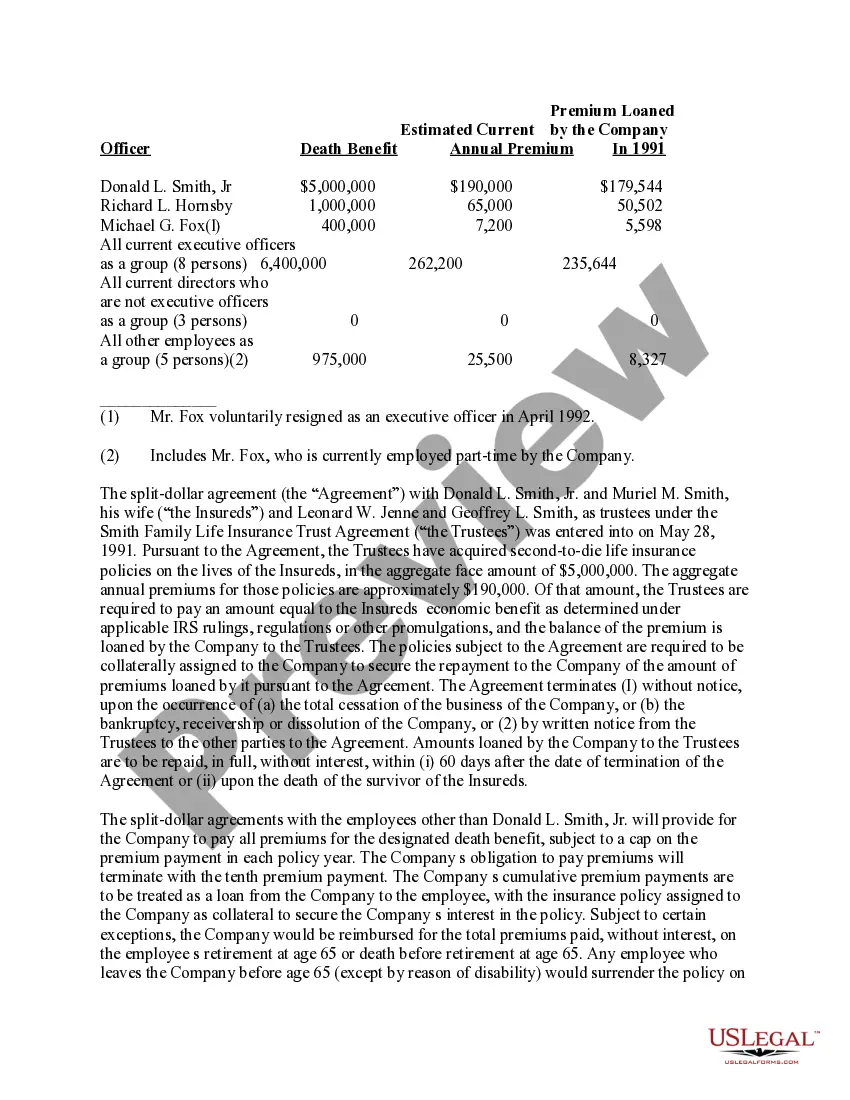

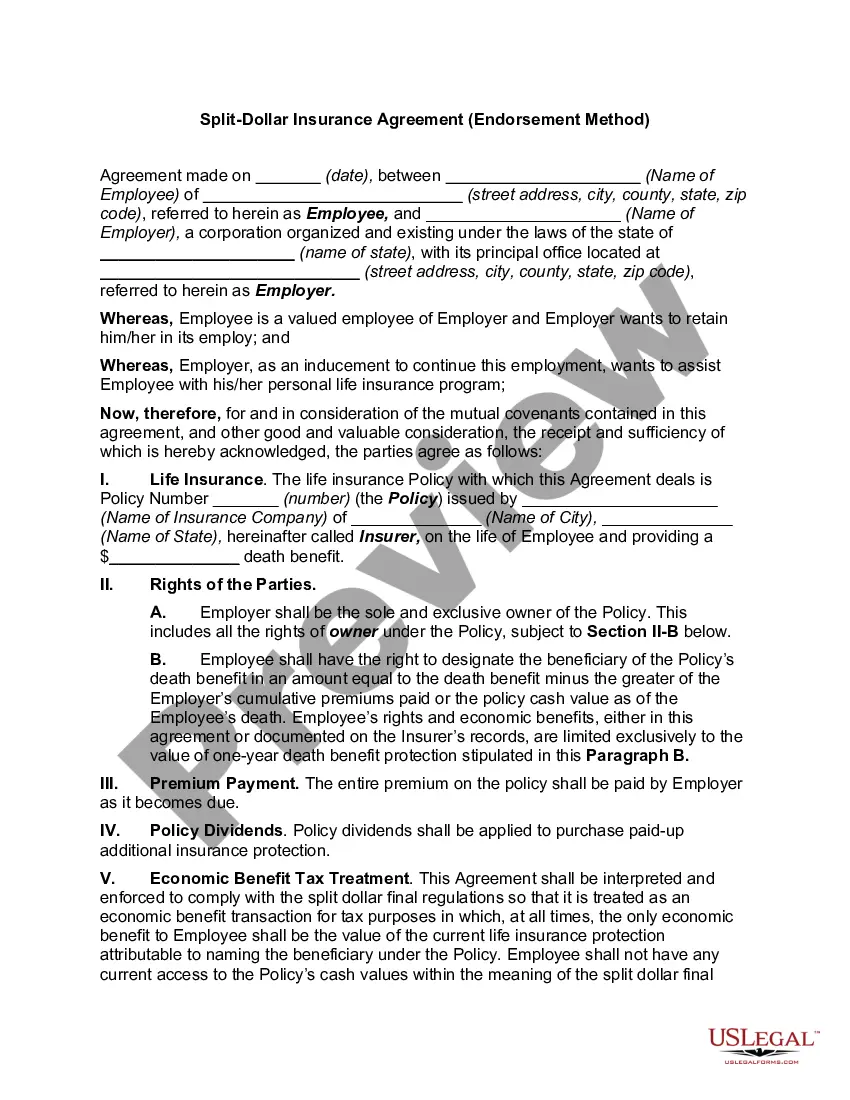

Split-dollar life insurance can be a mutually beneficial arrangement for employers and employees, with each party gaining different advantages. For example, employees receive quality life insurance for little cost and may be able to access tax-efficient income through withdrawals or loans.

Reverse Split-Dollar Arrangements In a reverse split-dollar arrangement, the employer owns the death benefit and the employee owns the cash value.

Multiple beneficiaries For example, if you name your spouse, child and a local charity as primary beneficiaries, you might allocate 50% to your spouse, 30% to your child and 20% to the charity. No matter how you divide a life insurance payout among beneficiaries, the percentages must add up to 100%.

You might each decide to be both the owner and beneficiary for the other person's policy. If you have a cash value life insurance policy, you and your spouse may decide to terminate the policy and then divide the cash value equally.

Split the policy In some cases, it's possible to split a joint life insurance policy into two single policies in the event of a separation. This is a known as a 'separation benefit' or 'separation agreement'. It allows you to easily split the policy without having to provide any new medical information.