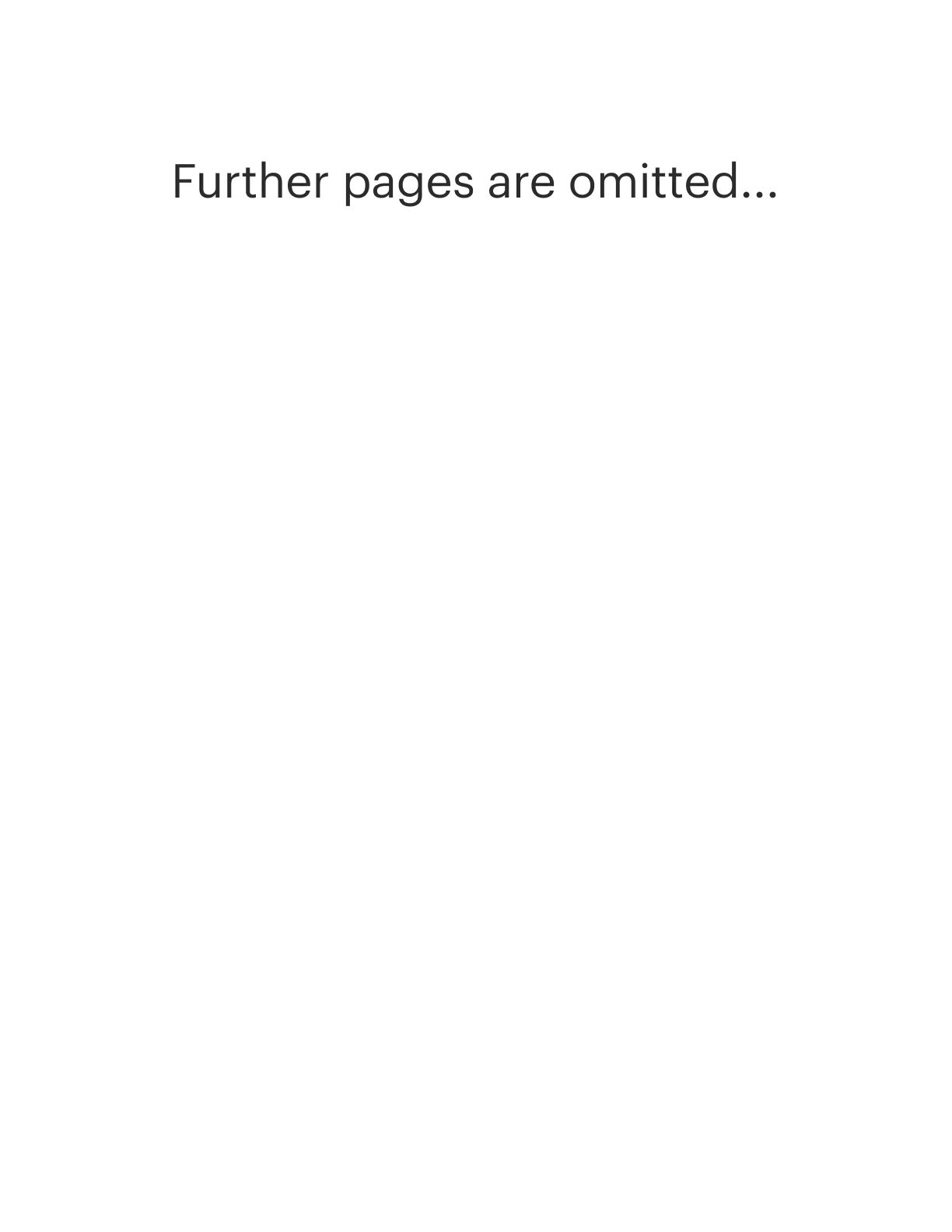

District of Columbia Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc.

Description

How to fill out Stock Option And Long Term Incentive Plan Of Golf Technology Holding, Inc.?

US Legal Forms - one of several biggest libraries of authorized types in the USA - gives a wide range of authorized file templates you can obtain or print. Making use of the website, you will get a huge number of types for company and specific uses, categorized by types, states, or keywords and phrases.You can find the newest models of types like the District of Columbia Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. in seconds.

If you have a registration, log in and obtain District of Columbia Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. from your US Legal Forms catalogue. The Acquire switch can look on every single develop you perspective. You have accessibility to all in the past saved types inside the My Forms tab of your respective account.

If you want to use US Legal Forms for the first time, here are easy instructions to obtain started off:

- Ensure you have picked out the proper develop for your personal area/county. Click the Preview switch to check the form`s content material. Browse the develop information to actually have selected the proper develop.

- In the event the develop doesn`t match your needs, utilize the Lookup field at the top of the display screen to obtain the one which does.

- When you are content with the form, verify your choice by clicking on the Get now switch. Then, pick the rates plan you want and supply your accreditations to register on an account.

- Approach the transaction. Utilize your credit card or PayPal account to perform the transaction.

- Find the structure and obtain the form on your system.

- Make adjustments. Fill up, revise and print and signal the saved District of Columbia Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc..

Each format you included with your money does not have an expiration particular date and is also the one you have permanently. So, if you want to obtain or print another version, just visit the My Forms portion and then click about the develop you will need.

Obtain access to the District of Columbia Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. with US Legal Forms, one of the most considerable catalogue of authorized file templates. Use a huge number of specialist and express-certain templates that fulfill your small business or specific needs and needs.

Form popularity

FAQ

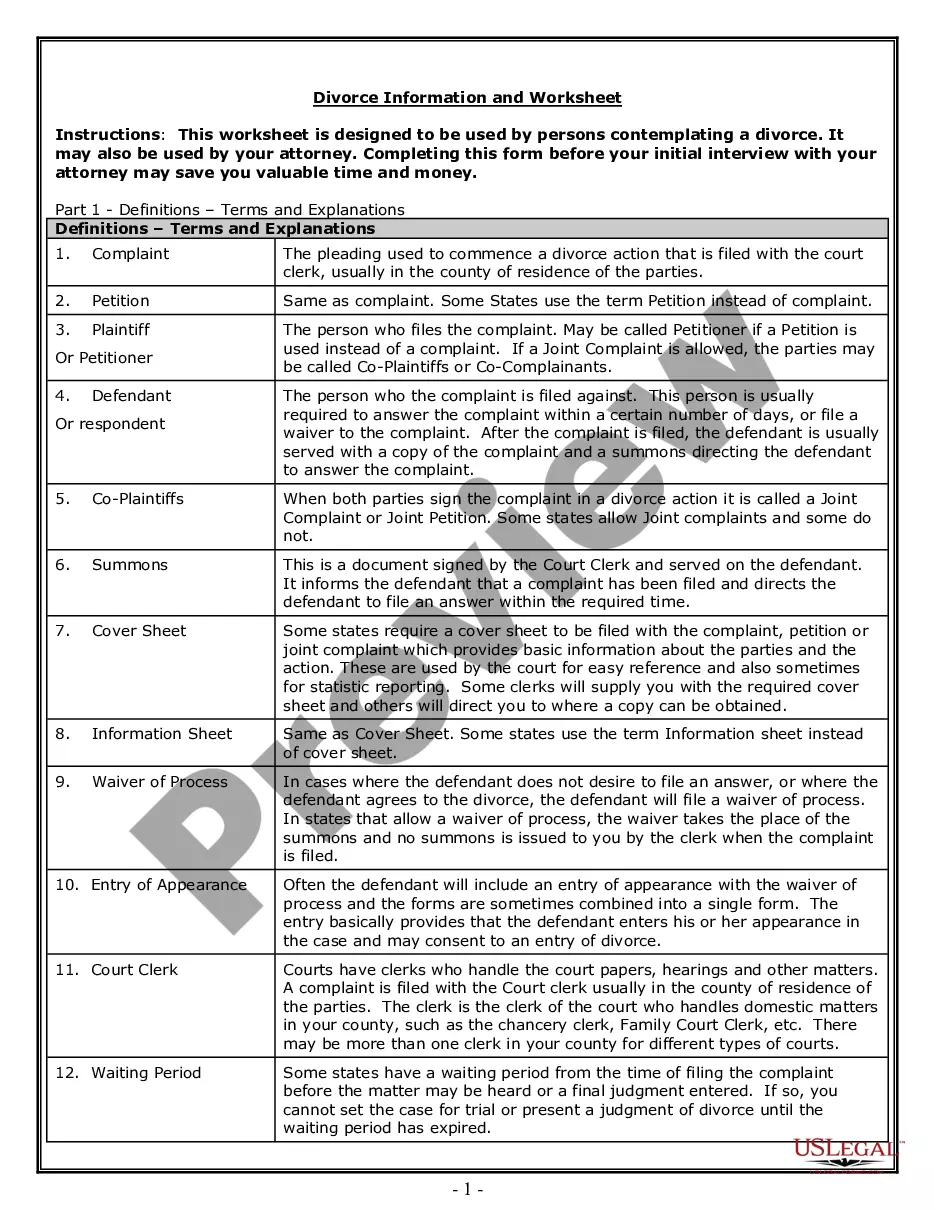

A stock incentive plan, or employee stock purchase plan, is a form of compensation by a company for employees or contractors which can be used as an alternative to cash payment. It's designed to motivate employees by offering them the opportunity for future earnings through company stocks.

An example of a long-term incentive could be a cash plan, equity plan or share plan. A long-term incentive plan can typically run between three years and five years before the full benefit of the incentive is received by the employee.

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.

The basic idea behind a LTIP is that participants receive share options or shares if they satisfy certain performance criteria over time. Sometimes, the LTIP participants have to invest a proportion of salary or cash bonus towards the acquisition of shares.

What Is a Long-Term Incentive Plan? A long-term incentive plan (LTIP) is a company policy that rewards employees for reaching specific goals that lead to increased shareholder value. In a typical LTIP, the employee, usually an executive, must fulfill various conditions or requirements.

term incentive plan (LTIP) incentivizes employees to take actions that will maximize shareholder value and promote longterm growth for the organization. In a standard LTIP, the employee, who is normally a senior executive, is required to meet a number of criteria to receive the incentive.

The basic idea behind a LTIP is that participants receive share options or shares if they satisfy certain performance criteria over time. Sometimes, the LTIP participants have to invest a proportion of salary or cash bonus towards the acquisition of shares.