District of Columbia Issuance of Common Stock in Connection with Acquisition

Description

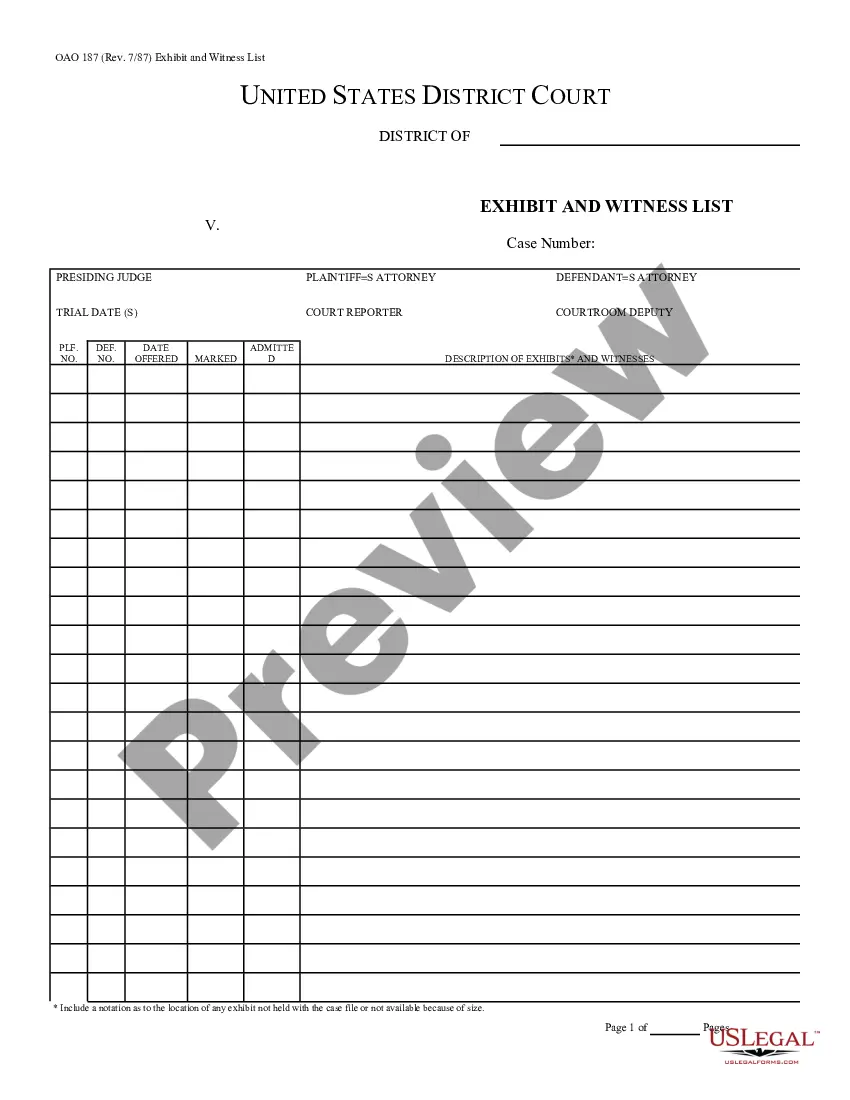

How to fill out Issuance Of Common Stock In Connection With Acquisition?

US Legal Forms - one of the greatest libraries of lawful kinds in the States - offers a wide range of lawful record themes it is possible to download or print. Making use of the website, you can find 1000s of kinds for company and person purposes, categorized by categories, states, or keywords.You can find the most up-to-date variations of kinds just like the District of Columbia Issuance of Common Stock in Connection with Acquisition within minutes.

If you already have a subscription, log in and download District of Columbia Issuance of Common Stock in Connection with Acquisition from your US Legal Forms library. The Acquire key will appear on every single form you see. You have accessibility to all in the past downloaded kinds in the My Forms tab of your respective account.

In order to use US Legal Forms initially, listed here are simple guidelines to help you started off:

- Be sure to have selected the correct form to your town/region. Select the Preview key to check the form`s articles. Browse the form outline to ensure that you have selected the proper form.

- When the form does not suit your needs, make use of the Search discipline at the top of the screen to get the one who does.

- When you are happy with the form, confirm your selection by clicking on the Get now key. Then, opt for the prices prepare you want and give your credentials to register for an account.

- Procedure the purchase. Use your credit card or PayPal account to perform the purchase.

- Select the file format and download the form on your device.

- Make alterations. Complete, change and print and indication the downloaded District of Columbia Issuance of Common Stock in Connection with Acquisition.

Each and every design you put into your money does not have an expiry date and is the one you have permanently. So, if you wish to download or print an additional copy, just check out the My Forms portion and click on about the form you need.

Gain access to the District of Columbia Issuance of Common Stock in Connection with Acquisition with US Legal Forms, the most considerable library of lawful record themes. Use 1000s of specialist and condition-certain themes that fulfill your business or person requirements and needs.

Form popularity

FAQ

Depending on the specifics of the merger, investors may have their shares cashed-out, or exchanged for shares of the new company. Prices of stocks may increase or decrease, often depending on if they're shares of the target or acquiring company.

The terms all-stock deal and all-paper deal are often used in reference to mergers and acquisitions. In this type of acquisition, shareholders of the target company receive shares in the acquiring company as payment, rather than cash. Example: An investor owns 10,000 shares in a beverage company's stock.

The target company's stock price usually rises due to the deal; an acquiring company pays a premium on the target shares to win the appreciation of the target company's shareholders. Thus, with the premium paid, the selling company stocks get higher and can attract more potential investors.

Most of the time, your exercised shares get paid out in cash or converted into common shares of the acquiring company. You may also get the chance to exercise shares during or shortly after the deal closes.

When A Company Is Bought, What Happens to the Stock? The stock of the company that has been bought tends to rise since the acquiring company has likely paid a premium on its shares as a way to entice stockholders. However, there are some instances when the newly acquired company sees its shares fall on the merger news.