District of Columbia Restructuring Agreement

Description

How to fill out Restructuring Agreement?

It is possible to commit time on-line looking for the legitimate record web template which fits the state and federal specifications you want. US Legal Forms gives a huge number of legitimate varieties that happen to be analyzed by experts. It is possible to download or printing the District of Columbia Restructuring Agreement from our assistance.

If you already have a US Legal Forms bank account, you can log in and click on the Down load key. After that, you can complete, change, printing, or indication the District of Columbia Restructuring Agreement. Every legitimate record web template you get is the one you have for a long time. To acquire yet another version of any acquired type, check out the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms internet site the very first time, stick to the easy directions below:

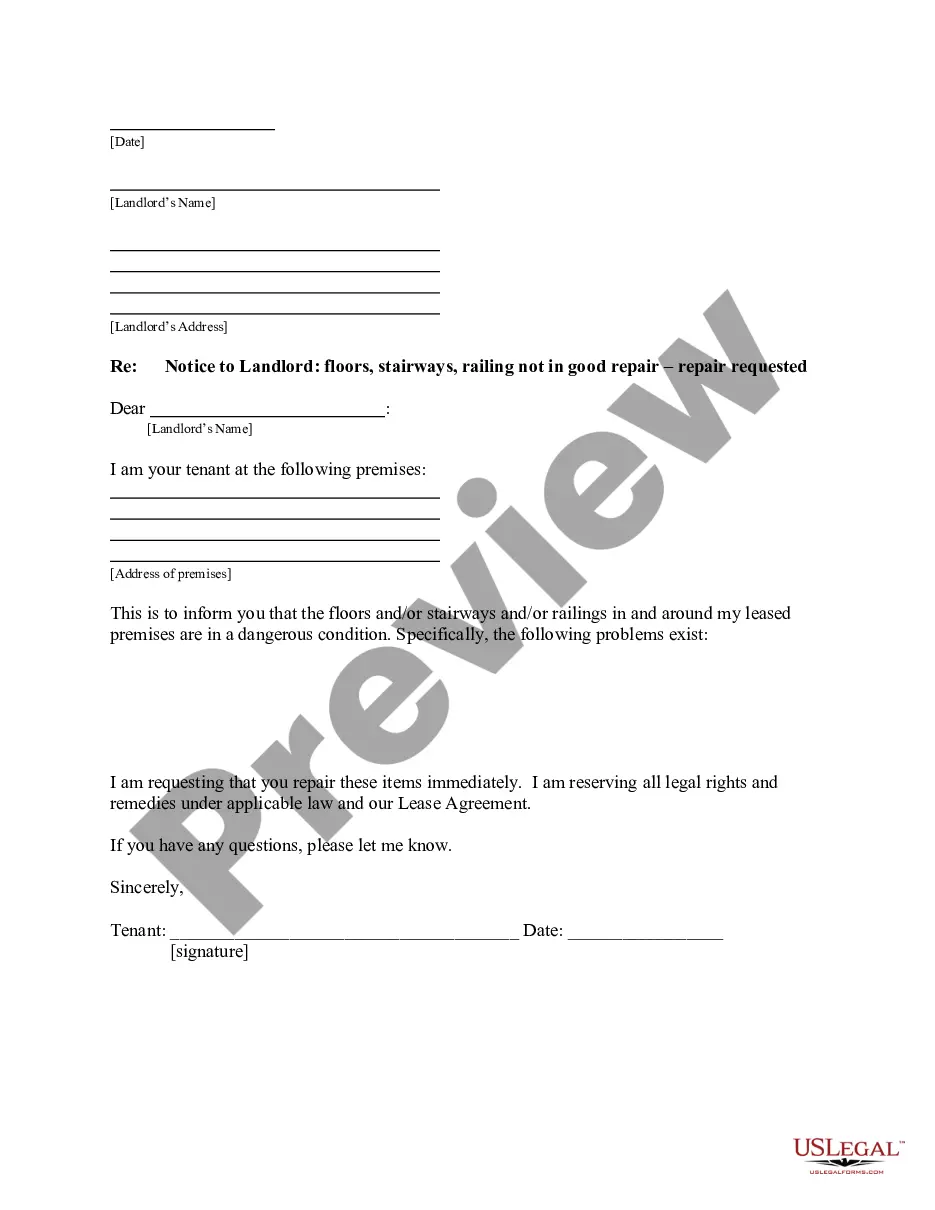

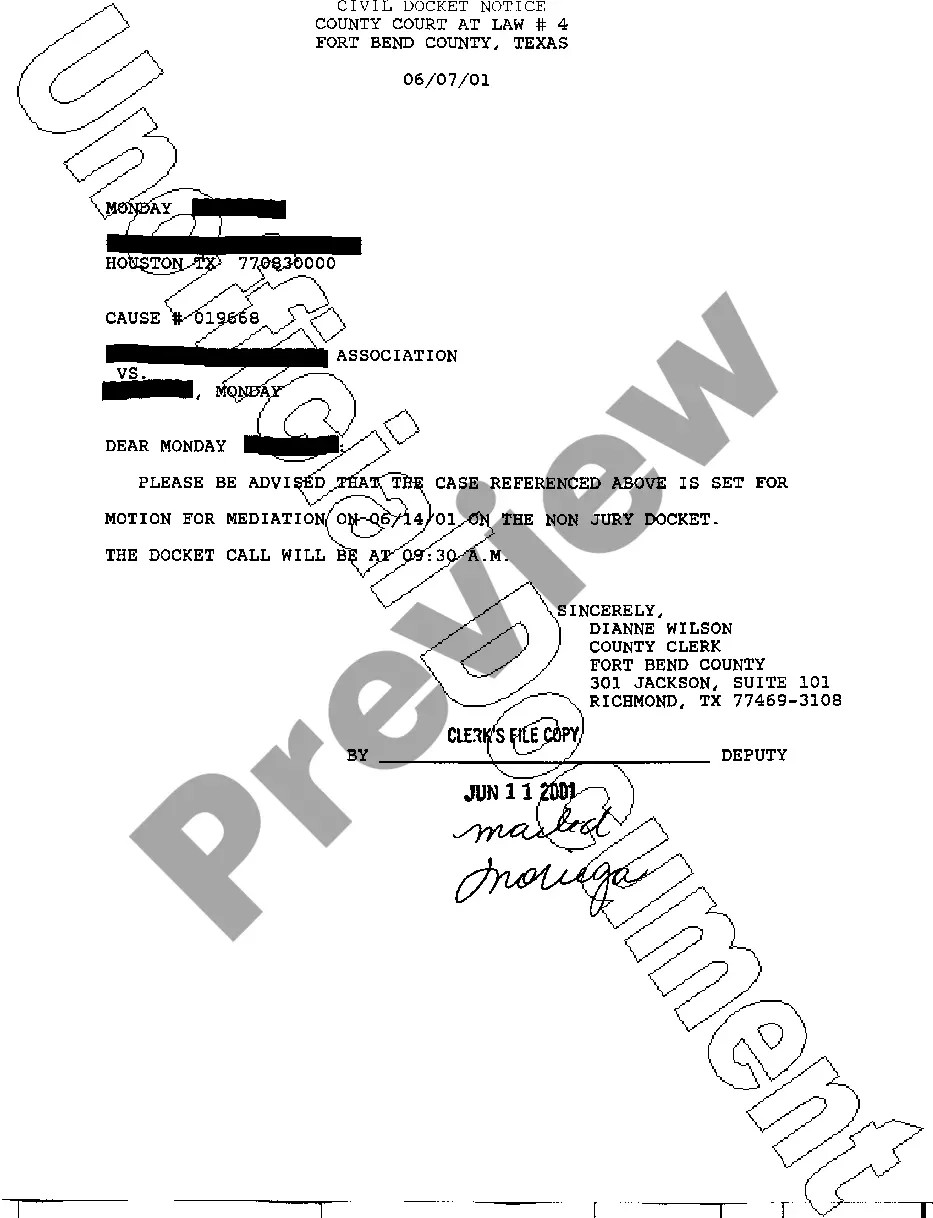

- First, be sure that you have selected the right record web template for that area/town of your choice. Look at the type explanation to make sure you have selected the right type. If available, make use of the Review key to appear through the record web template too.

- In order to discover yet another variation from the type, make use of the Research field to obtain the web template that meets your requirements and specifications.

- Once you have found the web template you desire, simply click Purchase now to proceed.

- Choose the costs strategy you desire, key in your references, and sign up for a free account on US Legal Forms.

- Total the transaction. You should use your bank card or PayPal bank account to cover the legitimate type.

- Choose the file format from the record and download it to your device.

- Make alterations to your record if needed. It is possible to complete, change and indication and printing District of Columbia Restructuring Agreement.

Down load and printing a huge number of record layouts utilizing the US Legal Forms web site, that provides the most important variety of legitimate varieties. Use skilled and express-distinct layouts to tackle your organization or individual demands.

Form popularity

FAQ

Communicate early and often Through emails, town hall meetings, video messages, and other channels, you should announce the plan for the restructure, clearly conveying why the change is being made, the timeline, and what can be expected.

In a re-org thosough usually the job duties remain roughly the same but the actual workload is expanding or contracting. In a realignment, they are generally changing the type of business responsibilites the organizational entities perform or the products they support.

How to restructure a small business: 6 steps Conduct a strategic review. Often the hardest part in understanding how to restructure a small business is knowing how (and when) to begin. ... Assess your business strategy. ... Map out your potential restructure. ... Assemble a change team. ... Develop a communications plan. ... Roll out.

How to reorganize your department Define the problem. Before you begin making a plan, the first step is to define the problem that you're hoping to solve. ... Set your end goal. ... Determine the new structure. ... Consider the workplace culture. ... Choose people to lead the change. ... Implement feedback.

How to restructure a company or department Start with your business strategy. ... Identify strengths and weaknesses in the current organizational structure. ... Consider your options and design a new structure. ... Communicate the reorganization. ... Launch your company restructure and adjust as necessary.