District of Columbia Summons to Debtor in Involuntary Case - B 250E

Description

How to fill out Summons To Debtor In Involuntary Case - B 250E?

Have you been in a situation the place you require papers for possibly business or person functions just about every working day? There are plenty of authorized record web templates available online, but discovering kinds you can rely on is not simple. US Legal Forms provides thousands of form web templates, just like the District of Columbia Summons to Debtor in Involuntary Case - B 250E, which can be created to satisfy federal and state demands.

If you are presently informed about US Legal Forms internet site and get a free account, merely log in. Following that, you may obtain the District of Columbia Summons to Debtor in Involuntary Case - B 250E design.

Unless you provide an bank account and would like to begin to use US Legal Forms, follow these steps:

- Obtain the form you need and ensure it is to the proper town/region.

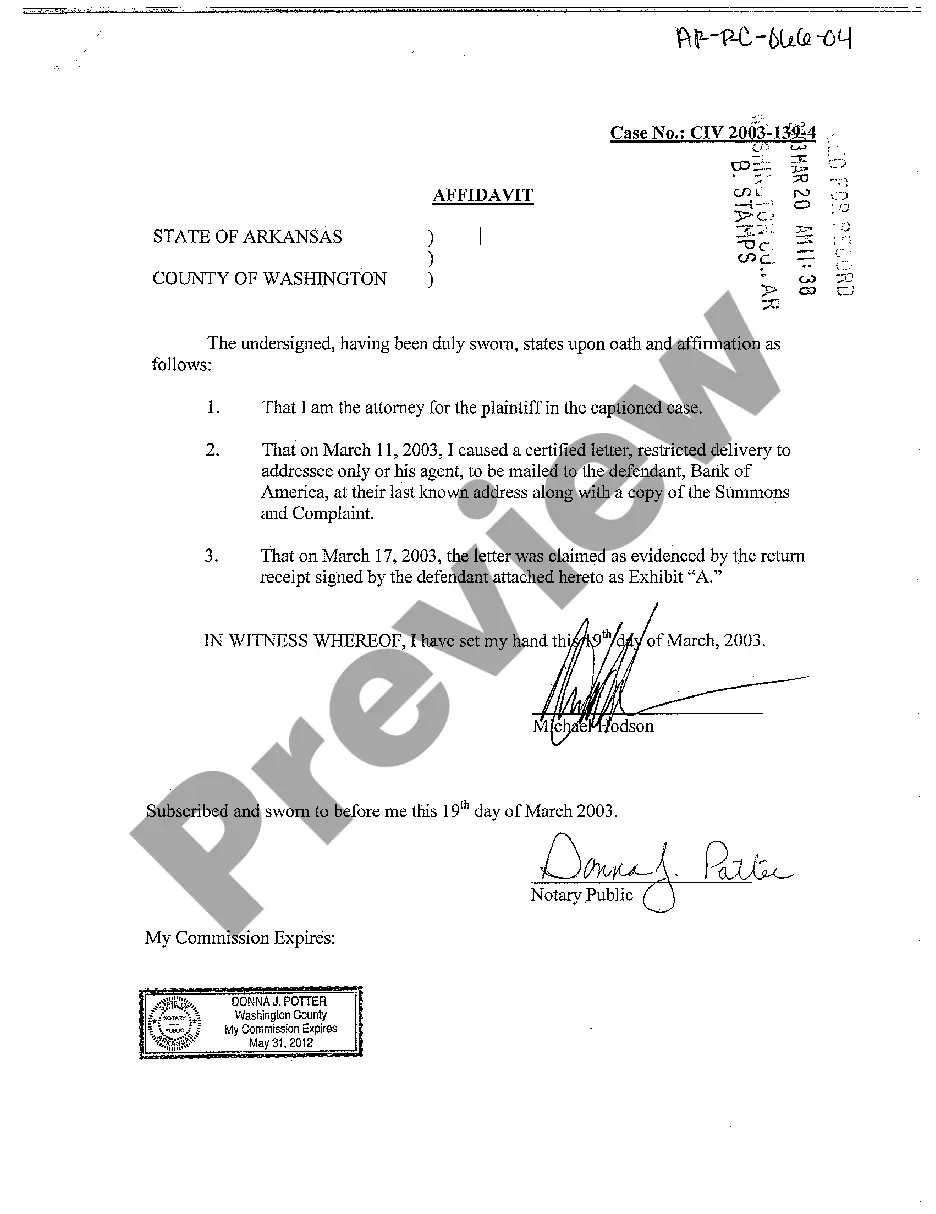

- Take advantage of the Review option to analyze the form.

- See the description to ensure that you have selected the right form.

- In case the form is not what you`re looking for, utilize the Research field to obtain the form that meets your needs and demands.

- When you discover the proper form, simply click Buy now.

- Select the costs program you want, complete the necessary information and facts to produce your bank account, and pay money for the order with your PayPal or Visa or Mastercard.

- Choose a convenient document formatting and obtain your duplicate.

Get each of the record web templates you have purchased in the My Forms food selection. You can get a extra duplicate of District of Columbia Summons to Debtor in Involuntary Case - B 250E any time, if required. Just click on the necessary form to obtain or print out the record design.

Use US Legal Forms, by far the most comprehensive collection of authorized kinds, in order to save time as well as steer clear of faults. The service provides professionally created authorized record web templates which can be used for an array of functions. Make a free account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

You Are Not a Business Entity Only individuals and those filing jointly as spouses can file for Chapter 13 bankruptcy. For instance, businesses that are corporations and limited liability companies (LLC) are ineligible for Chapter 13 and must instead file for Chapter 11 bankruptcy.

-A Chapter 13 proceeding can be initiated only by the voluntary filing of a petition by the debtor. -Creditors cannot file an involuntary petition to place a debtor in Chapter 13 bankruptcy.

A bankruptcy petition filed by creditors, usually to force a debtor to enter a liquidation proceeding under Chapter 7. The debtor can contest the petition and can choose to convert it into a case under Chapter 11.

Section 303(a) of the Bankruptcy Code only permits involuntary cases under either chapter 7 or chapter 11 of the Code. No involuntary chapter 9, chapter 12 or chapter 13 cases are authorized. Further, an involuntary cannot be commenced against a farmer, family farmer or not for profit entity.

Voluntary bankruptcy is a bankruptcy proceeding commenced by the debtor; bankruptcy instituted by an adjudication upon a debtor's petition. Involuntary bankruptcy, on the other hand, is a bankruptcy case initiated by a debtor's creditors.

An involuntary case may be commenced only under chapter 7 or 11 of this title, and only against a person, except a farmer, family farmer, or a corporation that is not a moneyed, business, or commercial corporation, that may be a debtor under the chapter under which such case is commenced.

An order for relief will be entered if the debtor does not contest the involuntary petition or, if the debtor contests the involuntary petition, an order for relief will be entered if (1) the court determines that the debtor is not paying its undisputed debts as they come due, or (2) a custodian (other than a trustee, ...