District of Columbia Agreement to Reimburse for Insurance Premium

Description

How to fill out Agreement To Reimburse For Insurance Premium?

If you wish to collect, acquire, or create legal document templates, utilize US Legal Forms, the finest assortment of legal forms, available online.

Leverage the site's simple and efficient search to find the documents you need.

A multitude of templates for business and personal purposes are organized by categories, states, or keywords.

Every legal document template you purchase is yours for an extended period. You have access to every form you saved within your account.

Access the My documents section and select a form to print or download again. Procure and print the District of Columbia Agreement to Reimburse for Insurance Premium with US Legal Forms. There are countless professional and state-specific forms you can utilize for your personal or business needs.

- Use US Legal Forms to locate the District of Columbia Agreement to Reimburse for Insurance Premium in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to find the District of Columbia Agreement to Reimburse for Insurance Premium.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have chosen the form for the correct city/state.

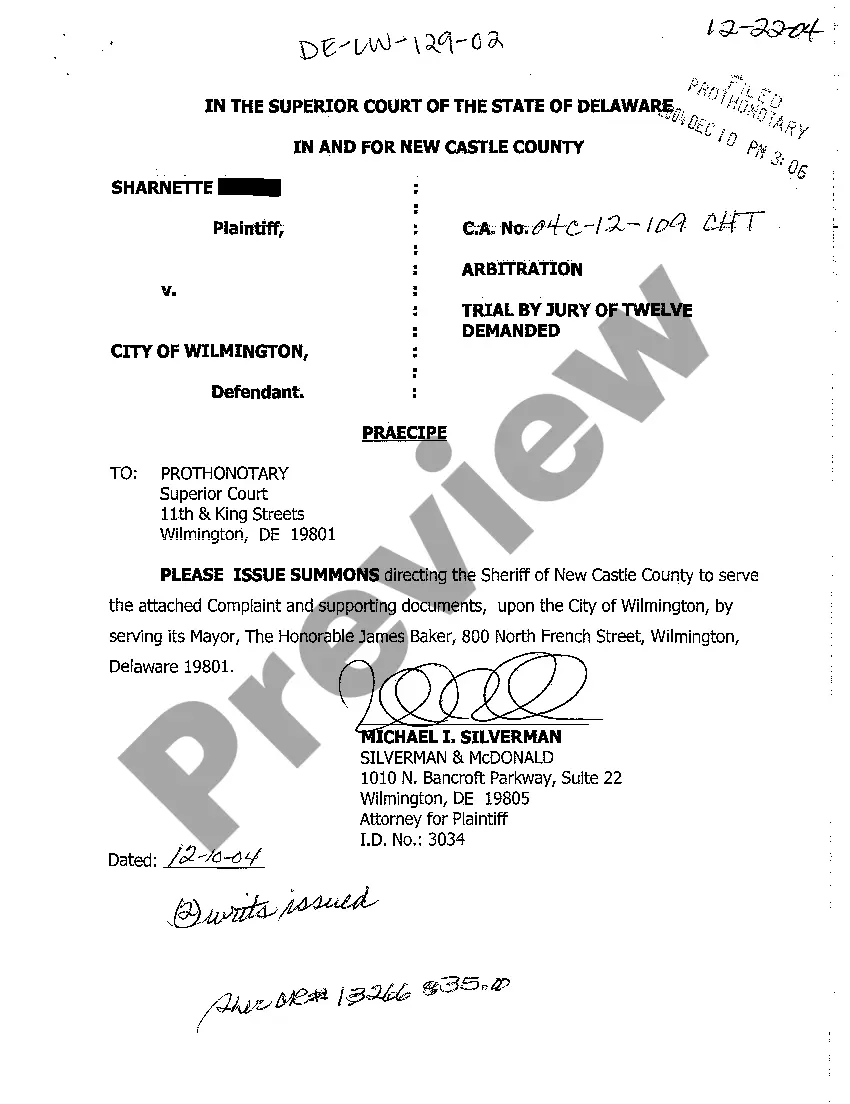

- Step 2. Use the Review option to examine the form’s content. Don’t forget to check the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal template.

- Step 4. Once you have located the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to set up an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your legal document and download it to your system.

- Step 7. Complete, review, and print or sign the District of Columbia Agreement to Reimburse for Insurance Premium.

Form popularity

FAQ

The four basic components of a car insurance contract are the declaration page, insuring agreement, exclusions, and conditions.

Insurance Program Agreement means an agreement that sets forth the program for insurance for the Company and its members in form and substance agreed to by the Valero Member and the Frontier Member, each in their sole discretion.

Insuring Agreement that portion of the insurance policy in which the insurer promises to make payment to or on behalf of the insured. The insuring agreement is usually contained in a coverage form from which a policy is constructed.

Because the law of contracts is used to interpret an insurance policy, the basic elements of contract (offer, acceptance, and consideration) must be present for a court to uphold an insurance agreement.

In general, an insurance contract must meet four conditions in order to be legally valid: it must be for a legal purpose; the parties must have a legal capacity to contract; there must be evidence of a meeting of minds between the insurer and the insured; and there must be a payment or consideration.

A premium finance agreement is defined as an agreement by which an insured or prospective insured promises to pay to a premium finance company the amount advanced or to be advanced under the agreement to an insurer or to an insurance agent or producing agent in payment of premiums of an insurance contract, together

In general, an insurance contract must meet four conditions in order to be legally valid: it must be for a legal purpose; the parties must have a legal capacity to contract; there must be evidence of a meeting of minds between the insurer and the insured; and there must be a payment or consideration.

The major types of life insurance contracts are term, whole life, and universal life, but innumerable combinations of these basic types are sold. Term insurance contracts, issued for specified periods of years, are the simplest.

An insurance policy is simply a recitation of terms and conditions which do not attach to a particular person, item or interest. By contrast, an insurance contract creates contractual obligations between the parties. The formation of insurance contracts is governed by the law of contracts.

Put simply, an insurance premium is an amount paid for purchasing an insurance plan. An insurance plan is a contract between an insurer and an insured. Any valid contract has a consideration, and the consideration you pay for an insurance policy is called its insurance premium.