Arkansas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

Have you ever been in a situation where you need paperwork for either business or personal reasons almost every day.

There is a plethora of legal document templates accessible online, but locating ones you can trust isn't simple.

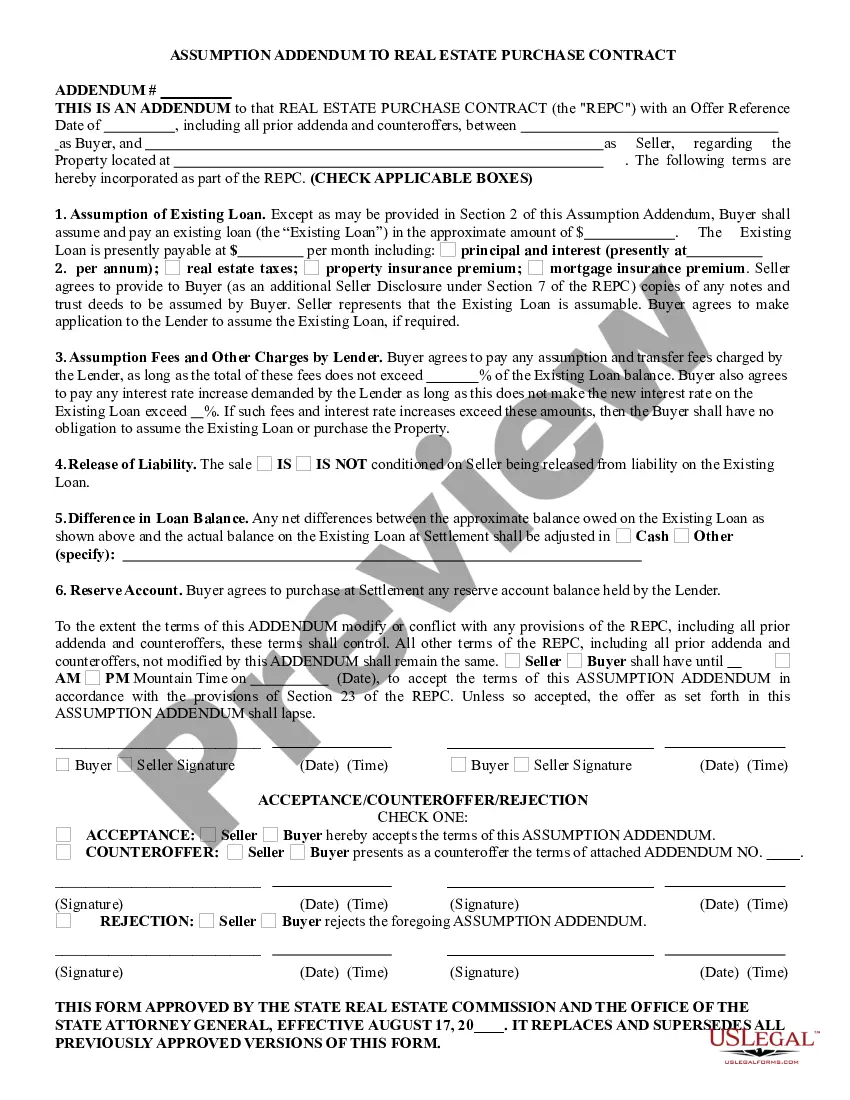

US Legal Forms provides a vast array of form templates, including the Arkansas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan, which are designed to meet state and federal regulations.

If you find the right form, simply click Buy now.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Arkansas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to locate the form that suits your needs and requirements.

Form popularity

FAQ

An FHA/VA financing addendum is attached to a purchase contract to state that a buyer with FHA/VA financing can back out of the sale if the appraised property value is less than the asking price.

The Bottom Line The FHA amendatory clause protects borrowers because if the appraisal comes back low, the buyer can cancel the transaction and get their earnest money back. Signing on the dotted line for a home that appraises for below the sales price could result in a bad investment for both lenders and buyers.

A seller financing addendum outlines the terms under which the seller of a property agrees to loan money to the buyer in order to purchase their property.

VA loans include certain contingencies that protect earnest money deposits and allow them to be refunded to the buyer under specific circumstances. Some of the most common VA contract contingencies include a home inspection contingency, financing contingency, home sale contingency and appraisal contingency.

The essential purpose of the FHA and VA amendatory/escape clauses is to give the buyer the right to terminate the sales contract if the sales price exceeds the appraised value of the Property. Form 2A4-T includes the prescribed wording of the FHA and VA amendatory/escape clauses.