District of Columbia Qualifying Event Notice Information for Employer to Plan Administrator

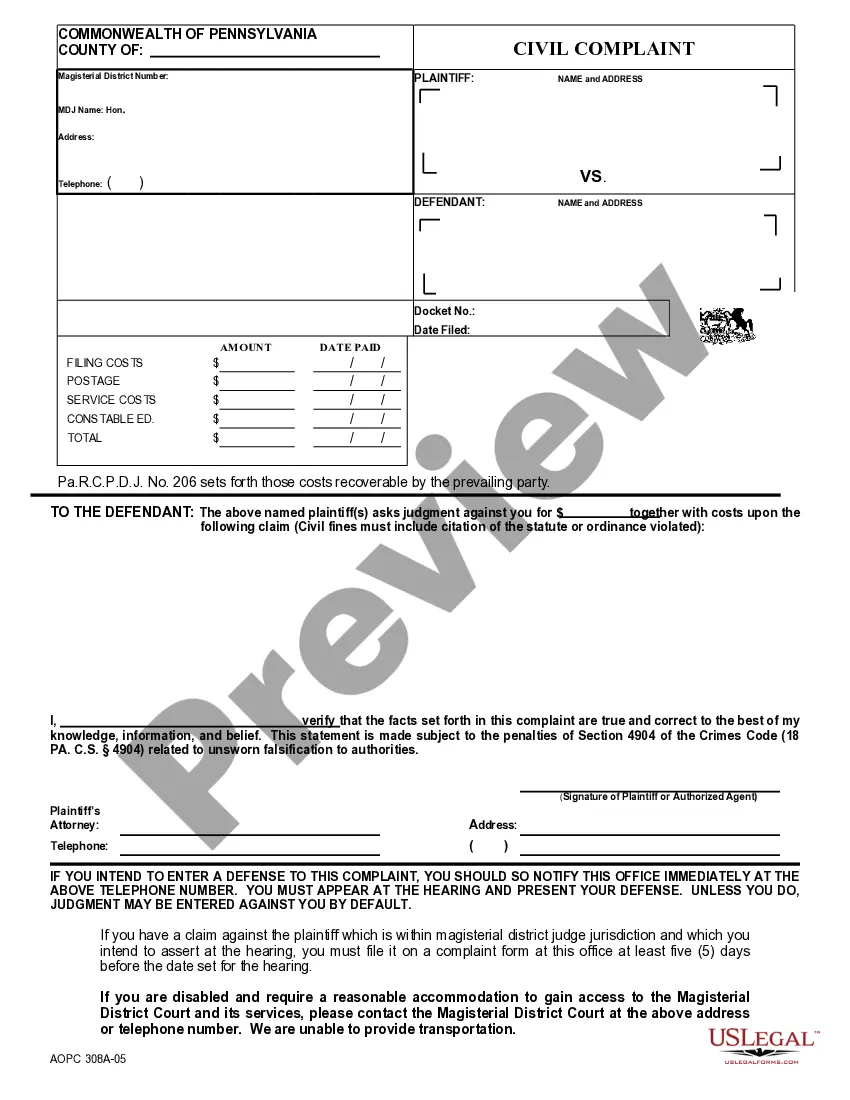

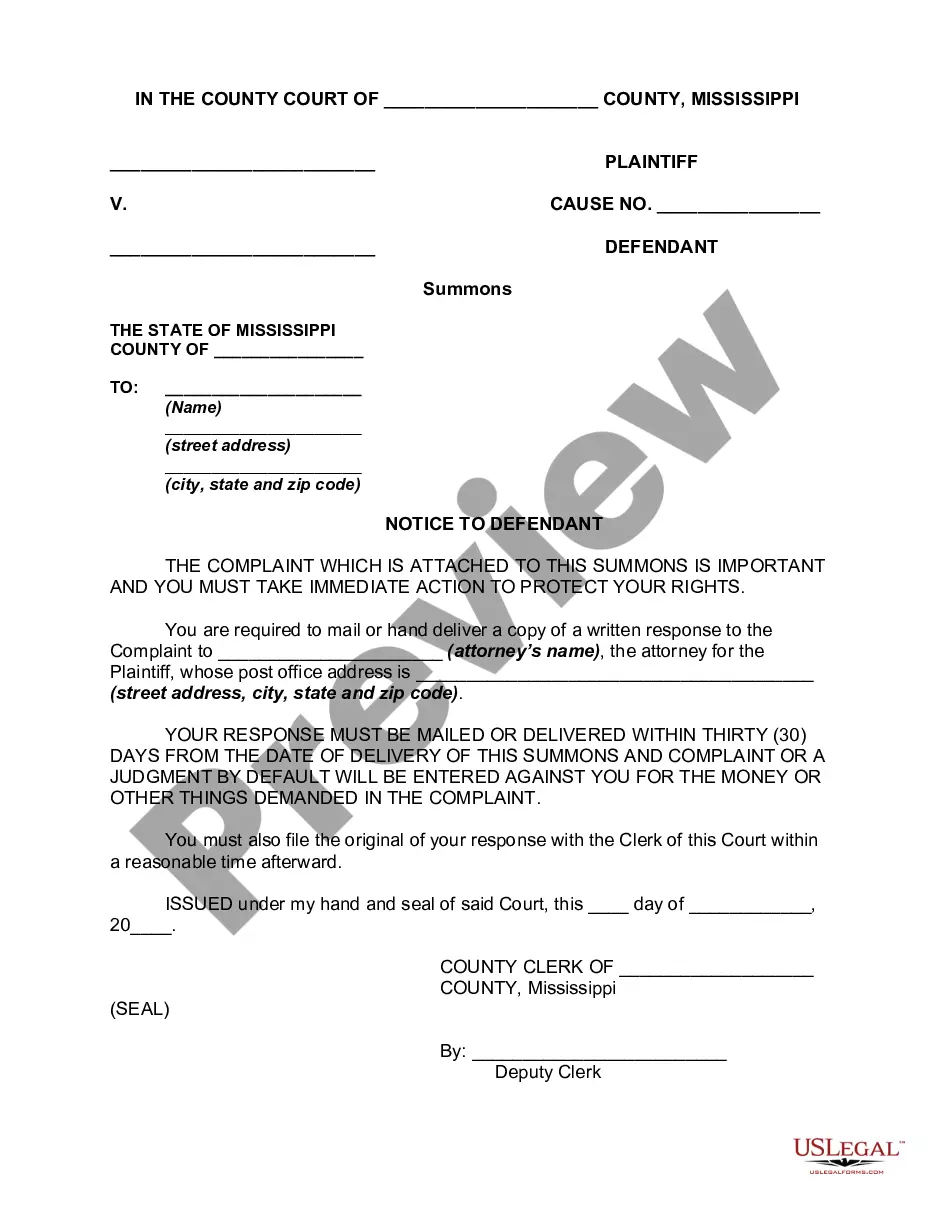

Description

How to fill out Qualifying Event Notice Information For Employer To Plan Administrator?

Have you ever been in a situation where you require documents for either business or personal activities nearly every day? There are numerous official document templates accessible online, but identifying reliable ones can be challenging.

US Legal Forms offers thousands of document templates, including the District of Columbia Qualifying Event Notice Information for Employer to Plan Administrator, which are designed to comply with federal and state regulations.

If you're already familiar with the US Legal Forms website and have an account, simply Log In. Once logged in, you can download the District of Columbia Qualifying Event Notice Information for Employer to Plan Administrator template.

- Acquire the form you need and confirm it is for the correct city/state.

- Use the Preview button to examine the document.

- Review the description to ensure you have selected the correct form.

- If the form does not meet your needs, use the Search field to find a template that suits your requirements.

- Once you find the right template, click Purchase now.

- Select the pricing plan you prefer, fill out the necessary information to create your account, and make the payment using PayPal or Visa or Mastercard.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

In a contributory group plan, the employer pays part of the premium. Most states require that at least 75% of the eligible employees participate in the contributory plan. When an employer establishes a group insurance plan, what evidence of insurance may each participating employee receive?

The following are qualifying events: the death of the covered employee; a covered employee's termination of employment or reduction of the hours of employment; the covered employee becoming entitled to Medicare; divorce or legal separation from the covered employee; or a dependent child ceasing to be a dependent under

Second qualifying events may include the death of the covered employee, divorce or legal separation from the covered employee, the covered employee becoming entitled to Medicare benefits (under Part A, Part B or both), or a dependent child ceasing to be eligible for coverage as a dependent under the group health plan.

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss,

States generally define true "group" insurance as having at least 10 people covered under one master contract.

Contributory plans require that the employer pay the premium with 100% participation. Contributory Plans require both the employee and employer contribute to the premium, and 75% participation is required. When a group is covered by a MET, who is issued the Master Policy?

Normally,100% of eligible employees must participate in a noncontributory group plan before the plan can be put in force. You just studied 15 terms!

Under a contributory group plan, you are expected to pay part of the premium for group life insurance. To avoid adverse selection, the insurer typically requires that at least 75 percent of eligible employees participate in the plan.

COBRA Qualifying Event Notice The employer must notify the plan if the qualifying event is: Termination or reduction in hours of employment of the covered employee, 2022 Death of the covered employee, 2022 Covered employee becoming entitled to Medicare, or 2022 Employer bankruptcy.