Full text and statutory guidelines for the Post Assessment Property and Liability Insurance Guaranty Association Model Act.

District of Columbia Post Assessment Property and Liability Insurance Guaranty Association Model Act

Description

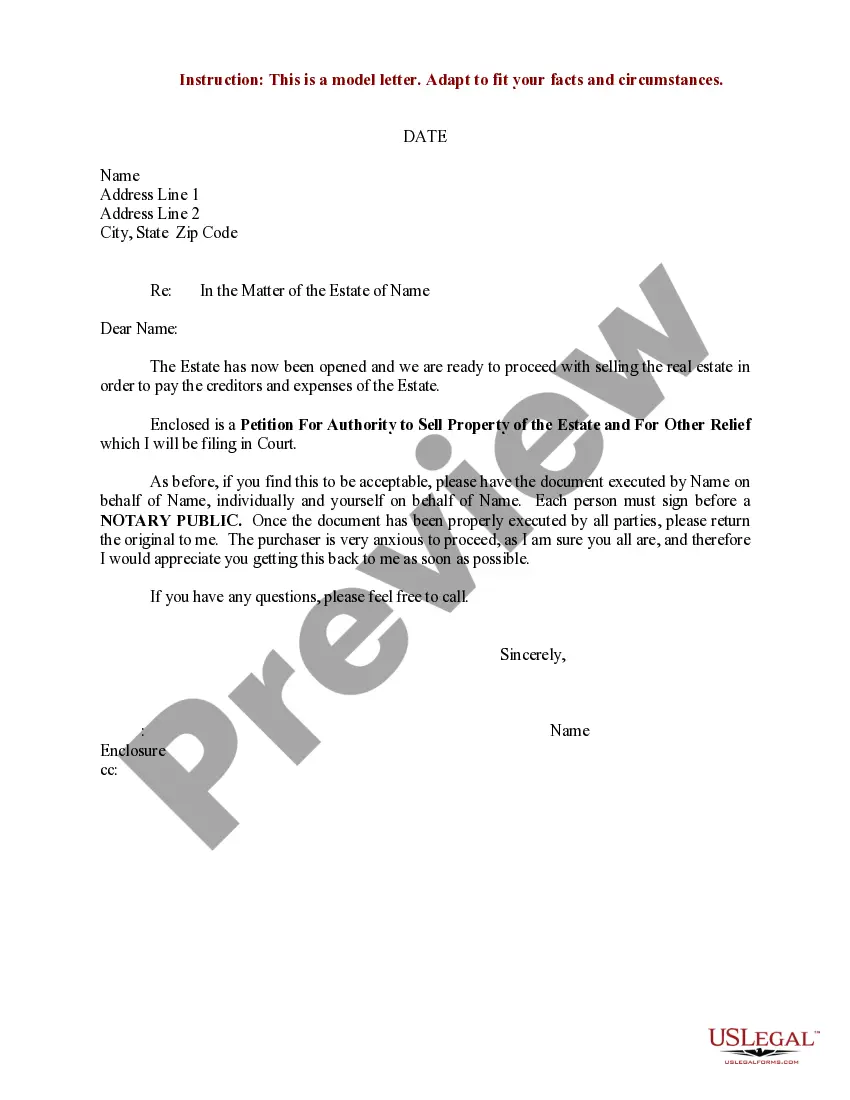

How to fill out Post Assessment Property And Liability Insurance Guaranty Association Model Act?

Discovering the right legitimate papers format can be a battle. Naturally, there are a variety of web templates accessible on the Internet, but how do you find the legitimate develop you need? Make use of the US Legal Forms site. The support provides a large number of web templates, such as the District of Columbia Post Assessment Property and Liability Insurance Guaranty Association Model Act, which you can use for business and personal requires. All of the types are checked out by professionals and satisfy state and federal demands.

In case you are already listed, log in to the accounts and click on the Acquire switch to get the District of Columbia Post Assessment Property and Liability Insurance Guaranty Association Model Act. Make use of accounts to search from the legitimate types you possess acquired in the past. Proceed to the My Forms tab of your respective accounts and acquire another copy of the papers you need.

In case you are a fresh user of US Legal Forms, allow me to share easy directions so that you can follow:

- Initial, ensure you have selected the proper develop for the town/region. You can look through the form using the Review switch and read the form explanation to ensure this is the right one for you.

- When the develop is not going to satisfy your requirements, use the Seach discipline to discover the correct develop.

- Once you are positive that the form is proper, click on the Purchase now switch to get the develop.

- Choose the pricing program you would like and enter the required details. Design your accounts and pay for your order with your PayPal accounts or charge card.

- Select the file structure and acquire the legitimate papers format to the gadget.

- Total, modify and produce and signal the received District of Columbia Post Assessment Property and Liability Insurance Guaranty Association Model Act.

US Legal Forms is the largest library of legitimate types where you can discover numerous papers web templates. Make use of the company to acquire skillfully-made papers that follow state demands.

Form popularity

FAQ

The maximum payable on any claim by the OIGA is the lesser of your policy limits or $300,000. The maximum payable on any claim for unearned premium is $10,000. We do not pay any claim, including any unearned premium claim, which does not exceed $100.00.

An insurance guaranty association is a state-sanctioned organization that protects policyholders and claimants in the event of an insurance company's impairment or insolvency.

The guaranty association's coverage of insurance company insolvencies is funded by post-insolvency assessments of the other guaranty association member companies. These assessments are based on each member's share of premium during the prior three years.

Examples of the types of insurance that fall under the guaranty fund are automobile, homeowners, liability and workers' compensation insurance.

You say the guaranty funds pay these claims. Where do they get the money to pay them? Guaranty funds largely are funded by industry assessments, which are usually collected following insolvencies.

Once an insurer has been declared insolvent, the insurance department determines the value of the company's remaining assets. It then calculates the amount of money the guaranty association will need to pay claims. This amount is assessed by insurers.

A state guaranty fund is administered by a U.S. state to protect policyholders in the event that an insurance company defaults on benefit payments or becomes insolvent. The fund only protects beneficiaries of insurance companies that are licensed to sell insurance products in that state.

$100,000 in net cash surrender or withdrawal values for life insurance. $300,000 in disability income (DI) insurance benefits. $300,000 in long-term care (LTC) insurance benefits.