District of Columbia Resolution of Meeting of LLC Members to Sell or Transfer Stock

Description

How to fill out Resolution Of Meeting Of LLC Members To Sell Or Transfer Stock?

You can spend hours on the internet searching for the valid document template that meets the state and national requirements you need.

US Legal Forms offers thousands of valid forms that can be evaluated by professionals.

You can easily download or print the District of Columbia Resolution of Meeting of LLC Members to Sell or Transfer Stock from the service.

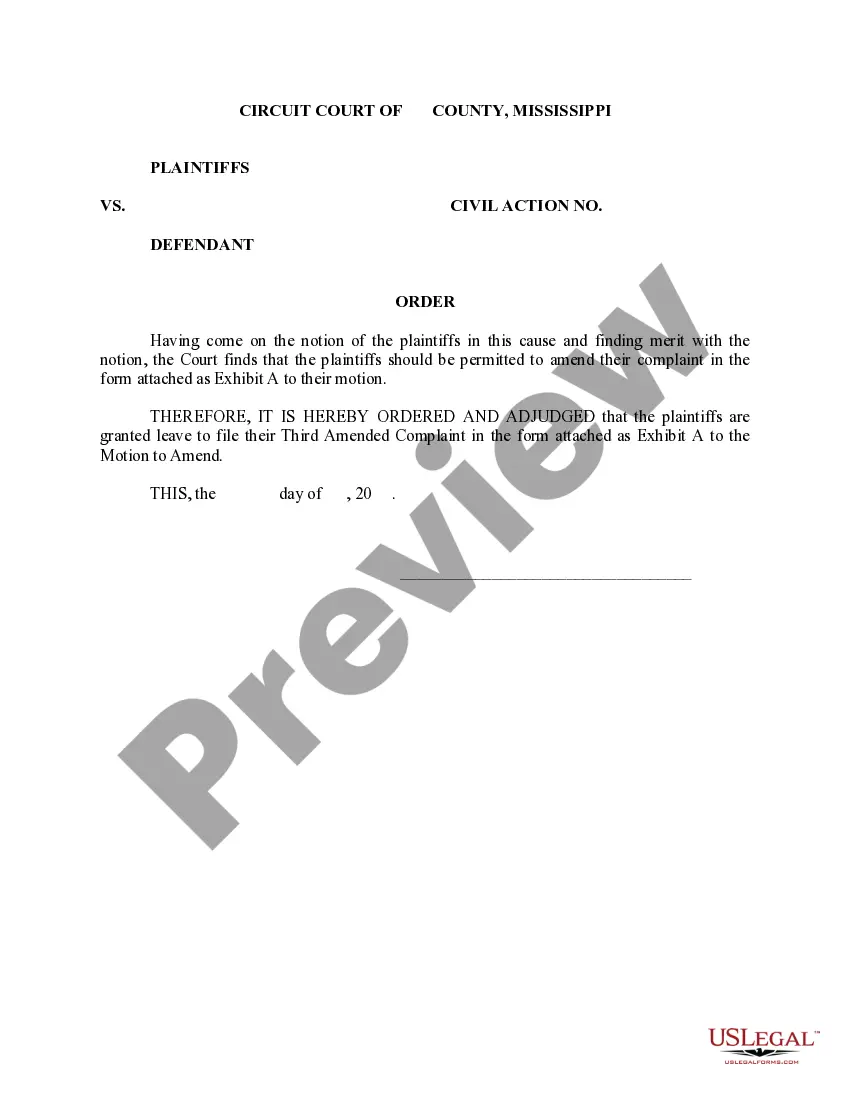

If available, use the Review button to look through the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- Afterward, you can complete, edit, print, or sign the District of Columbia Resolution of Meeting of LLC Members to Sell or Transfer Stock.

- Each valid document template you purchase is yours forever.

- To obtain another copy of any purchased form, visit the My documents tab and click on the respective button.

- If this is your first time using the US Legal Forms website, follow the basic instructions below.

- First, ensure you have selected the correct document template for your county/area of choice.

- Read the form information to verify you have chosen the right form.

Form popularity

FAQ

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

O The names of the initial members of the board of directors (D.C. law provides that a nonprofit corporation must have a minimum of three directors);

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

Unlike LLCs, corporations are required to make resolutions. Therefore, they are used to preparing them when shareholders or the board of directors make decisions. Although an LLC is not required to make resolutions, there are many reasons for getting in the habit of maintaining resolutions.