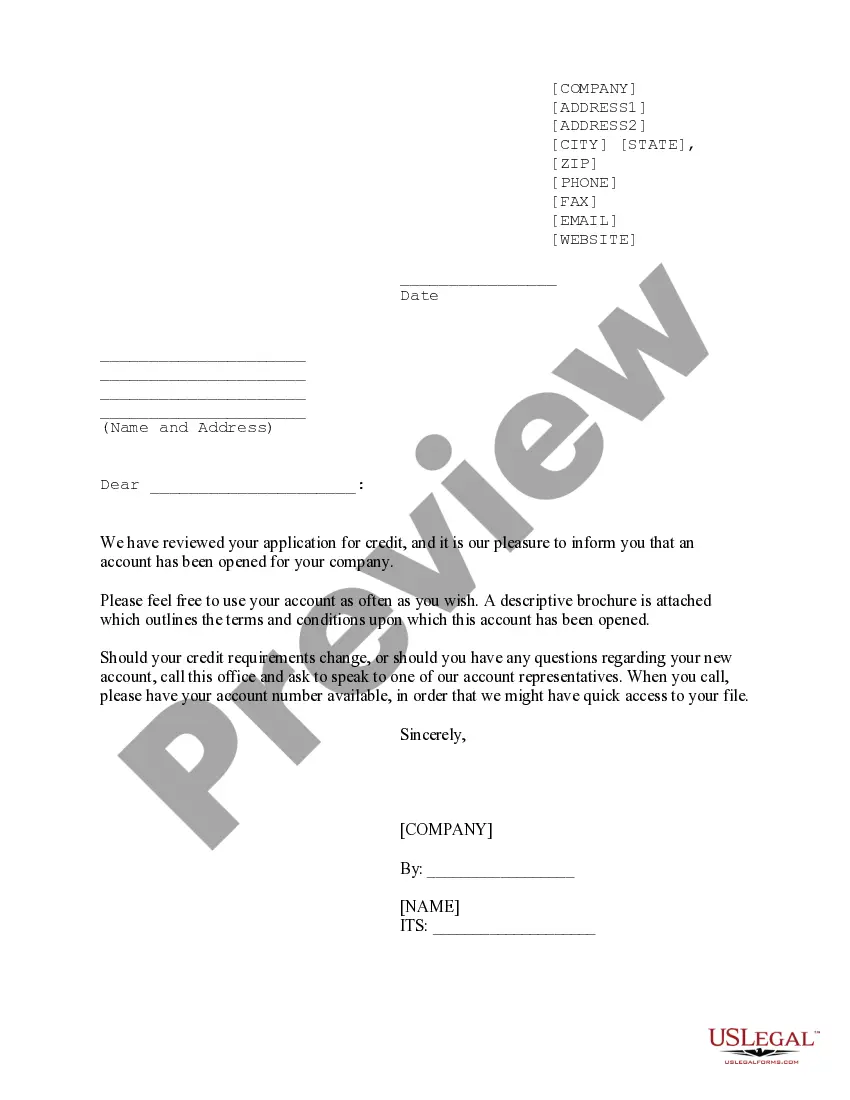

District of Columbia Credit Approval Form

Description

How to fill out Credit Approval Form?

Are you within a position where you require documentation for potential business or particular objectives almost every day.

There are numerous legal document templates accessible online, but finding forms you can rely on isn't straightforward.

US Legal Forms offers thousands of template forms, such as the District of Columbia Credit Approval Form, which are designed to meet federal and state requirements.

Once you acquire the appropriate form, click Get now.

Select a pricing plan you prefer, fill in the requested information to create your account, and complete your purchase using PayPal or a credit card. Then, choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the District of Columbia Credit Approval Form template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these steps.

- Locate the form you need and verify it is for your specific area/county.

- Utilize the Preview button to review the form.

- Examine the description to ensure you have chosen the correct form.

- If the form is not what you are looking for, use the Search box to find the form that meets your criteria.

Form popularity

FAQ

500, or Combined Tax Registration Form, is used by businesses to register all their tax requirements on one simple form. Whether registering for sales tax, franchise tax, unemployment tax, etc., the business person completes all areas applicable to their business activity either in hardcopy or online.

Taxpayers who wish to register a new business in the District of Columbia can conveniently complete the Register a New Business: Form FR-500 application online via the Office of Tax and Revenue's (OTR) tax portal, MyTax.DC.gov.

Yes. Your state of residence can tax you on all your earnings, regardless of where earned. Because of tax reciprocity, you do not have to file a DC return. But your DC earnings are fully taxable by PA.

A DC Resident is an individual that maintains a place of abode within DC for 183 days or more. If the individual is domiciled in the state at anytime, you are considered to be a DC resident. A DC Nonresident is an individual that did not spend any time domiciled in the state.

Apply for a Basic Business LicenseObtain an Employer Identification Number (EIN) from the IRS.Register with the District of Columbia Office of Tax and Revenue.Make sure your DC business premise has a Certificate of Occupancy Permit (or Home Occupation Permit).Complete the Clean Hands Self Certification.More items...

500, or Combined Tax Registration Form, is used by businesses to register all their tax requirements on one simple form. Whether registering for sales tax, franchise tax, unemployment tax, etc., the business person completes all areas applicable to their business activity either in hardcopy or online.

States With Reciprocal AgreementsArizona. Arizona has reciprocity with one neighboring stateCaliforniaas well as with Indiana, Oregon, and Virginia.Washington D.C.Illinois.Indiana.Iowa.Kentucky.Maryland.Michigan.More items...

Credit for Taxes Paid to Another State The District of Columbia allows taxpayers to claim a credit for individual income tax paid to other state(s) if the income taxed by that state is derived from that state and is of a kind taxed by DC.

There are generally two ways reciprocal agreements work: Income not taxed at source: both states tax the income, but the state of residence offers the credit. Reverse credit states: both states tax the income, but the nonresident state offers the credit.

Individual Income Property Tax Credit The Individual Income Tax Credit reduces the DC individual income tax liability of eligible homeowners and renters by up to $1000.