District of Columbia Independent Consultant Programming Services General Agreement (User Oriented)

Description

How to fill out Independent Consultant Programming Services General Agreement (User Oriented)?

You can dedicate multiple hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms provides countless legal templates that have been reviewed by experts.

You can easily download or print the District of Columbia Independent Consultant Programming Services General Agreement (User Oriented) from my services.

If you wish to find another variation of the form, use the Search field to locate the template that suits your requirements.

Once you have identified the template you need, click Get now to proceed.

Select the pricing plan you prefer, enter your information, and register for a free account on US Legal Forms.

Complete the purchase. You can use your Visa, Mastercard, or PayPal account to buy the legal template.

Choose the format of the document and download it to your device.

Make alterations to your document as needed. You can complete, edit, and sign or print the District of Columbia Independent Consultant Programming Services General Agreement (User Oriented).

Download and print thousands of document layouts using the US Legal Forms website, which offers the largest collection of legal templates.

Utilize professional and state-specific templates to address your business or personal needs.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the District of Columbia Independent Consultant Programming Services General Agreement (User Oriented).

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any acquired form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your location/area of interest. Review the form description to confirm you have selected the proper template.

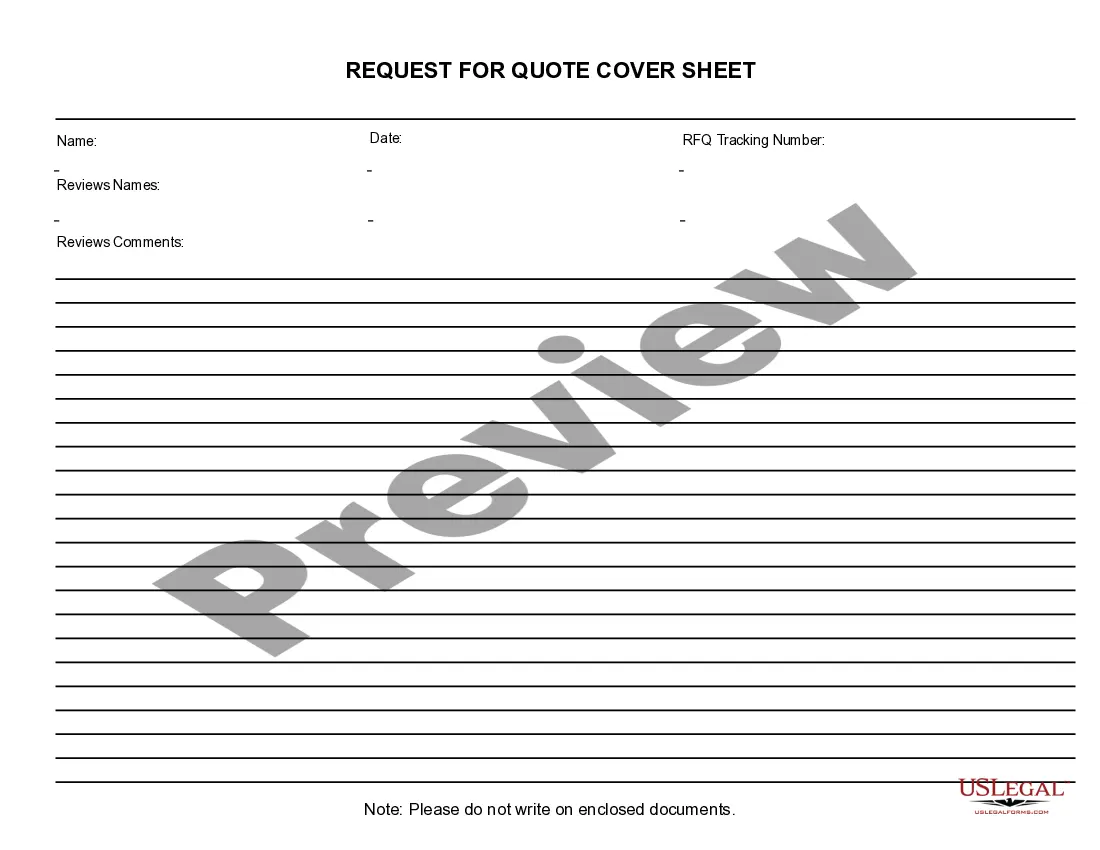

- If available, use the Preview button to view the document template at the same time.

Form popularity

FAQ

An Independent Contractor Agreement is a legal contract that outlines the scope, payment schedule, and deadlines for freelance work. Signed by both the contractor and the client, this agreement can help to set expectations and reduce the risk of conflicts.

A: To be eligible for Unemployment Insurance benefits, an individual must meet the following wage requirements: 2022 Wages must be reported in at least two quarters of the base period; 2022 At least $1,300 in wages must be reported in one quarter of the base period; 2022 At least $1,950 in wages must be reported for the entire

Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

An Independent Contractor Agreement (IC agreement) is a contract between an individual and the company that will be employing them. An IC agreement determines what rights, obligations, and duties each party has in their relationship to one another.

An independent contractor working as an individual is not subject to coverage under the DC unemployment insurance law.

An Independent Contractor Agreement is a written contract that outlines the terms and conditions of the working arrangement between an independent contractor and client, including: A description of the services provided. Terms and length of the project or service.

The First Source Law requires all beneficiaries of contractual agreements totaling $300,000 or more to enter into a First Source Employment Agreement with the Department of Employment Services.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

1. PURPOSE. To establish a legal contract between the college and individuals who provide a service to the college and to determine whether an individual is an independent contractor or an employee based on Internal Revenue Service criteria.