District of Columbia Aging Accounts Payable

Description

How to fill out Aging Accounts Payable?

Are you presently in a circumstance where you need paperwork for business or personal objectives on a daily basis.

There are numerous valid document templates accessible online, yet locating reliable versions can be challenging.

US Legal Forms provides thousands of template options, such as the District of Columbia Aging Accounts Payable, which are designed to meet state and federal regulations.

Once you locate the correct form, click Purchase now.

Choose the payment plan you desire, provide the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are now familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the District of Columbia Aging Accounts Payable template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the template you require and ensure it is for the correct city/state.

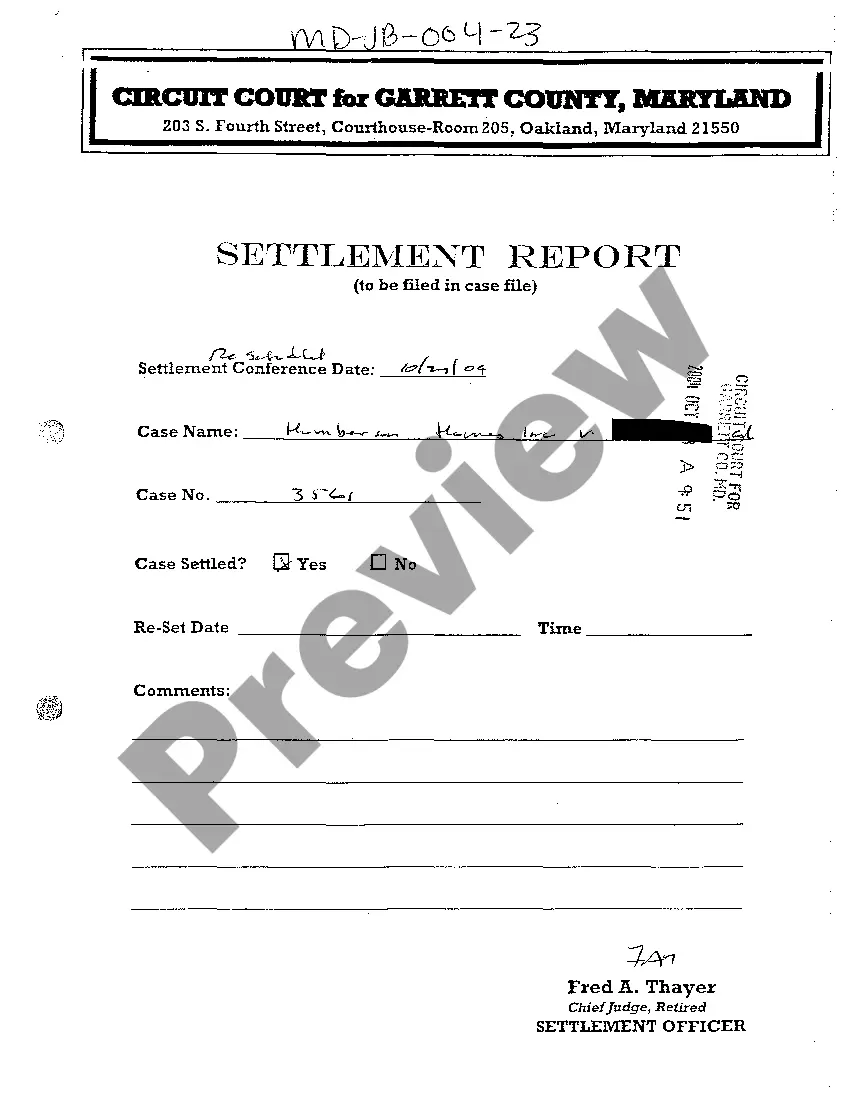

- Use the Review option to examine the document.

- Check the description to verify that you have chosen the right form.

- If the form is not what you’re searching for, utilize the Look for field to find the template that fits your needs.

Form popularity

FAQ

To calculate accounts payable aging, determine the amount owed and the specific due dates for each invoice. You can then categorize these amounts into different aging brackets, which will reflect how long these payables have been outstanding. This approach allows you to effectively manage the District of Columbia Aging Accounts Payable and helps ensure that you maintain healthy vendor relationships.

The accounts payable turnover in days shows the average number of days that a payable remains unpaid. To calculate the accounts payable turnover in days, simply divide 365 days by the payable turnover ratio. Therefore, over the fiscal year, the company takes approximately 60.53 days to pay its suppliers.

To prepare accounts receivable aging report, sort the unpaid invoices of a business with the number of days outstanding. This report displays the amount of money owed to you by your customers for good and services purchased.

AP Aging ReportsGo to Reports on the top menu.Choose Vendors and Payables.Select A/P Aging Detail.Tick the Customize Report tab.In the Dates field choose Custom.Enter the date for April in the From and To field.Tap OK.16-Feb-2021

The report is typically set up with 30-day time buckets. This approach results in a report where each successive column lists supplier invoices that are 0 to 30 days old, 31 to 60 days old, 61 to 90 days old, and older than 90 days.

Aging of Accounts Receivables = (Average Accounts Receivables 360 Days)/Credit SalesAging of Accounts Receivables = ($ 4, 50,000.00360 days)/$ 9, 00,000.00.Aging of Accounts Receivables = 90 Days.

When you pay off an invoice, remove the current or past due amount from your report. For example, say you paid off the $100 invoice that's 61 90 days past due for Vendor 3. After you pay Vendor 3 the $100, make sure you change the 61 90 days column to say $0.

The accounts payable turnover in days shows the average number of days that a payable remains unpaid. To calculate the accounts payable turnover in days, simply divide 365 days by the payable turnover ratio. Therefore, over the fiscal year, the company takes approximately 60.53 days to pay its suppliers.

Simply put, accounts payable aging reports gives you an overview of what your business owes for supplies, inventory, and services. A quick glance at this report reveals the identities of your creditors, how much money is owed to each creditor and how long that money has been owed.

How to create an accounts receivable aging reportStep 1: Review open invoices.Step 2: Categorize open invoices according to the aging schedule.Step 3: List the names of customers whose accounts are past due.Step 4: Organize customers based on the number of days outstanding and the total amount due.10-May-2021