District of Columbia Aging of Accounts Receivable

Description

How to fill out Aging Of Accounts Receivable?

It is feasible to spend several hours online looking for the appropriate legal document template that satisfies your state and federal requirements.

US Legal Forms provides a multitude of legal forms that are evaluated by experts.

You can conveniently download or print the District of Columbia Aging of Accounts Receivable from our service.

- If you possess a US Legal Forms account, you can sign in and click on the Obtain button.

- Then, you can fill out, modify, print, or sign the District of Columbia Aging of Accounts Receivable.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click on the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, make sure you have chosen the correct document template for the area/city of your selection.

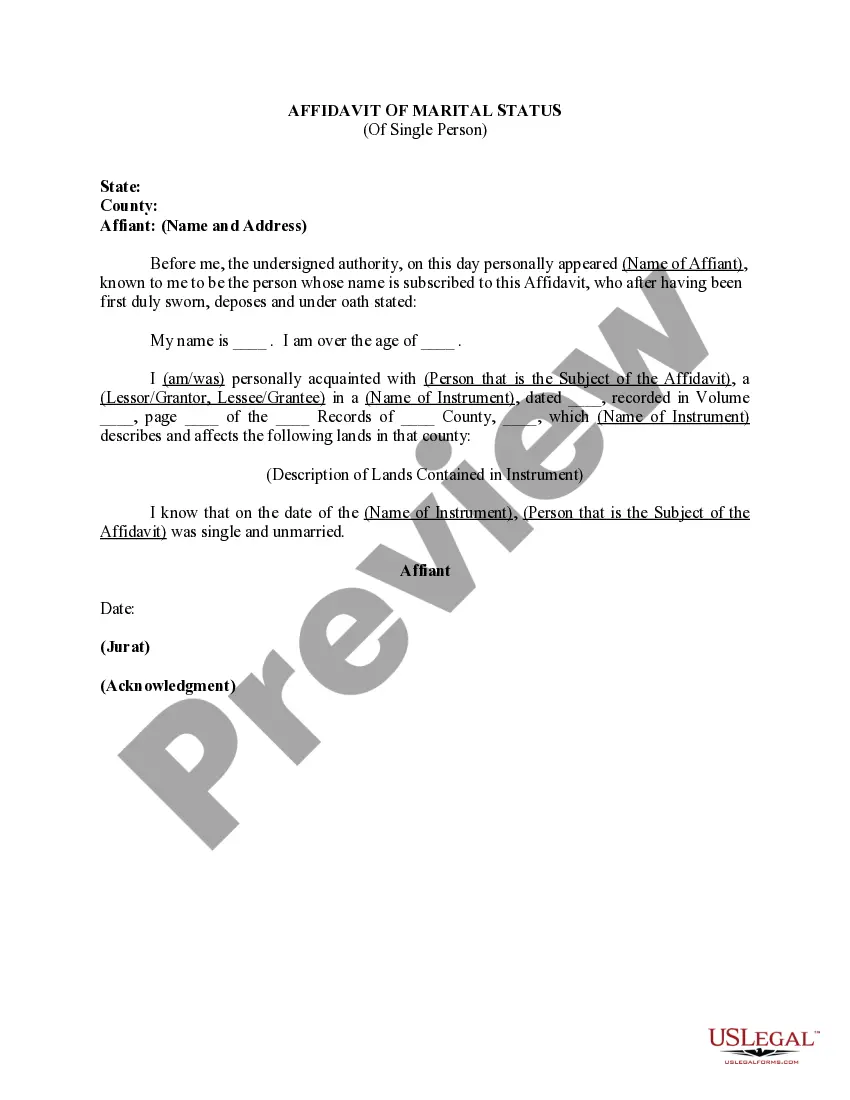

- Read the form description to ensure you have selected the correct form.

- If available, use the Review button to check the document template as well.

- To find another version of your form, use the Search field to locate the template that meets your needs.

- Once you have found the template you desire, click on Purchase now to proceed.

- Select the pricing plan you want, enter your information, and register for an account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal account to pay for the legal form.

- Choose the format of your document and download it to your device.

- Make adjustments to your document if necessary. You can fill out, revise, sign, and print the District of Columbia Aging of Accounts Receivable.

- Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

To calculate the aging of accounts receivable method, first collect data on all receivable accounts. Next, organize these accounts into groups based on how long they have been unpaid, such as 0-30 days, 31-60 days, and so on. This analysis not only enhances your financial strategy but also aligns with best practices in managing the District of Columbia Aging of Accounts Receivable.

Creating an accounts receivable aging report involves summarizing all outstanding receivables organized by age. Start by listing customer names, invoice amounts, and due dates, then calculate the total for each aging category. This structured report provides valuable insights into your financial status and the efficiency of collections within the District of Columbia Aging of Accounts Receivable.

To calculate the accounts receivable aging method, list all outstanding invoices and categorize them by age, typically in 30-day intervals. Then, assign each amount to the appropriate age bracket and calculate the total for each category. This approach illustrates how long accounts have been outstanding, giving you clear insights into the District of Columbia Aging of Accounts Receivable.

The aging report for accounts receivable summarizes the status of outstanding invoices for businesses in the District of Columbia. It offers insights into which customers are overdue and the total amount due. This report is essential for effective collections and can help you identify potential financial risks.

The aging schedule for accounts receivable provides an overview of all outstanding invoices, helping businesses in the District of Columbia monitor their finances. It breaks down amounts owed by time intervals, allowing you to see which accounts need immediate attention. This tool enhances your ability to make informed financial decisions.

The aging of accounts receivable method is a financial analysis technique used by businesses in the District of Columbia. It involves grouping receivables by their due dates, enabling companies to assess the quality of their accounts. By using this method, businesses can take timely actions to improve collection processes and reduce bad debt.

You can email ERAP DC by visiting their official site, which typically lists the appropriate contact information for inquiries. Make sure to include all relevant details in your email to get the best assistance concerning the District of Columbia Aging of Accounts Receivable. This way, you can address any concerns efficiently.

To email DC jail, you need to find the specific address provided by the facility where the inmate is located. Each jail may have its own guidelines, and checking the official website will provide the most accurate information. If you’re inquiring about matters related to the District of Columbia Aging of Accounts Receivable, it might also help to understand the documentation needed for effective communication.

To close a DC withholding account, you must submit a written request to the DC Office of Tax and Revenue. This request should include your account information and any pertinent details regarding the District of Columbia Aging of Accounts Receivable. It’s advisable to follow up to ensure your account has been successfully closed.

There might be several reasons why your DC tax refund is delayed, such as incomplete information or higher-than-normal processing volumes. It's a good idea to check your refund status on the DC Office of Tax and Revenue's website. If you are facing issues related to the District of Columbia Aging of Accounts Receivable, consider reaching out directly for clarification.