District of Columbia Sample Letter for Request for Removal of Derogatory Credit Information

Description

How to fill out Sample Letter For Request For Removal Of Derogatory Credit Information?

You may commit hrs online trying to find the legitimate papers design which fits the federal and state specifications you require. US Legal Forms provides a large number of legitimate types that happen to be reviewed by professionals. You can easily down load or print the District of Columbia Sample Letter for Request for Removal of Derogatory Credit Information from your assistance.

If you already have a US Legal Forms account, it is possible to log in and then click the Acquire switch. Next, it is possible to complete, edit, print, or sign the District of Columbia Sample Letter for Request for Removal of Derogatory Credit Information. Every legitimate papers design you acquire is your own eternally. To acquire another copy for any obtained type, proceed to the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms site initially, adhere to the basic guidelines under:

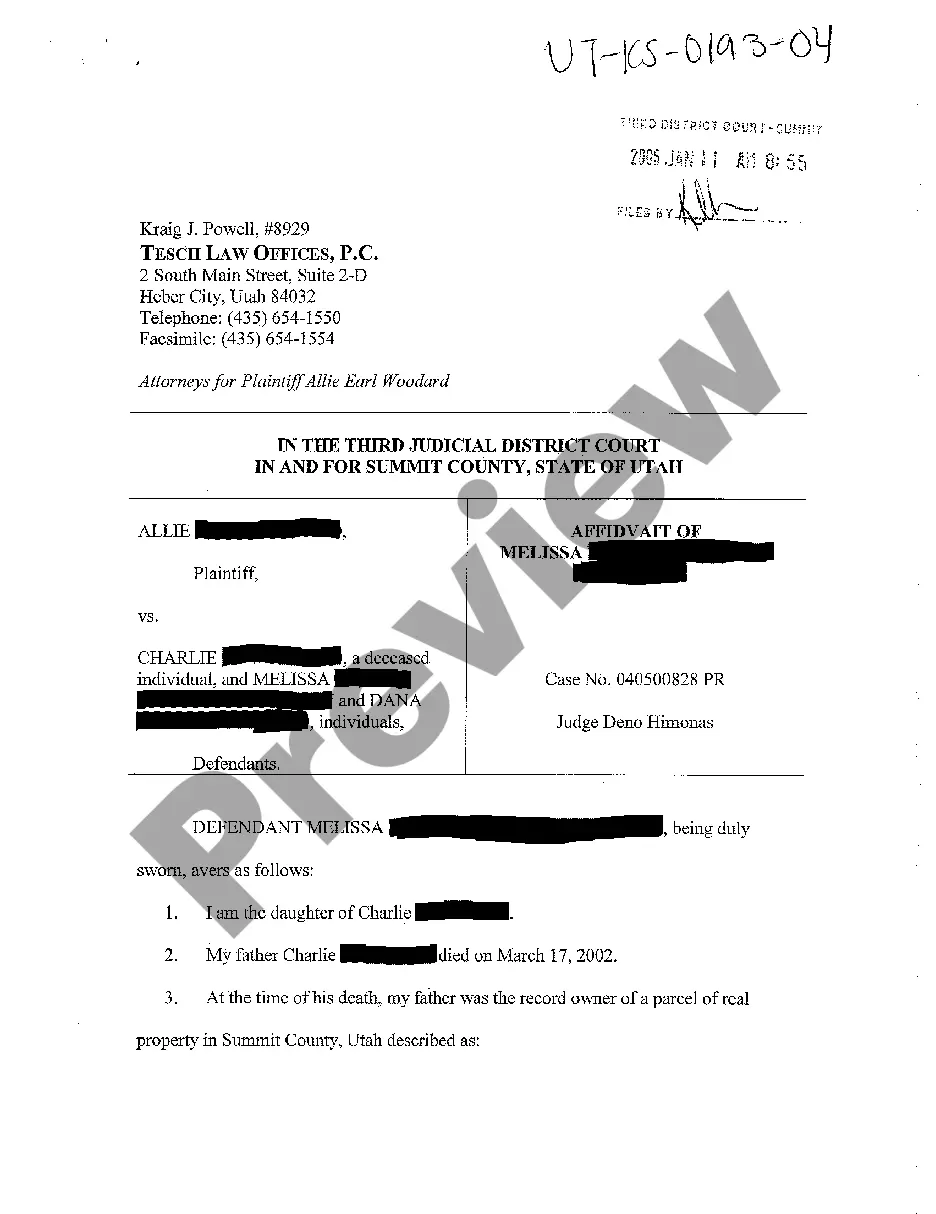

- First, be sure that you have chosen the right papers design for that county/metropolis of your choice. See the type explanation to ensure you have picked the correct type. If available, make use of the Review switch to check through the papers design at the same time.

- If you wish to get another version of the type, make use of the Lookup area to obtain the design that fits your needs and specifications.

- After you have found the design you desire, simply click Purchase now to continue.

- Pick the prices program you desire, type your credentials, and register for an account on US Legal Forms.

- Full the financial transaction. You should use your bank card or PayPal account to fund the legitimate type.

- Pick the structure of the papers and down load it for your system.

- Make changes for your papers if possible. You may complete, edit and sign and print District of Columbia Sample Letter for Request for Removal of Derogatory Credit Information.

Acquire and print a large number of papers templates while using US Legal Forms Internet site, that offers the largest variety of legitimate types. Use professional and condition-distinct templates to tackle your business or person requires.

Form popularity

FAQ

Paying off collection accounts can raise credit scores calculated using FICO® Score 9 and 10 and VantageScore 3.0 and 4.0, but it won't have any effect on scores produced by older FICO scoring models.

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years.

How to remove negative items from your credit report yourself Get a free copy of your credit report. ... File a dispute with the credit reporting agency. ... File a dispute directly with the creditor. ... Review the claim results. ... Hire a credit repair service. ... Send a request for ?goodwill deletion? ... Work with a credit counseling agency.

If the derogatory mark is in error, you can file a dispute with the credit bureaus to get negative information removed from your credit reports. You can see all three of your credit reports for free on a weekly basis. If the derogatory marks are not errors, you'll need to wait for them to age off your credit reports.

A 609 letter is a formal document consumers use to request more information about account details listed on their credit reports they believe to be erroneous and to request the removal or correction of this inaccurate information.

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. And if you're willing, you can spend big bucks on templates for these magical dispute letters.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.