District of Columbia Borrowers Certification of Inventory

Description

How to fill out Borrowers Certification Of Inventory?

Are you currently within a place the place you require files for either enterprise or individual purposes almost every day time? There are plenty of lawful file themes available on the Internet, but locating types you can rely is not straightforward. US Legal Forms offers a large number of develop themes, such as the District of Columbia Borrowers Certification of Inventory, that happen to be created to meet state and federal demands.

When you are presently acquainted with US Legal Forms web site and have a free account, just log in. Next, you are able to acquire the District of Columbia Borrowers Certification of Inventory design.

Should you not offer an account and would like to begin to use US Legal Forms, follow these steps:

- Find the develop you need and ensure it is to the correct area/area.

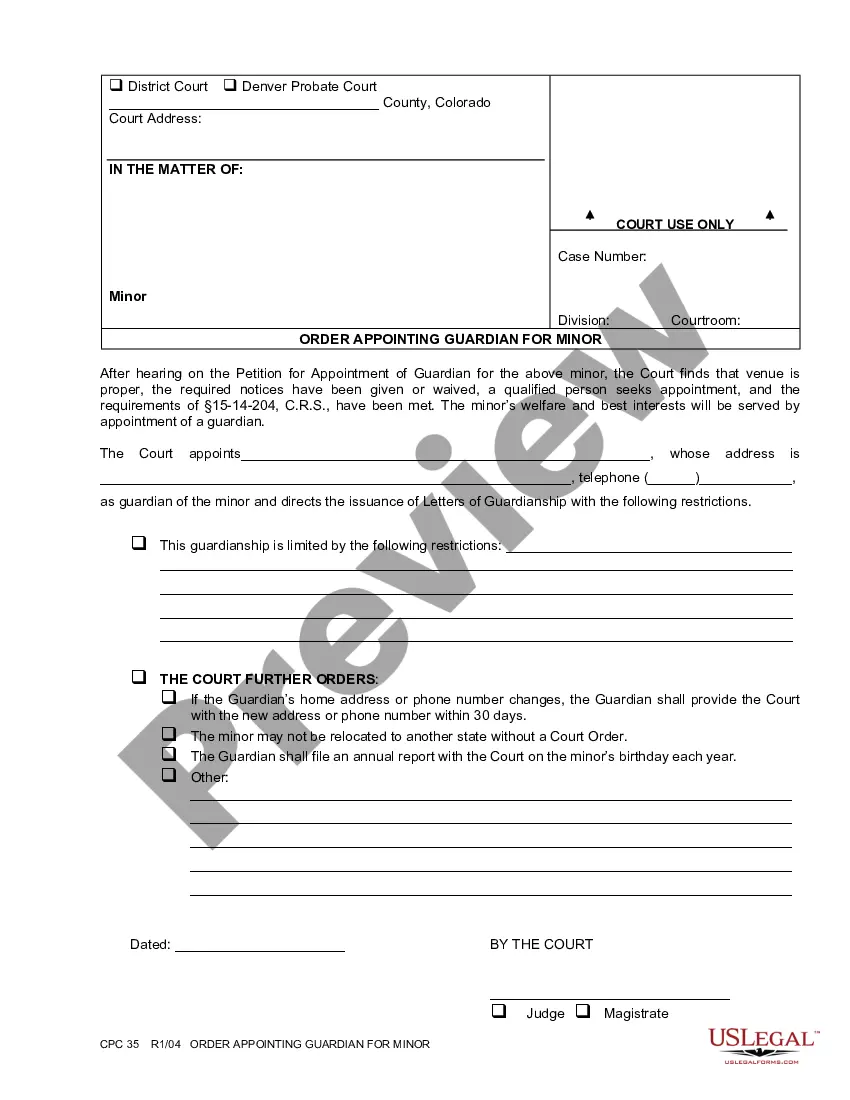

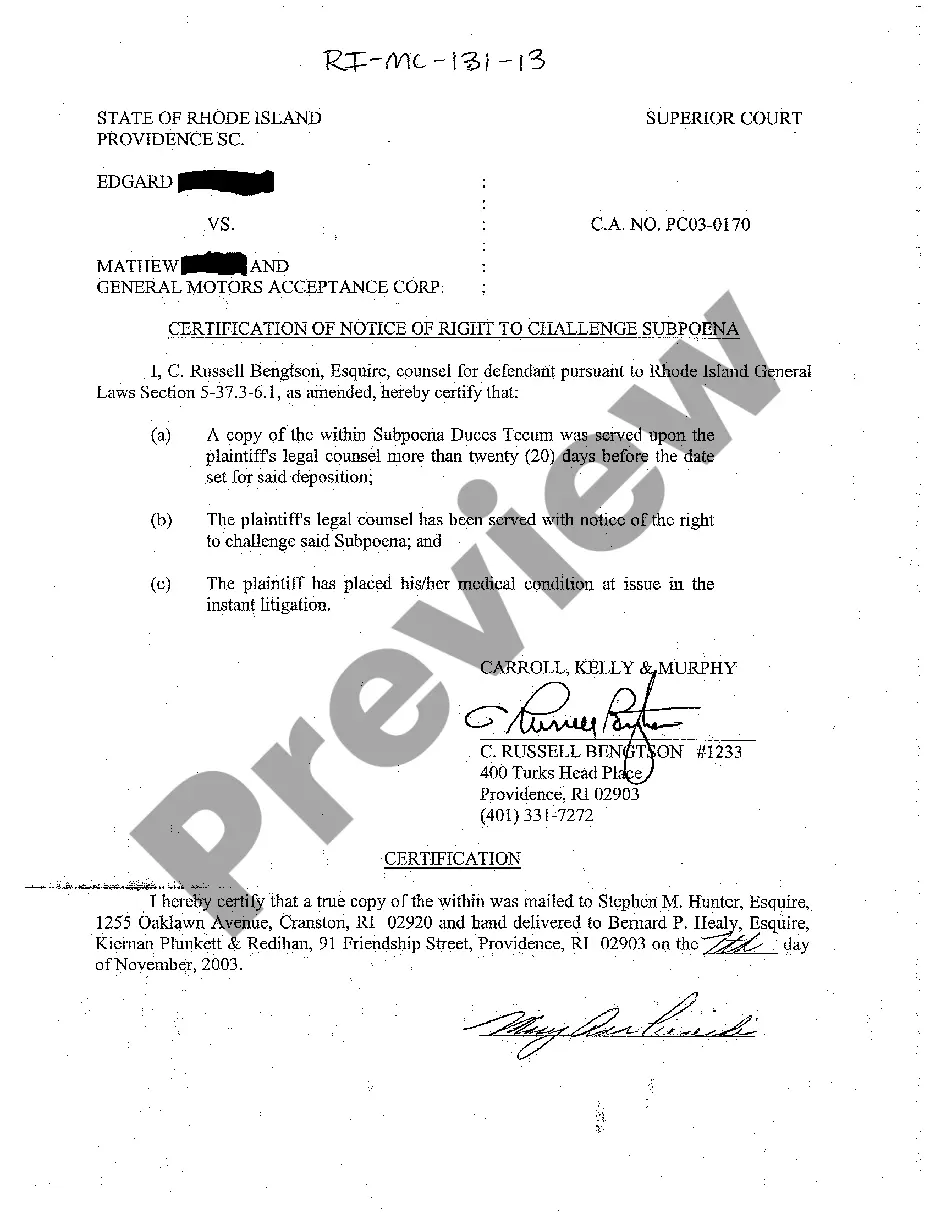

- Use the Preview option to review the shape.

- Read the description to actually have selected the appropriate develop.

- In case the develop is not what you`re trying to find, utilize the Lookup field to get the develop that fits your needs and demands.

- Whenever you find the correct develop, just click Purchase now.

- Choose the pricing strategy you want, fill in the necessary information and facts to generate your account, and pay for your order making use of your PayPal or credit card.

- Decide on a hassle-free document formatting and acquire your copy.

Get all the file themes you might have bought in the My Forms food selection. You may get a further copy of District of Columbia Borrowers Certification of Inventory anytime, if possible. Just click the needed develop to acquire or printing the file design.

Use US Legal Forms, by far the most comprehensive variety of lawful types, to save lots of some time and avoid mistakes. The service offers skillfully manufactured lawful file themes that you can use for a variety of purposes. Produce a free account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

Summary. This certificate of borrower (limited liability company) is a form of officer's certificate delivered by a borrower (that is organized as a limited liability company) to the lender at the closing of an acquisition loan transaction. This template includes practical guidance and drafting notes.

The program lends the required down payment to the purchaser, which is eventually repaid (with no interest due) when the homeowner sells, moves out, or refinances their mortgage. This down payment assistance is paired with a mortgage at an interest rate set by DC (more info below).

(c) It shall be lawful to contract for a rate of interest not exceeding 24% per annum on a loan or financial transaction which is secured directly or indirectly by: (1) a mortgage or deed of trust, other than a first purchase mortgage or first purchase deed of trust, on residential real property; (2) a security ...

(c) It shall be lawful to contract for a rate of interest not exceeding 24% per annum on a loan or financial transaction which is secured directly or indirectly by: (1) a mortgage or deed of trust, other than a first purchase mortgage or first purchase deed of trust, on residential real property; (2) a security ...

District law sets the maximum interest rates that lenders can charge in their written contracts at 24% per year. Violations of these limits are illegal under the Consumer Protection Procedures Act (CPPA), which prohibits a broad range of deceptive and unfair business practices.

District law sets the maximum interest rates that lenders can charge in their written contracts at 24% per year. Violations of these limits are illegal under the Consumer Protection Procedures Act (CPPA), which prohibits a broad range of deceptive and unfair business practices.

Today's rate Today's mortgage rates in Washington, DC are 8.140% for a 30-year fixed, 7.149% for a 15-year fixed, and 8.240% for a 5-year adjustable-rate mortgage (ARM).

FindLaw Newsletters Stay up-to-date with how the law affects your life Legal Maximum Rate of Interest12% absent written contract rate (§19.52.010(1))Penalty for Usury (Unlawful Interest Rate)Debtor entitled to costs, attorney's fees, and twice amount paid in excess of what lender is entitled to (§19.52.030(1))2 more rows