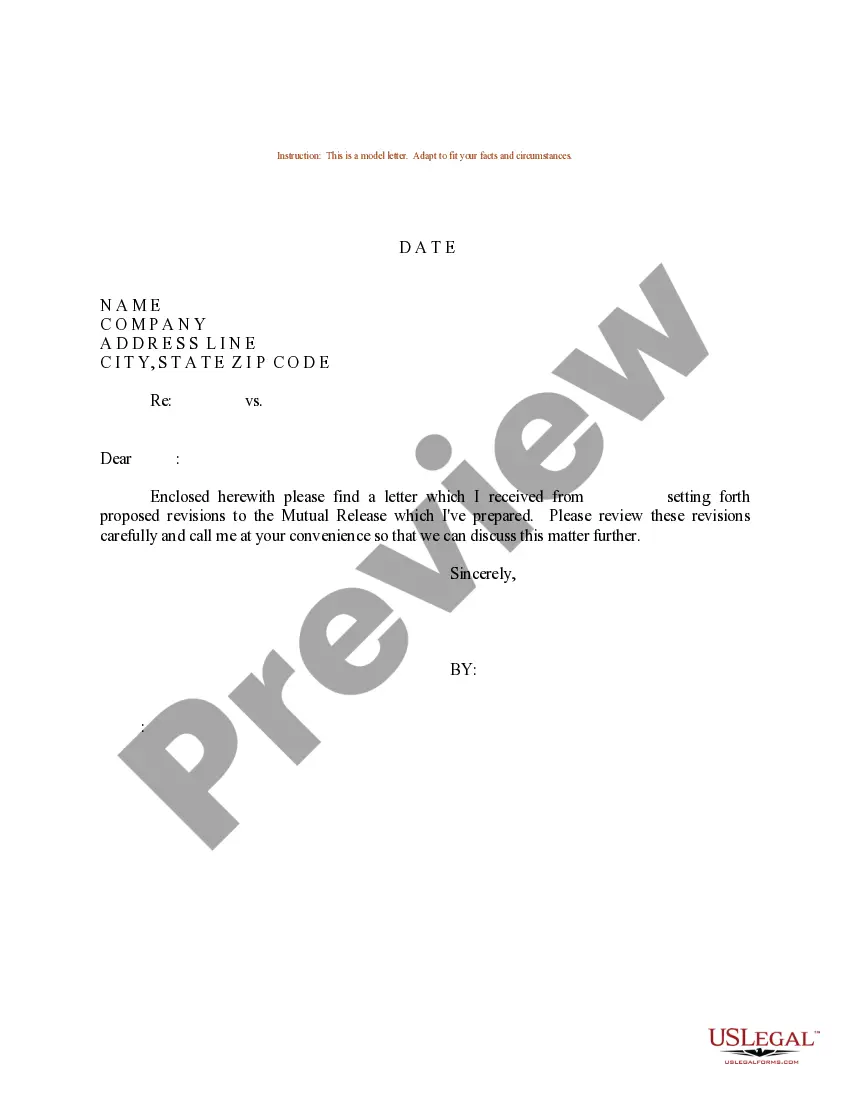

District of Columbia Sample Letter for Revised Promissory Note

Description

How to fill out Sample Letter For Revised Promissory Note?

Locating the appropriate authentic document template can be quite challenging.

Obviously, there are numerous designs available on the internet, but how can you discover the true type you require? Utilize the US Legal Forms website.

The service offers a vast array of templates, such as the District of Columbia Sample Letter for Revised Promissory Note, that can be utilized for both business and personal purposes.

You can review the form using the Review button and view the form outline to ensure it is indeed the most suitable choice for you. If the form does not satisfy your needs, utilize the Search field to find the appropriate form. Once you are confident that the form is correct, click on the Buy now button to obtain the document. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the document format and download the legal document template onto your device. Finally, complete, modify, and print and sign the retrieved District of Columbia Sample Letter for Revised Promissory Note. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to download professionally created papers that adhere to state requirements.

- All documents are evaluated by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the District of Columbia Sample Letter for Revised Promissory Note.

- Use your account to search for the legal forms you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the form you need.

- If you are a new user of US Legal Forms, here are simple guidelines you should follow.

- Firstly, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

An amended promissory note is a legal document that changes the terms of the original promissory note. These amendments should be made with consent from the lender and, once in place, will be considered binding by all parties involved. Canceling a promissory note is a completely different process from amending it.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Refinancing a hard money note is exactly like refinancing a bank mortgage. Find the refinancing lender and loan, go through a qualifications process, have the property appraised, and give contact information for the original note holder to your new lender so it can make arrangements to pay off the privately held note.

An amended promissory note is a legal document that changes the terms of the original promissory note. These amendments should be made with consent from the lender and, once in place, will be considered binding by all parties involved. Canceling a promissory note is a completely different process from amending it.

An amended and restated promissory note is a legally binding addition to a promissory note that notes any significant changes and replaces the original agreement. Amended and restated promissory notes are seen as the most recent and up-to-date versions of the promise to pay between a borrower and a lender.

How to Modify a Promissory NoteIdentify the terms of the note that are creating difficulty in repayment.Communicate your need to modify the terms of the note to the note holder.Have the holder of the note draft modifications to the original note.Sign and notarize the modified promissory note.

An amended and restated promissory note is a legally binding addition to a promissory note that notes any significant changes and replaces the original agreement. Amended and restated promissory notes are seen as the most recent and up-to-date versions of the promise to pay between a borrower and a lender.

Circumstances for Release of a Promissory Note The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.