District of Columbia Sample Letter for Collection of Refund

Description

How to fill out Sample Letter For Collection Of Refund?

Finding the right authorized record design can be quite a struggle. Of course, there are a lot of layouts available online, but how would you obtain the authorized type you want? Utilize the US Legal Forms site. The assistance provides a huge number of layouts, for example the District of Columbia Sample Letter for Collection of Refund, that you can use for enterprise and private requires. Every one of the varieties are inspected by experts and fulfill federal and state demands.

If you are currently authorized, log in to your account and click the Down load option to get the District of Columbia Sample Letter for Collection of Refund. Make use of account to look from the authorized varieties you have ordered earlier. Visit the My Forms tab of your respective account and acquire one more version of the record you want.

If you are a brand new customer of US Legal Forms, here are straightforward instructions for you to comply with:

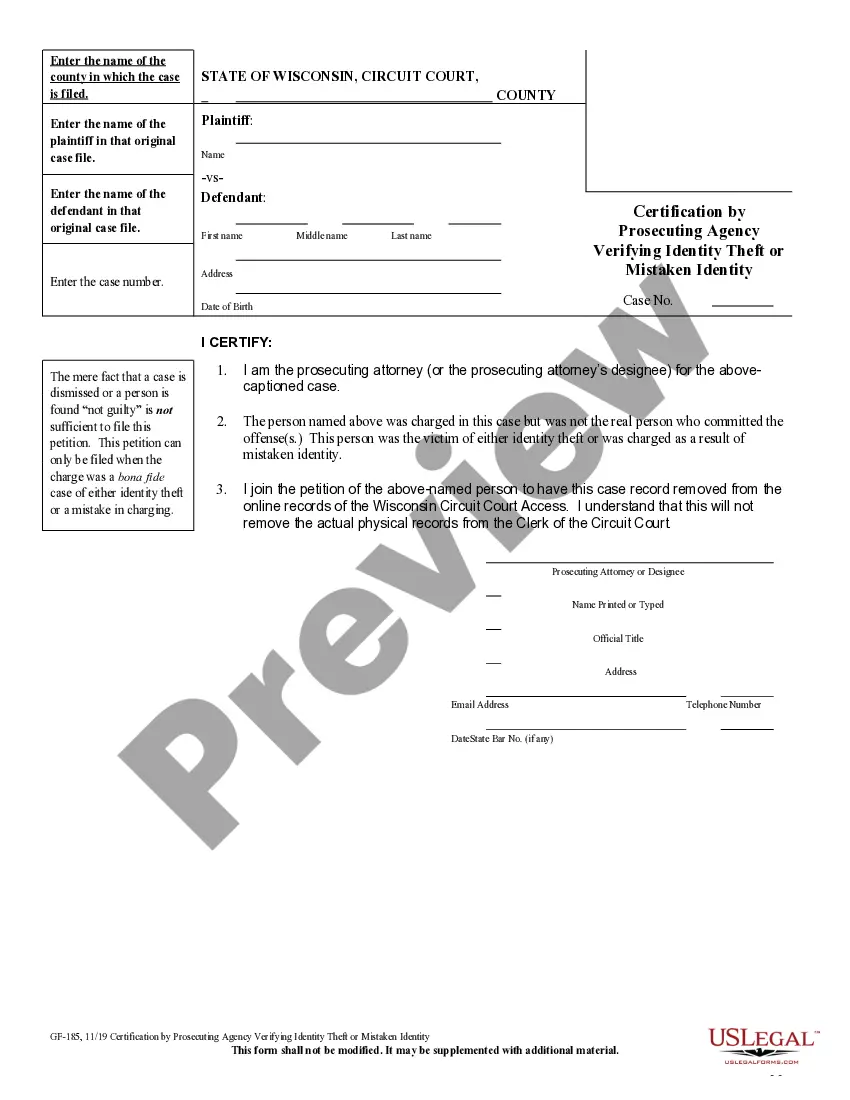

- First, make certain you have selected the proper type for the metropolis/county. You can check out the shape making use of the Preview option and study the shape explanation to make sure it is the right one for you.

- If the type is not going to fulfill your preferences, utilize the Seach discipline to discover the appropriate type.

- When you are positive that the shape would work, select the Purchase now option to get the type.

- Opt for the rates program you need and type in the required information and facts. Design your account and pay money for your order making use of your PayPal account or charge card.

- Select the submit formatting and download the authorized record design to your device.

- Comprehensive, modify and produce and indicator the received District of Columbia Sample Letter for Collection of Refund.

US Legal Forms is definitely the greatest library of authorized varieties in which you can see numerous record layouts. Utilize the service to download skillfully-created papers that comply with state demands.

Form popularity

FAQ

Incorrect direct deposit information "A simple mistake in the routing or account number can delay a refund for weeks or even months," he adds. The IRS will issue a paper check once the deposit is rejected or returned by the bank and mail the check to you.

What happens after I successfully verify? We'll process your tax return. It may take up to 9 weeks to receive your refund or credit any overpayment to your account.

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022.

What can cause a delay in my District of Columbia refund? If the department needs to verify information reported on your return or request additional information, the process will take longer. Math errors in your return or other adjustments. You used more than one form type to complete your return.

The IRS says it can take more than 120 days to precess your refund if they need more information or verification from you, depending on how quickly and accurately you respond, and how quickly the IRS can complete the processing of your return. In such cases, you'll receive a letter from the IRS.

Processing of selected tax returns is estimated to take up to six weeks. To whom do I make my payment payable? Make your check or money order payable to the "DC Treasurer." Do not send cash.

I am attaching my Form 16 B for your reference and I request you to kindly refund the extra amount of Rs 21,000/- paid by me. Kindly let me know in case I need to provide any other documents. The cheque for the amount of Rs 21,000/- may kindly be send on my residential address as mentioned in the form. Thanking you!

The Role of Statute of Limitations on IRS Collections Meaning, the IRS can collect unpaid taxes for a total of ten years from the assessment date. After ten years have passed, the IRS must stop its collection efforts, barring any important exceptions.