District of Columbia Collection Report

Description

How to fill out Collection Report?

If you desire to complete, obtain, or print authentic documents themes, utilize US Legal Forms, the most significant collection of authentic forms, accessible on the web.

Take advantage of the site's straightforward and user-friendly search to locate the papers you need.

A selection of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the District of Columbia Collection Report.

Every legal document template you purchase is yours forever. You have access to every form you downloaded in your account. Visit the My documents section and select a form to print or download again.

- Utilize US Legal Forms to locate the District of Columbia Collection Report in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Acquire button to receive the District of Columbia Collection Report.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If this is your first experience with US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

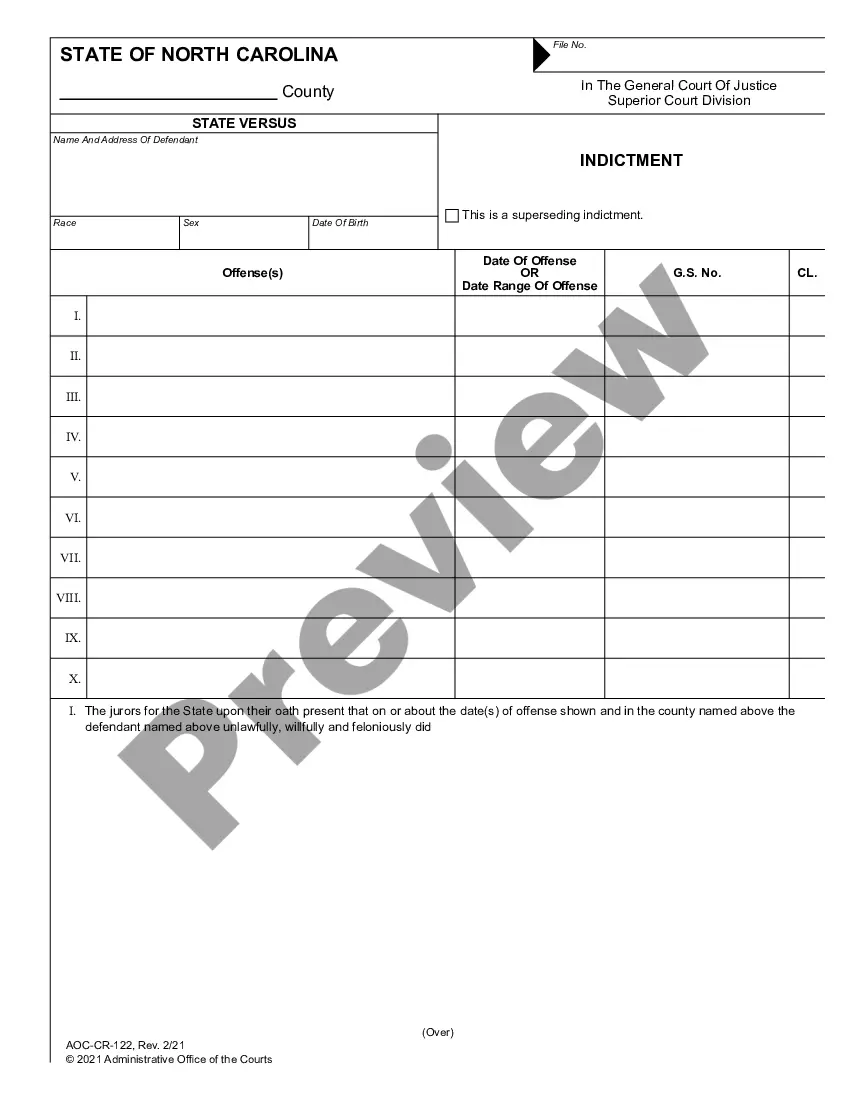

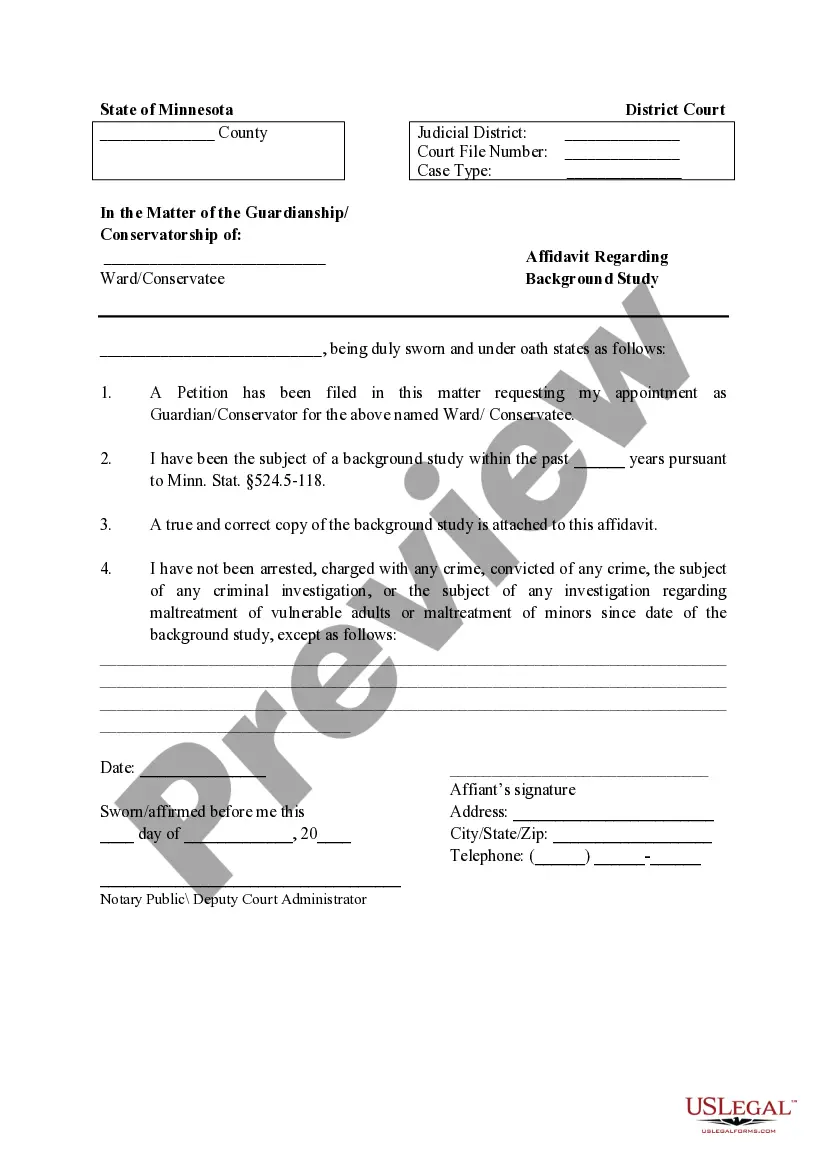

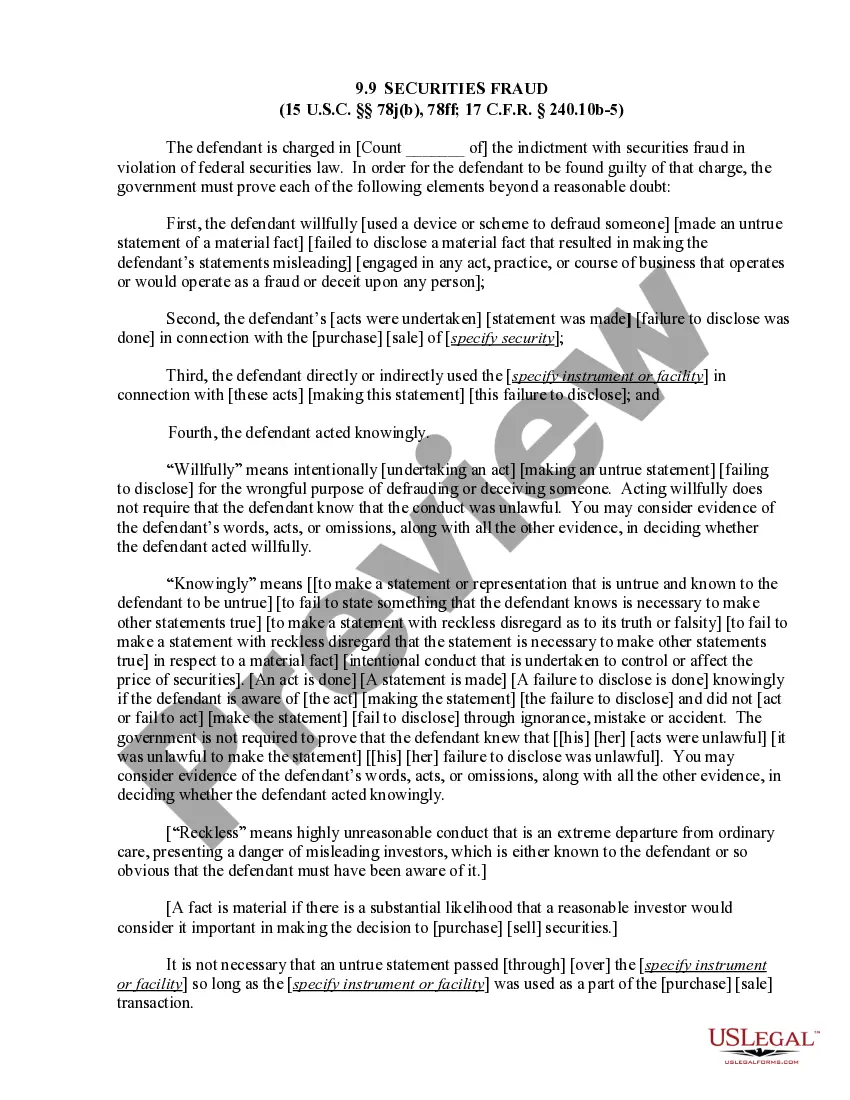

- Step 2. Use the Review option to examine the form's details. Don’t forget to read the information.

- Step 3. If you are unsatisfied with the form, use the Lookup field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The 183-day rule in the District of Columbia refers to the residency requirement for tax purposes. If you spend more than 183 days in DC during the year, you may be required to file a tax return as a resident. Understanding this rule is essential when reviewing your District of Columbia Collection Report to ensure you meet tax obligations.

How to Start a Business in Washington D.C.Choose a Business Idea. Take some time to explore and research ideas for your business.Decide on a Legal Structure.Choose a Name.Create Your Business Entity.Apply for Licenses and Permits.Find a Business Location and Check Zoning.File and Report Taxes.Obtain Insurance.More items...

As of July 1, 2021, you may start submitting your renewal application online if your license reflects an expiration date during the COVID-19 pandemic....Complete a 3-hour DC Real Estate Commission (DCREC) approved Fair Housing course.Passing score on the state (DC) portion of the Salesperson exam.More items...

If you have any other questions, please contact the DCRA Consumer Protection Hotline at (202) 442-4476 or send an email to: dcra.consumerprotection@dc.gov.

If you need to search existing business entities in Washington D.C., visit the Washington D.C. Department of Consumer and Regulatory Affairs Business Entity Search and include any info you have on the business in the search cells.

Online Service Site: Corporations Division can be contacted by phone, fax, email, US Postal Service or walk-in visit:Phone: (202) 442-4400, Option #5.Fax: (202) 442-4523.Mailing Address: DCRA Corporations Division, PO Box 92300, Washington, DC 20090.More items...

Online via the Business License Verification system; By telephone at (202) 442 4311(Maximum of 3 requests per call); In Person, Business License Center, 1100 4th Street, SW, 2nd Floor, Washington, DC 20024; and....RoadmapBusiness Name;Tax Number (if available);Business Address;License Number; and/or.Business Activity.

If you encounter any issues with this process or have questions, please contact us at 202-442-4320.

Online via the Business License Verification system; By telephone at (202) 442 4311(Maximum of 3 requests per call); In Person, Business License Center, 1100 4th Street, SW, 2nd Floor, Washington, DC 20024; and....RoadmapBusiness Name;Tax Number (if available);Business Address;License Number; and/or.Business Activity.

Apply for a Basic Business LicenseObtain an Employer Identification Number (EIN) from the IRS.Register with the District of Columbia Office of Tax and Revenue.Make sure your DC business premise has a Certificate of Occupancy Permit (or Home Occupation Permit).Complete the Clean Hands Self Certification.More items...