District of Columbia Sample Letter for Breakdown of Account Arrearage

Description

How to fill out Sample Letter For Breakdown Of Account Arrearage?

Choosing the best lawful papers web template can be a struggle. Naturally, there are a lot of web templates available online, but how do you get the lawful form you will need? Utilize the US Legal Forms website. The support gives a huge number of web templates, like the District of Columbia Sample Letter for Breakdown of Account Arrearage, which can be used for organization and private requirements. All the kinds are checked by professionals and fulfill state and federal requirements.

When you are already listed, log in in your accounts and click on the Download key to obtain the District of Columbia Sample Letter for Breakdown of Account Arrearage. Utilize your accounts to appear throughout the lawful kinds you possess acquired in the past. Proceed to the My Forms tab of your respective accounts and have yet another version in the papers you will need.

When you are a whole new user of US Legal Forms, listed below are simple directions so that you can follow:

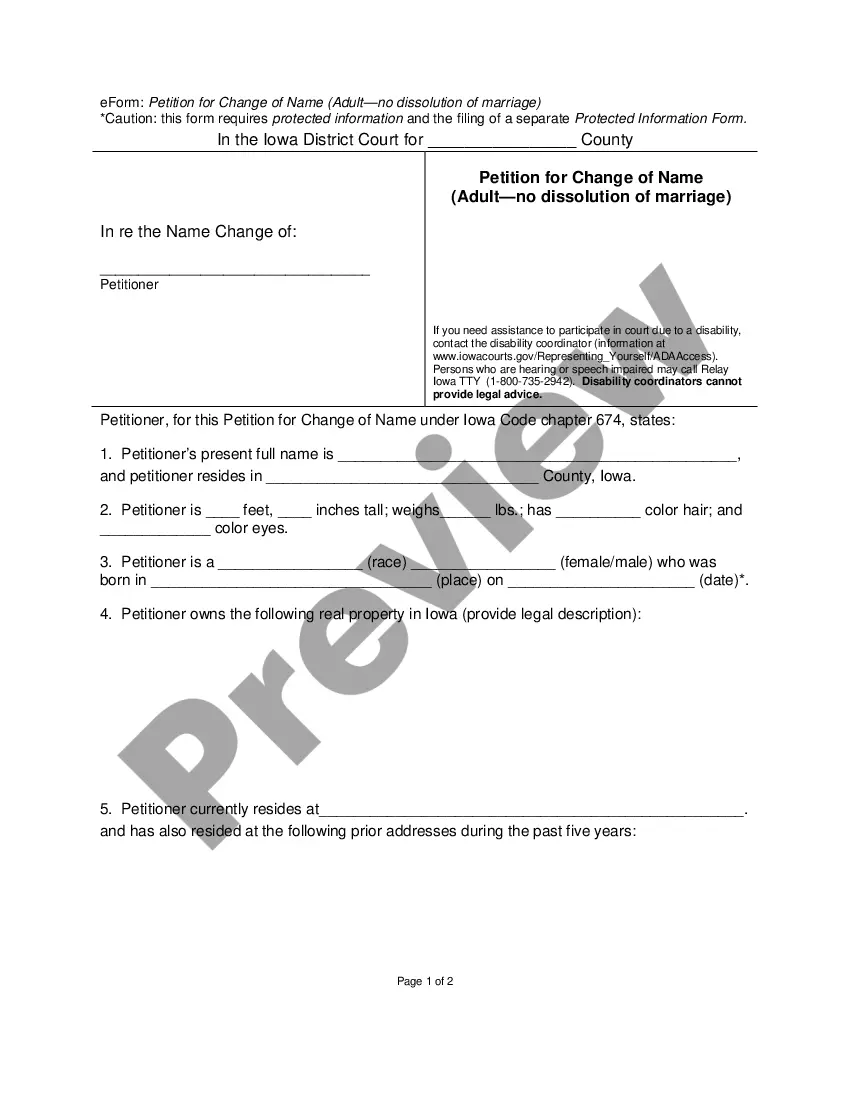

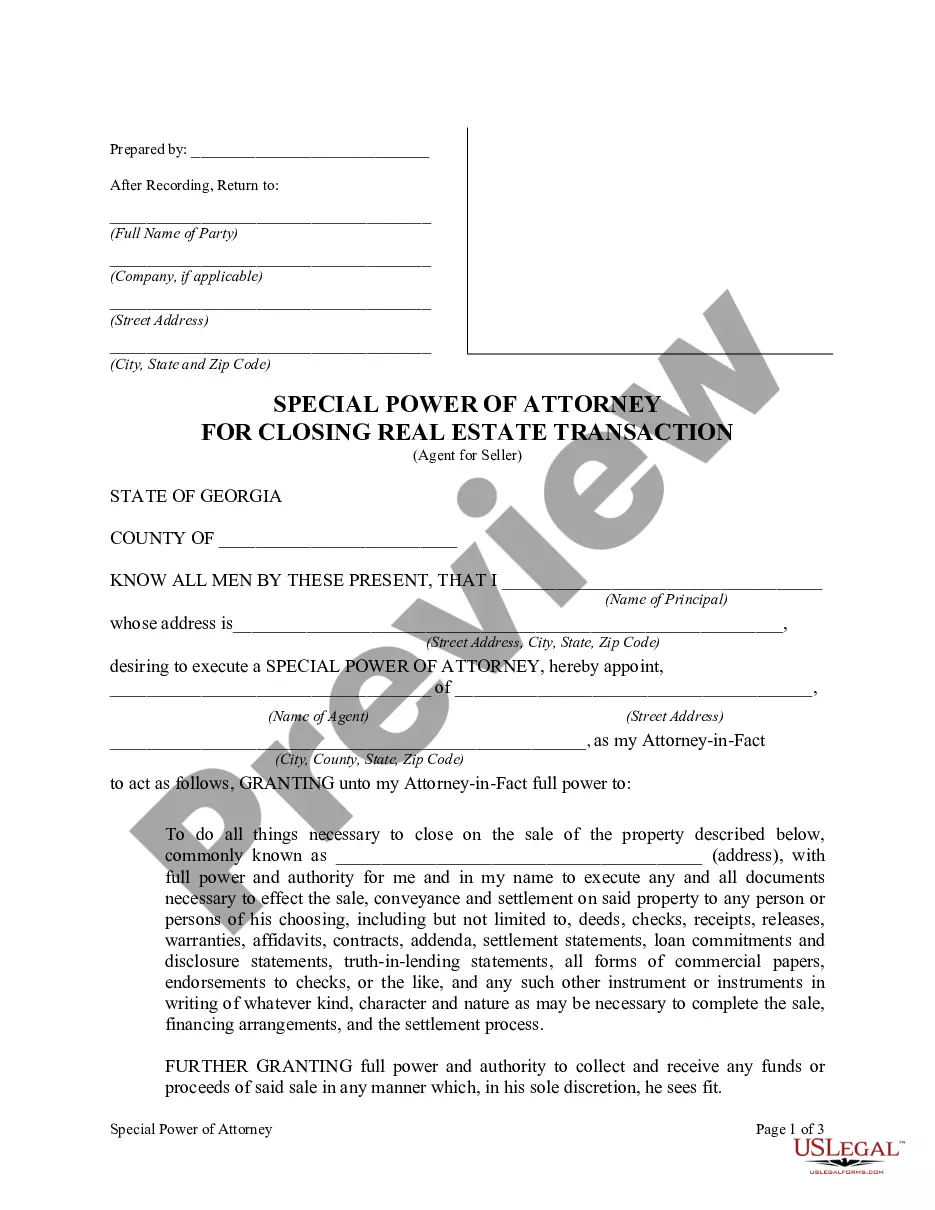

- First, ensure you have chosen the appropriate form for the city/region. It is possible to examine the shape using the Review key and study the shape description to guarantee it will be the right one for you.

- When the form will not fulfill your expectations, use the Seach area to discover the correct form.

- Once you are certain the shape is proper, select the Acquire now key to obtain the form.

- Opt for the pricing plan you need and type in the needed info. Create your accounts and purchase the transaction making use of your PayPal accounts or Visa or Mastercard.

- Opt for the file format and obtain the lawful papers web template in your device.

- Full, edit and print and indicator the received District of Columbia Sample Letter for Breakdown of Account Arrearage.

US Legal Forms may be the most significant local library of lawful kinds in which you will find a variety of papers web templates. Utilize the company to obtain expertly-made documents that follow express requirements.