A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

District of Columbia Check Disbursements Journal

Description

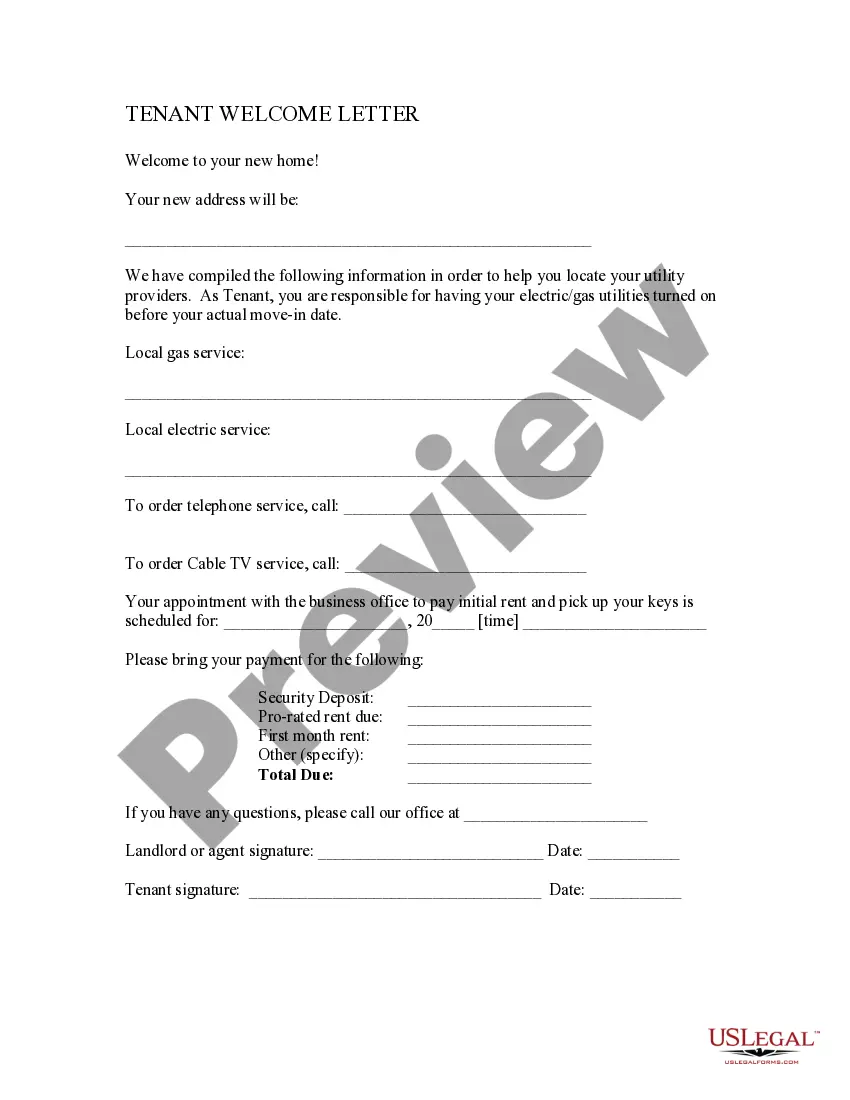

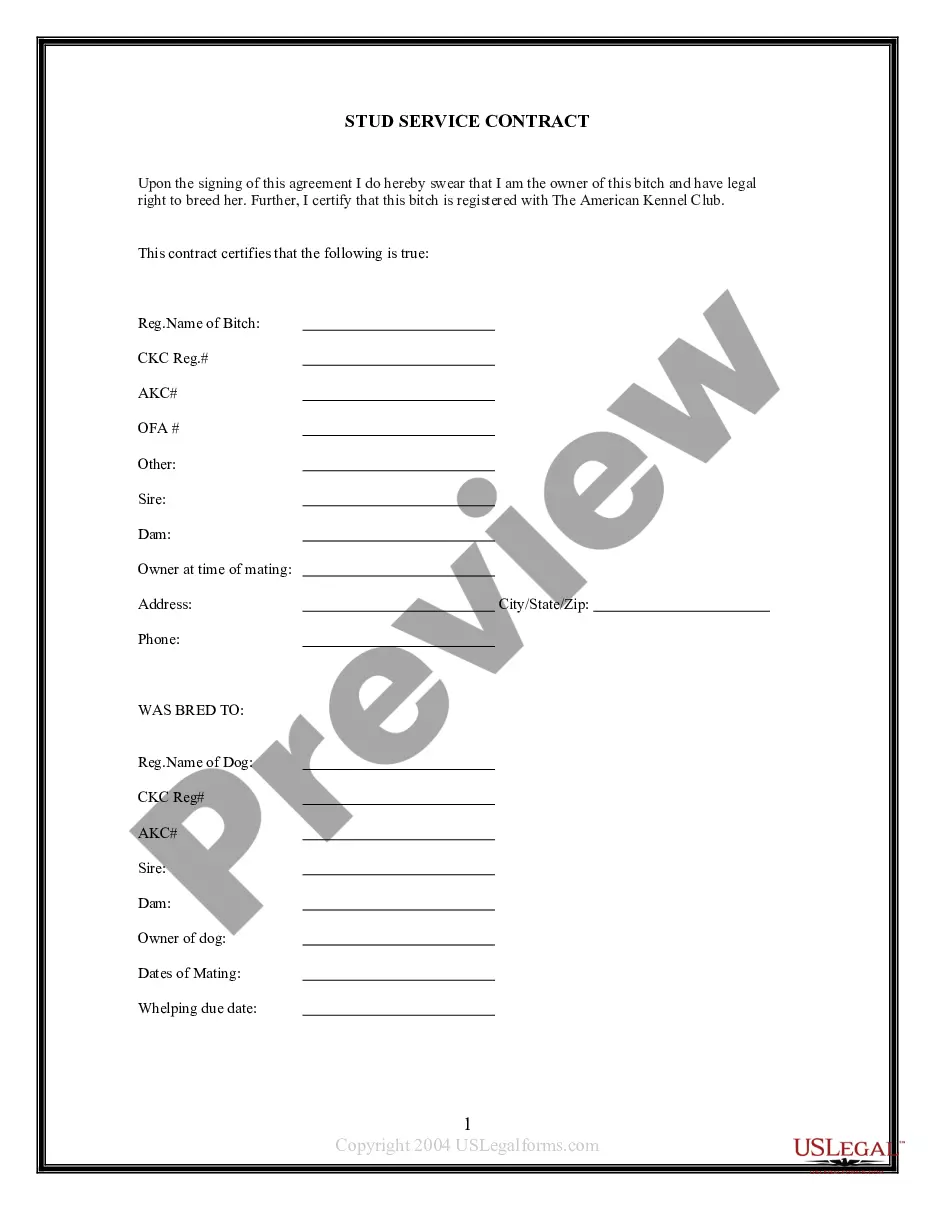

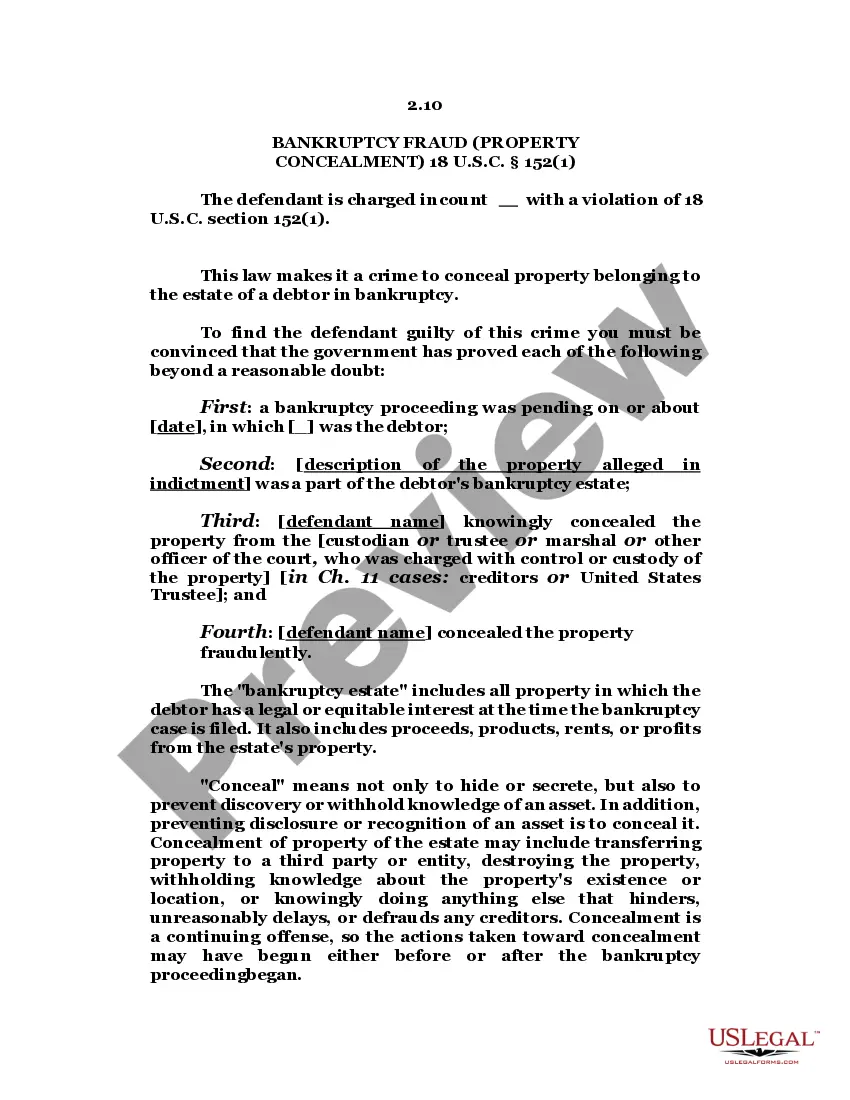

How to fill out Check Disbursements Journal?

Are you in a situation where you require documents for potential corporate or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is not easy.

US Legal Forms offers a variety of form templates, including the District of Columbia Check Disbursements Journal, designed to comply with state and federal regulations.

Choose the pricing plan you prefer, complete the required information for your payment, and finalize your order using PayPal, Visa, or Mastercard.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the District of Columbia Check Disbursements Journal template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific region.

- Use the Preview button to view the document.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you require, use the Lookup field to find a form that suits your needs.

- Once you find the suitable form, click Get now.

Form popularity

FAQ

Closing a DC does account requires a few steps to ensure your account is settled. First, verify that all transactions are complete and there are no pending obligations. You may need to submit a formal request to the relevant financial institution. Utilizing tools like the District of Columbia Check Disbursements Journal can assist you in understanding any last financial obligations before you finalize your account closure.

The District of Columbia is funded through a mix of local revenues, federal contributions, and grants. Local revenues primarily come from taxes, fees, and other charges imposed on residents and businesses. Understanding the funding sources can provide context on how public services and infrastructure are maintained. Additionally, the District of Columbia Check Disbursements Journal offers clarity on where and how these funds are allocated.

Yes, you can file your taxes online in the District of Columbia using the Office of Tax and Revenue's website. This convenient method allows residents to submit their tax returns securely and efficiently. Online processing often speeds up your tax situation, letting you keep track of your filings. For assistance and to understand your obligations better, consider looking at the District of Columbia Check Disbursements Journal.

In the District of Columbia, property taxes remain due regardless of age, unless you qualify for specific exemptions. Senior citizens aged 65 and older can apply for tax relief programs that can lessen their tax burden. It is important to stay informed about these options as they can significantly affect your finances. For details, you may want to explore resources related to the District of Columbia Check Disbursements Journal to understand applicable tax relief measures.

To check your DC tax refund status, visit the official DC tax website where you'll find a dedicated section for refund inquiries. You'll be required to enter specific details, such as your Social Security number and the amount of your refund. Keeping records like those in your District of Columbia Check Disbursements Journal can assist you in providing accurate information to expedite the checking process.

To file a DC income and expense report, you need to gather all relevant financial documents, including your District of Columbia Check Disbursements Journal. You'll typically download the required forms from the official website or utilize online tools available for filing. Follow the instructions carefully to ensure all information is accurate and submitted on time.

Yes, you can electronically file a DC tax return, and it's a convenient option for many taxpayers. The process allows for faster processing and confirmation of your return. Ensure that you have your financial records organized, including entries from your District of Columbia Check Disbursements Journal, to streamline the electronic filing process.

District of Columbia tax refers to the taxes levied by the city on income, property, sales, and use. Each type of tax comes with its own set of requirements and rates, which can affect both individuals and businesses. Keeping an accurate District of Columbia Check Disbursements Journal will help you track your taxable transactions and ensure timely compliance with tax obligations.

The District of Columbia includes a variety of government agencies, services, and tax regulations. Specifically, it encompasses a range of municipal services, tax offices, and public resources. Staying informed about these aspects will help you effectively manage your business, especially when recording transactions in the District of Columbia Check Disbursements Journal.

Yes, the District of Columbia requires most businesses to obtain a business license. This applies to different business activities, from consulting to retail. Be sure to check the necessary licenses required for your business type to ensure you maintain compliance, alongside documenting your expenses in the District of Columbia Check Disbursements Journal.