US Legal Forms - one of many greatest libraries of lawful varieties in America - gives a wide range of lawful record themes you may down load or print out. Using the web site, you can get a huge number of varieties for organization and person uses, sorted by classes, says, or keywords.You will discover the latest variations of varieties just like the District of Columbia Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement in seconds.

If you already possess a registration, log in and down load District of Columbia Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement from the US Legal Forms collection. The Obtain switch will appear on each form you perspective. You have access to all previously downloaded varieties in the My Forms tab of your respective profile.

In order to use US Legal Forms the very first time, here are basic directions to obtain started off:

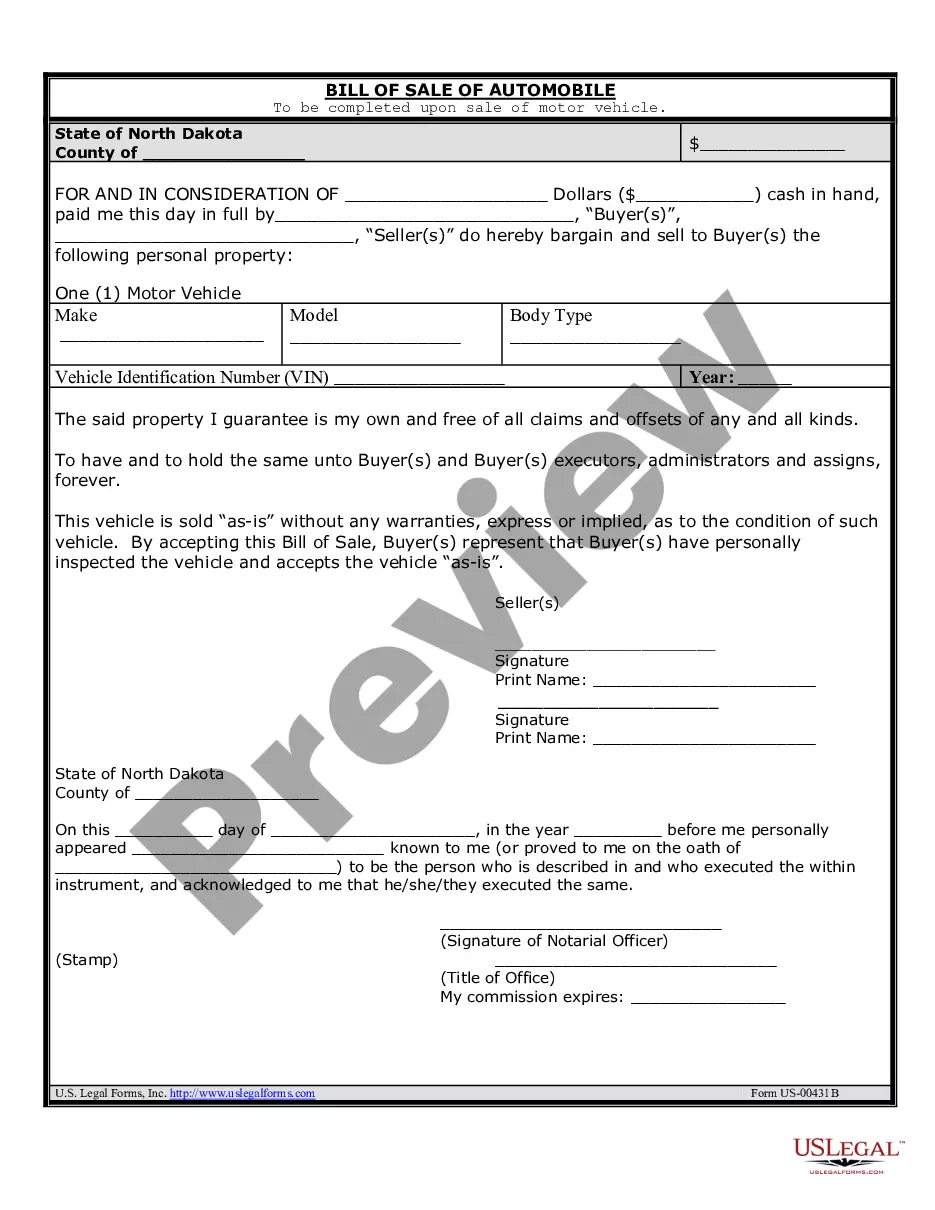

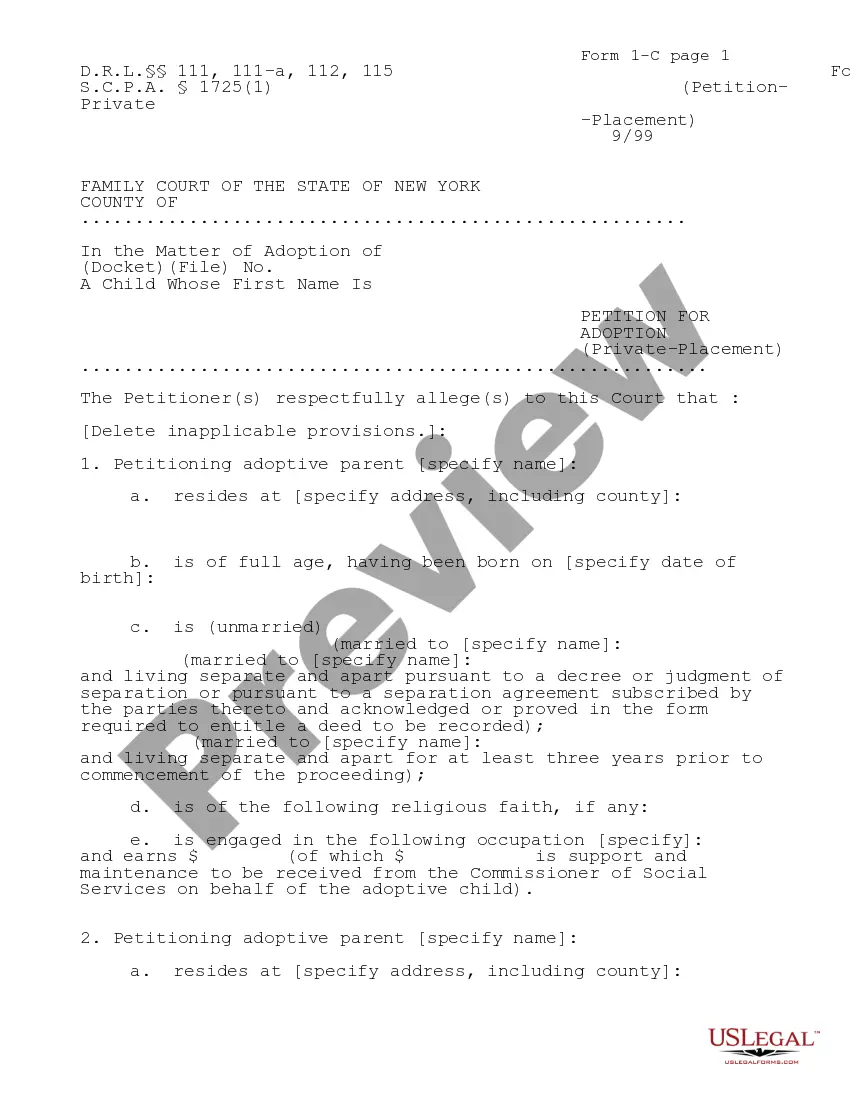

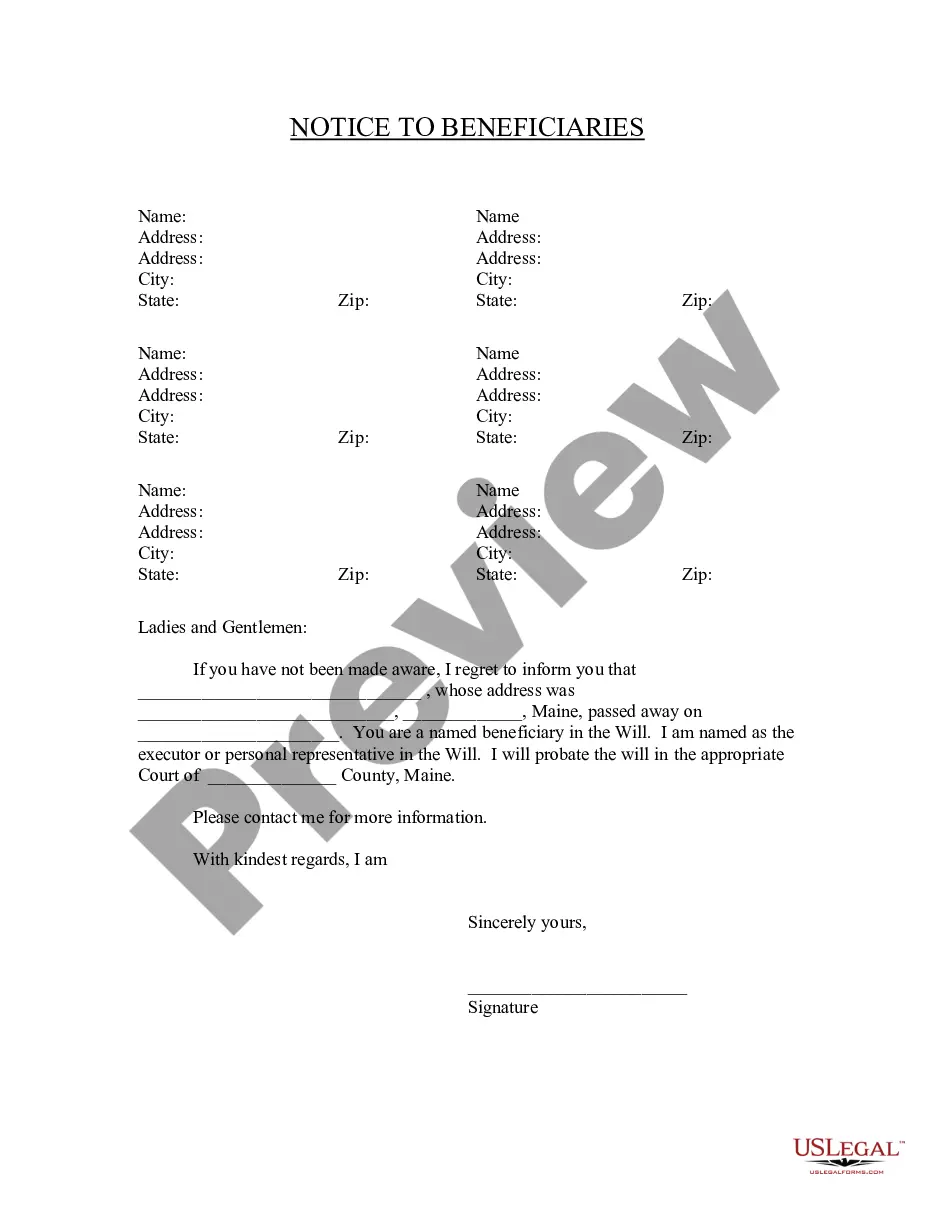

- Be sure to have picked out the proper form to your town/county. Click the Review switch to review the form`s information. See the form outline to ensure that you have chosen the right form.

- If the form does not suit your requirements, utilize the Search discipline near the top of the screen to get the the one that does.

- If you are happy with the shape, validate your decision by clicking on the Acquire now switch. Then, opt for the pricing prepare you prefer and offer your accreditations to sign up on an profile.

- Process the financial transaction. Use your Visa or Mastercard or PayPal profile to finish the financial transaction.

- Find the structure and down load the shape on the product.

- Make changes. Fill up, modify and print out and indication the downloaded District of Columbia Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement.

Every single web template you included with your bank account lacks an expiry date and it is the one you have forever. So, if you want to down load or print out another copy, just check out the My Forms segment and then click about the form you want.

Obtain access to the District of Columbia Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement with US Legal Forms, probably the most considerable collection of lawful record themes. Use a huge number of specialist and status-distinct themes that meet up with your business or person needs and requirements.