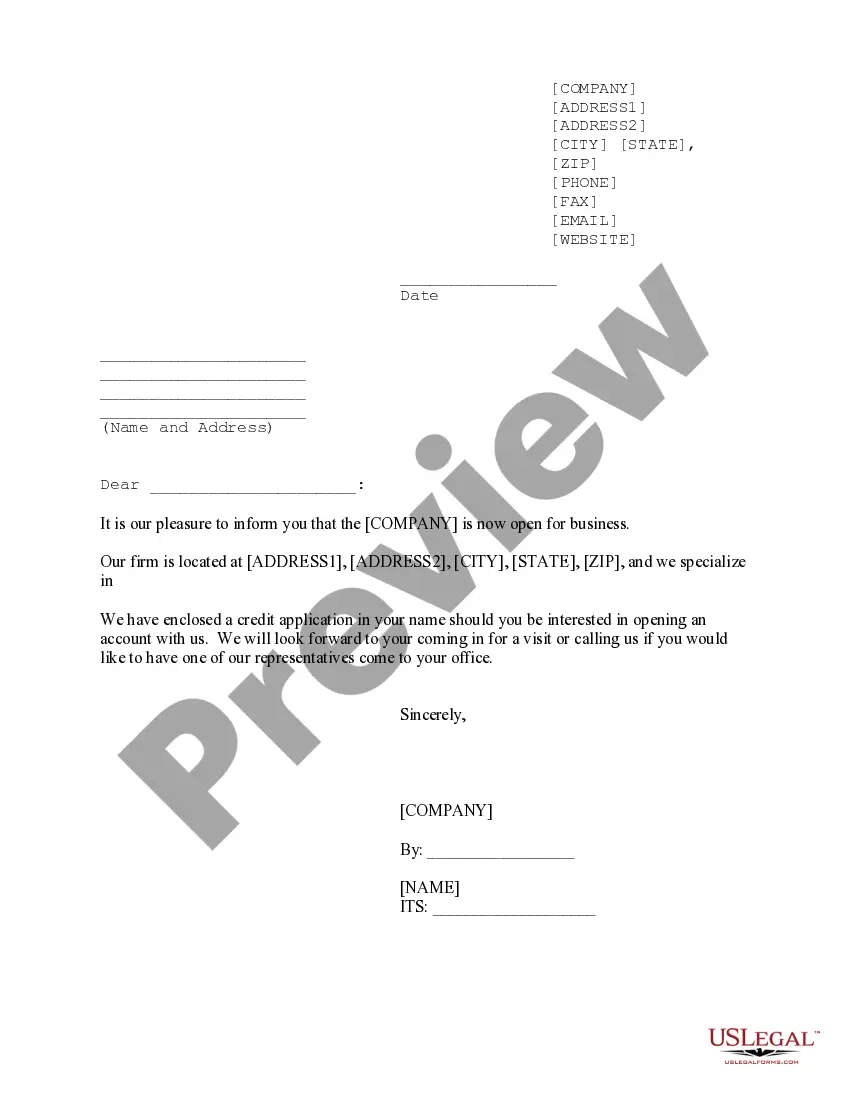

District of Columbia Sample Letter for New Business with Credit Application

Description

How to fill out Sample Letter For New Business With Credit Application?

US Legal Forms - among the largest collections of legal documents in the United States - offers a variety of legal document templates available for download or creation. By utilizing the website, you can access thousands of forms for commercial and personal use, organized by categories, states, or keywords.

You can find the most recent versions of forms such as the District of Columbia Sample Letter for New Business with Credit Application in just minutes.

If you already hold a subscription, Log In and retrieve the District of Columbia Sample Letter for New Business with Credit Application within the US Legal Forms collection. The Download button will appear on every form you view. You can access all previously saved forms from the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device.

- Ensure you have chosen the correct form for your city/region.

- Click the Preview button to review the contents of the form.

- Read the form description to confirm that you have selected the appropriate one.

- If the form does not fit your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Next, choose your payment method and provide your details to register for an account.

Form popularity

FAQ

To create a letter for credit, start with your contact information followed by that of the recipient. Clearly state the purpose of the letter in a professional tone, outlining the specifics of the credit you are requesting. Don’t forget to include details like terms, amounts, and relevant deadlines. Using a well-crafted 'District of Columbia Sample Letter for New Business with Credit Application' can streamline this process, making it easier to ensure you include all necessary information.

When writing a dispute letter for credit, begin by clearly stating the issue and including relevant details such as account numbers and dates. Be straightforward yet professional, ensuring your intentions are clear. Reference any supporting documentation you have and express your desire for resolution. A properly structured 'District of Columbia Sample Letter for New Business with Credit Application' can guide you in crafting an effective communication.

Business owners in the District of Columbia must file DC FR-500 if they plan to register a single-member LLC, corporation, or partnership. This form is crucial for tax registration purposes and sets the official tone for your new business. By completing the DC FR-500, you ensure compliance with local tax regulations, thus laying a solid foundation for your business along with the 'District of Columbia Sample Letter for New Business with Credit Application'.

Requesting a letter of credit involves addressing your request to a financial institution, detailing the transaction context, and specifying the amount needed. You should also include information about the beneficiary and any applicable terms. A well-structured request can enhance approval chances, and using a District of Columbia Sample Letter for New Business with Credit Application may simplify the process.

609 letters are often used to challenge inaccurate items on credit reports by invoking the Fair Credit Reporting Act. While responses can vary, many individuals find success removing unverifiable information. It is critical to understand the law and use precise wording in your request. A District of Columbia Sample Letter for New Business with Credit Application can guide you in creating an effective 609 letter.

Requesting a letter for credit information requires a formal approach. Clearly identify your business, specify the information desired, and explain why you need it. Including details such as account numbers or previous transactions can expedite the process. Using a District of Columbia Sample Letter for New Business with Credit Application can streamline your request.

To write a letter requesting a credit report, start by identifying yourself clearly and include relevant personal information such as your Social Security number and address. State your request for a copy of your credit report and specify why you need it. A District of Columbia Sample Letter for New Business with Credit Application can provide a comprehensive example to follow.

A letter of credit for a new business acts as a financial safety net when dealing with suppliers or banks. It assures the seller that they will receive payment even if the buyer defaults. This can facilitate smoother transactions, especially for startups that may lack substantial credit history. You can find templates, including the District of Columbia Sample Letter for New Business with Credit Application, to guide you in drafting your request.

A letter of credit serves as a payment guarantee from a bank to a seller, while a commercial letter of credit is specifically used in international transactions to facilitate trade. The commercial version often includes terms that govern payment based on the delivery of goods. Understanding these differences is essential for new businesses seeking to engage in trade, and a District of Columbia Sample Letter for New Business with Credit Application can help in such processes.

Writing a credit application letter involves several important steps. First, start with your business's name, address, and contact information at the top. Next, clearly state your request for credit, including the amount you need and the purpose of the credit. You can use a District of Columbia Sample Letter for New Business with Credit Application to ensure you include all necessary details.