District of Columbia Checklist - Leasing vs. Purchasing Equipment

Description

Every lease decision is unique so it's important to study the lease agreement carefully. When deciding to obtain equipment, you need to determine whether it is better to lease or purchase the equipment. You might use this checklist to compare the costs for each option.

How to fill out Checklist - Leasing Vs. Purchasing Equipment?

Are you in a scenario where you require documents for either business or personal purposes almost every time.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't simple.

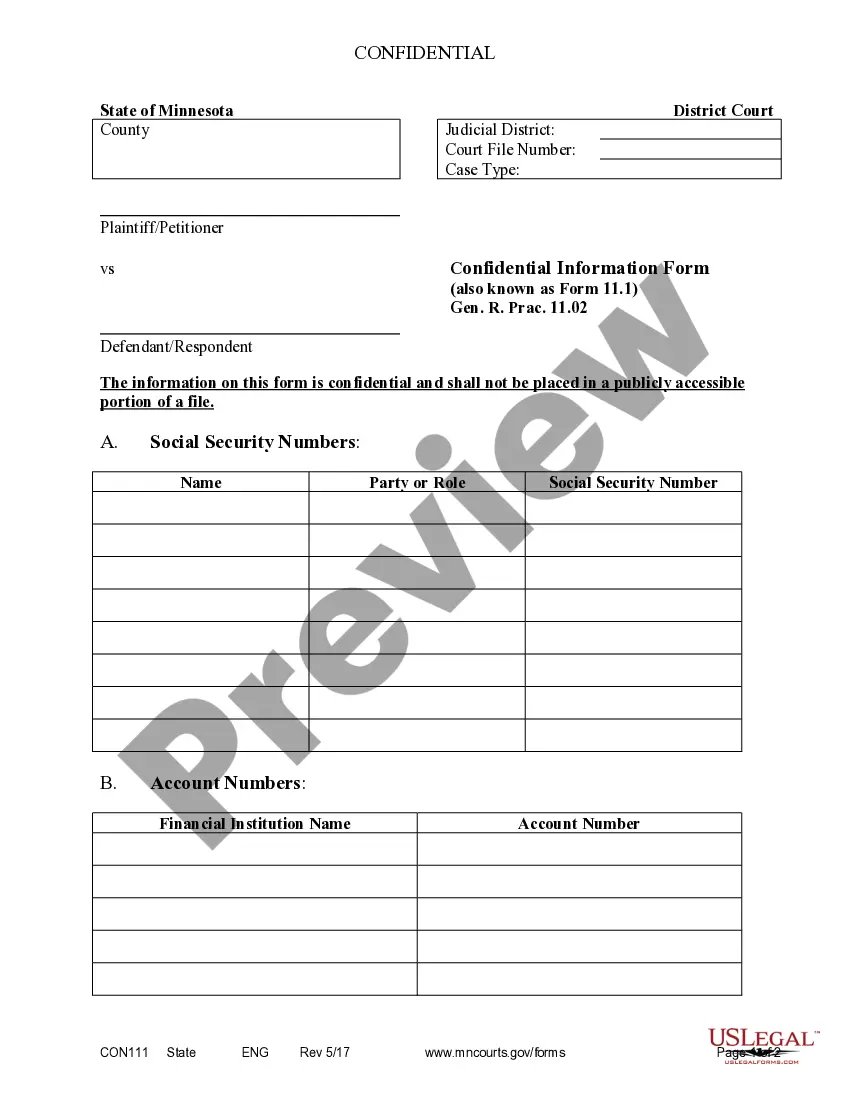

US Legal Forms offers thousands of template documents, including the District of Columbia Checklist - Leasing vs. Purchasing Equipment, which are designed to comply with state and federal regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download a fresh version of District of Columbia Checklist - Leasing vs. Purchasing Equipment anytime, if necessary. Just click the desired document to download or print the template.

Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for a wide range of purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the District of Columbia Checklist - Leasing vs. Purchasing Equipment template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct area/state.

- Use the Preview option to review the form.

- Read the description to make sure you have selected the right document.

- If the document isn’t what you're looking for, use the Search field to find the form that suits your needs and requirements.

- When you locate the correct document, click on Get now.

- Choose the pricing plan you want, fill in the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Whether to buy or lease a machine necessitates careful evaluation of your needs and financial situation. If you require consistent access to the latest technology without hefty upfront costs, leasing may be preferable. However, if you anticipate long-term use, purchasing might be more economical. Consider consulting resources like the US Legal Forms platform for additional guidance on navigating these decisions.

Deciding whether to lease or buy for tax purposes largely depends on your business situation. Leasing can provide immediate tax deductions, while purchasing may offer depreciation benefits over time. The right choice will vary based on your financial goals and how you consider the District of Columbia Checklist - Leasing vs. Purchasing Equipment.

While leasing has its benefits, there are disadvantages to consider. You may end up paying more over time compared to buying outright, especially if you lease for a long period. Additionally, lease agreements may come with restrictions on usage and modifications, making it essential to carefully review your options before proceeding.

The advantages of leasing include flexibility and access to newer technology. With leasing, you can choose equipment that meets your current needs without the long-term commitment of ownership. Moreover, leasing can help conserve your capital and keep your assets liquid, which is crucial under the District of Columbia Checklist - Leasing vs. Purchasing Equipment.

In the District of Columbia, most food purchases are exempt from sales tax, providing relief for residents. However, prepared foods and certain beverages may still incur a tax. This distinction is important when budgeting for everyday costs and equipment expenses. Our District of Columbia Checklist - Leasing vs. Purchasing Equipment helps you navigate these nuances smoothly.

Tangible personal property in the District of Columbia refers to physical items that can be seen and touched. This includes equipment, machinery, furniture, and more, which can be critical when making leasing versus purchasing decisions. Understanding what constitutes tangible property ensures you are aligned with local regulations. Our District of Columbia Checklist - Leasing vs. Purchasing Equipment offers clarity on these definitions.

The sales tax rate in the District of Columbia currently stands at 6%. However, specific goods, like alcohol and some services, may have different rates. When considering leasing versus purchasing equipment, this tax can affect your total expenses. The District of Columbia Checklist - Leasing vs. Purchasing Equipment provides key information to guide your financial planning.

Yes, the District of Columbia does impose a sales tax on various goods and services. The sales tax applies to most retail purchases, which can impact your equipment leasing and purchasing choices significantly. To ensure compliance and make informed decisions, refer to our District of Columbia Checklist - Leasing vs. Purchasing Equipment for detailed insights.

The tax rate in the District of Columbia varies based on the type of income or transaction. For individuals, the rates range from 4% to 8.95%, depending on the income level. Understanding these rates is crucial when navigating leasing and purchasing decisions. Our District of Columbia Checklist - Leasing vs. Purchasing Equipment can help clarify these obligations.

To file fp 31 in the District of Columbia, you need to complete the form with accurate financial data and submit it according to the specified guidelines. You have the option to file it electronically or via mail. The District of Columbia Checklist - Leasing vs. Purchasing Equipment provides essential information on the filing process.