District of Columbia Extended Date for Performance

Description

How to fill out Extended Date For Performance?

Are you currently in a scenario where you regularly require documents for both commercial or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms offers a vast array of form templates, such as the District of Columbia Extended Date for Performance, which are crafted to comply with state and federal regulations.

Once you find the right form, click Buy now.

Select the pricing plan you prefer, fill out the necessary details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, just Log In.

- After that, you can obtain the District of Columbia Extended Date for Performance template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Search for the form you need and ensure it is for your appropriate city/county.

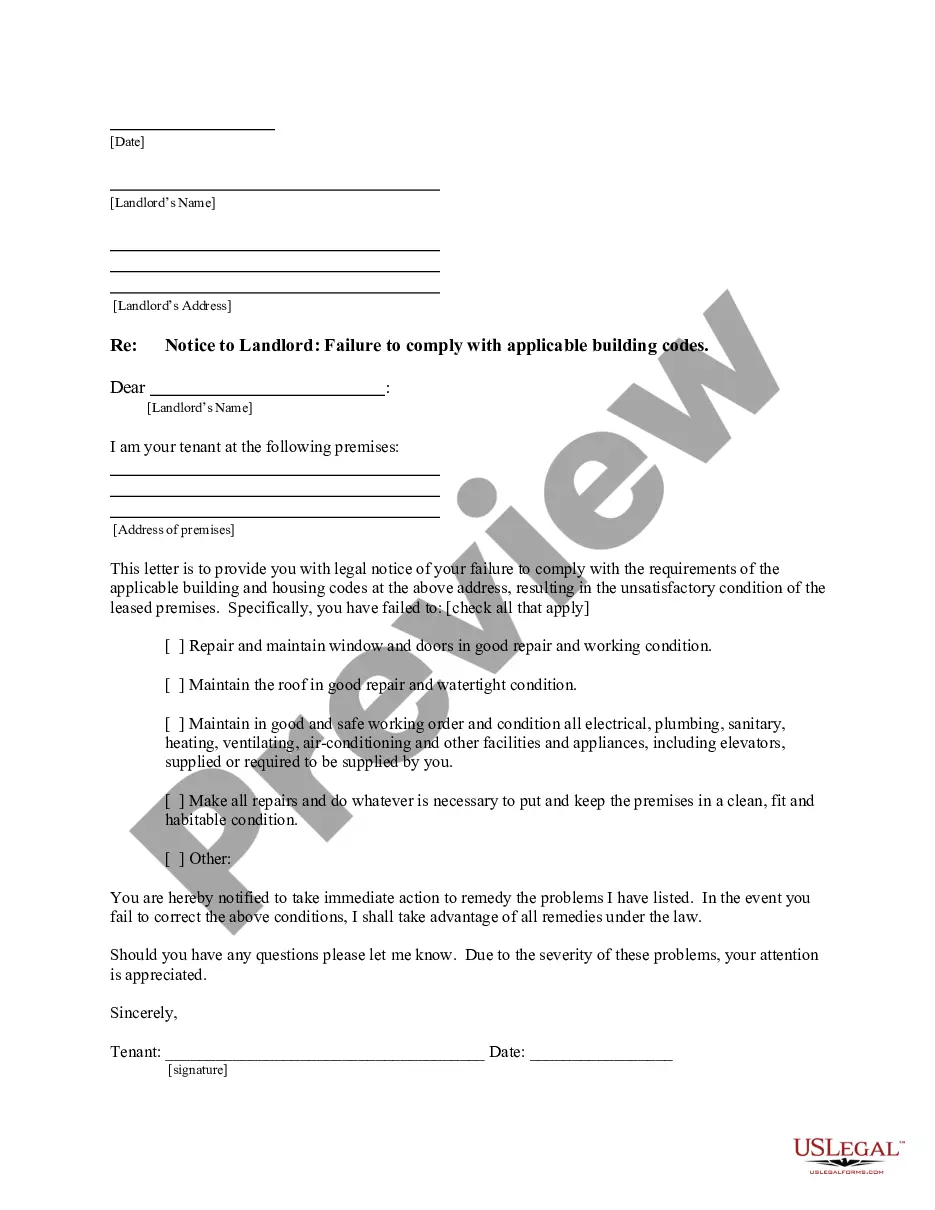

- Utilize the Preview button to view the form.

- Read the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Lookup field to find the document that suits your needs and requirements.

Form popularity

FAQ

To file for a District of Columbia Extended Date for Performance, start by gathering the necessary documentation that justifies your need for an extension. You can complete your filing online through the District’s official government website or consult a platform like uslegalforms for guidance. Ensure you fill out the required forms accurately and submit them within the deadline to avoid complications. Once submitted, keep copies of your forms for your records and to confirm your extension is processed.

Yes, a business license is typically required for any business operating within the District of Columbia. This applies to both new and existing businesses, regardless of size. By ensuring you obtain the necessary licenses, you can meet all requirements and stay compliant, especially when considering the District of Columbia Extended Date for Performance allows some flexibility in filing under certain conditions.

Generally, any resident or part-year resident earning income must file a DC tax return. This also includes non-residents who earn income sourced from the District of Columbia. It’s crucial to understand your filing obligations to comply with the District of Columbia Extended Date for Performance and avoid penalties.

The District of Columbia encompasses various areas, including the city itself and certain surrounding regions. When discussing tax responsibilities, it includes individual income tax, business taxes, and property taxes. Understanding what the District of Columbia includes is essential for taxpayers wanting to comply with the District of Columbia Extended Date for Performance and other taxing obligations.

To file an extension of time in the District of Columbia, start by completing the appropriate extension form, such as the Form D-400. You can submit this form online through the District’s tax portal or by mailing it to the relevant tax office. Make sure to meet the deadline to benefit from the District of Columbia Extended Date for Performance, which provides additional time for preparing and filing your return.

Yes, the District of Columbia usually adheres to federal extension guidelines for tax returns. If you meet the federal requirements for an extension, you will likely be granted a similar extension at the district level. This synchronization helps taxpayers manage deadlines and take full advantage of the District of Columbia Extended Date for Performance.

In the District of Columbia, taxes are generally due on April 15 each year, aligning with federal tax deadlines. However, when April 15 falls on a weekend or holiday, the due date may shift to the next business day. Being aware of these deadlines is crucial for timely compliance with tax obligations. You can stay organized by using tools like USLegalForms to track due dates and submit your returns on time.

Home rule in the District of Columbia refers to the local government's authority to govern itself and handle its own laws. This autonomy enables the city to enact legislation on various issues, including taxation and public services. However, Congress still holds ultimate authority, which can limit DC's home rule powers. Understanding home rule is key to comprehending the governance and regulatory landscape of the District.

To file a DC extension for your taxes, you need to complete and submit the appropriate form before the original due date. The process generally involves filing Form FR-127, which allows you to request an extension for performance deadlines. Ensuring timely submission of this form can provide you with additional time while preventing penalties. For additional guidance, consider using platforms like USLegalForms to simplify the filing process.

The 183 day rule in the District of Columbia is a guideline used to determine tax residency status. If you spend over 183 days in the District, you may be subject to different tax regulations than non-residents. This differentiation is important as it can significantly affect your tax liability. Knowing your residency status can help you navigate tax decisions more effectively.