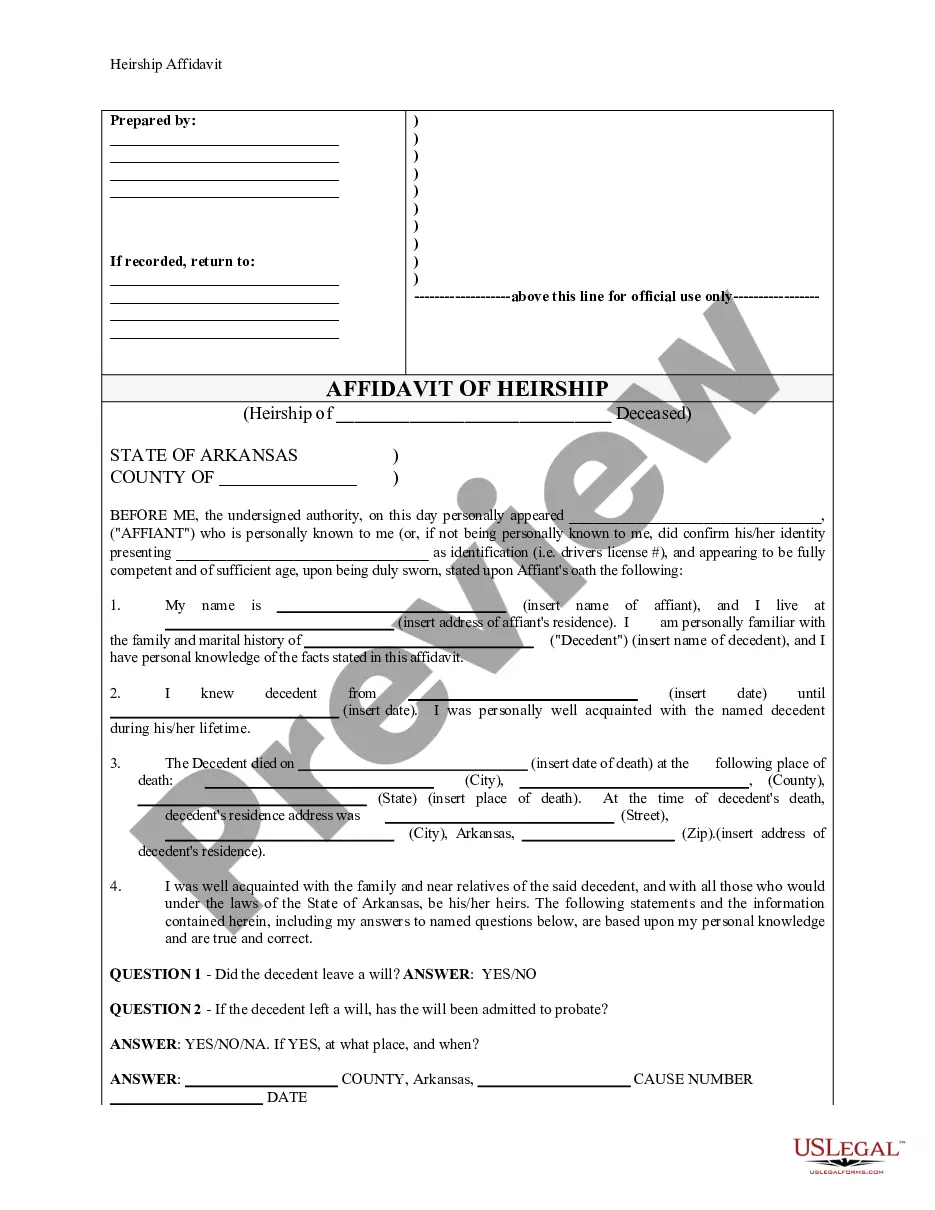

District of Columbia Clickable Software License Notice

Description

How to fill out Clickable Software License Notice?

If you need to total, obtain, or print authorized document templates, utilize US Legal Forms, the largest selection of legal forms, available online.

Utilize the website's user-friendly and accessible search to find the documents you require.

Many templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your details to sign up for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to get the District of Columbia Clickable Software License Notice in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the District of Columbia Clickable Software License Notice.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to examine the form's content. Do not forget to review the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Yes, the DC D-30 form can be filed electronically, which simplifies the process for taxpayers. This online option provides a convenient way to submit your tax information without the hassle of paperwork. Taking advantage of electronic filing can enhance your compliance related to various obligations, including the District of Columbia Clickable Software License Notice. Using platforms like uslegalforms can further facilitate this process, ensuring accuracy and timeliness.

In the District of Columbia, various goods and services are subject to sales tax, including electronics, furniture, and restaurant meals. However, certain items like groceries and healthcare supplies are exempt. Being aware of what is taxed can help both consumers and businesses effectively plan their budgets. When navigating tax obligations, consider how they relate to the District of Columbia Clickable Software License Notice for software purchases.

Filing the FR 500 DC form involves several straightforward steps. First, you will need to collect your business income and expenses to complete the form accurately. You can file this form online through the District of Columbia's Office of Tax and Revenue website, making it easier to stay compliant. Utilizing platforms like uslegalforms can further streamline the filing process, providing you with resources tailored to the District of Columbia Clickable Software License Notice.

Yes, the District of Columbia imposes a sales tax on most tangible goods and some services. The standard rate is set at 6%, but certain items may be taxed at different rates or qualify for exemptions. Businesses need to be aware of these tax rules, especially when dealing with the District of Columbia Clickable Software License Notice, to ensure compliance and customer satisfaction.

The DC 30 filing requirement refers to specific tax obligations for businesses operating in the District of Columbia. Entities must file the DC 30 tax return along with accompanying documents to report their business income, deductions, and credits. This is crucial for compliance with the tax laws and can impact your obligation related to the District of Columbia Clickable Software License Notice. Staying on top of these requirements can help avoid penalties.

In the District of Columbia, certain items are exempt from sales tax. These include grocery food items, prescription drugs, and many medical devices. Additionally, some services, such as child care and educational services, are not taxable. Understanding these exemptions can help residents make informed financial decisions and avoid unnecessary costs.

D.C. Code 47-2001 D 1 pertains to the taxation of personal property in the District. This code establishes guidelines for the assessment and taxation of various types of properties. Understanding these legal codes is essential for property owners and businesses. For assistance, consider using resources like the District of Columbia Clickable Software License Notice, which provides valuable legal insights.

Driving Under the Influence (DUI) offenses in the District of Columbia are covered under D.C. Code § 50-2206. This code outlines the penalties for individuals operating a vehicle while intoxicated. Being aware of the implications of DUI laws is crucial for maintaining public safety. Resources that include the District of Columbia Clickable Software License Notice can help your understanding of these laws.

In the District of Columbia, tax on food varies depending on the type of food purchased. Generally, most food sold for home consumption is exempt from sales tax, but prepared food carries a different rate. Understanding these classifications is essential for residents and business owners. Platforms like uslegalforms can assist in grasping these details, especially in the context of the District of Columbia Clickable Software License Notice.

The Bail Reform Act is outlined in D.C. Code § 23-1321 through 1326. This act aims to ensure fair treatment in pre-trial situations, allowing individuals the right to a reasonable bail. It's crucial for anyone involved in criminal justice in DC to be aware of these provisions. Knowledge of legal matters, such as those established in the District of Columbia Clickable Software License Notice, can help in navigating the system.