This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

District of Columbia Agreement to Extend Debt Payment Terms

Description

How to fill out Agreement To Extend Debt Payment Terms?

Are you presently in a situation where you frequently require paperwork for either business or personal purposes.

There are numerous legal document templates accessible online, however, finding forms you can trust is challenging.

US Legal Forms offers a vast array of form templates, including the District of Columbia Agreement to Extend Debt Payment Terms, which are designed to comply with state and federal regulations.

Select the pricing plan you prefer, input the necessary information to create your account, and pay for your order using your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the District of Columbia Agreement to Extend Debt Payment Terms template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

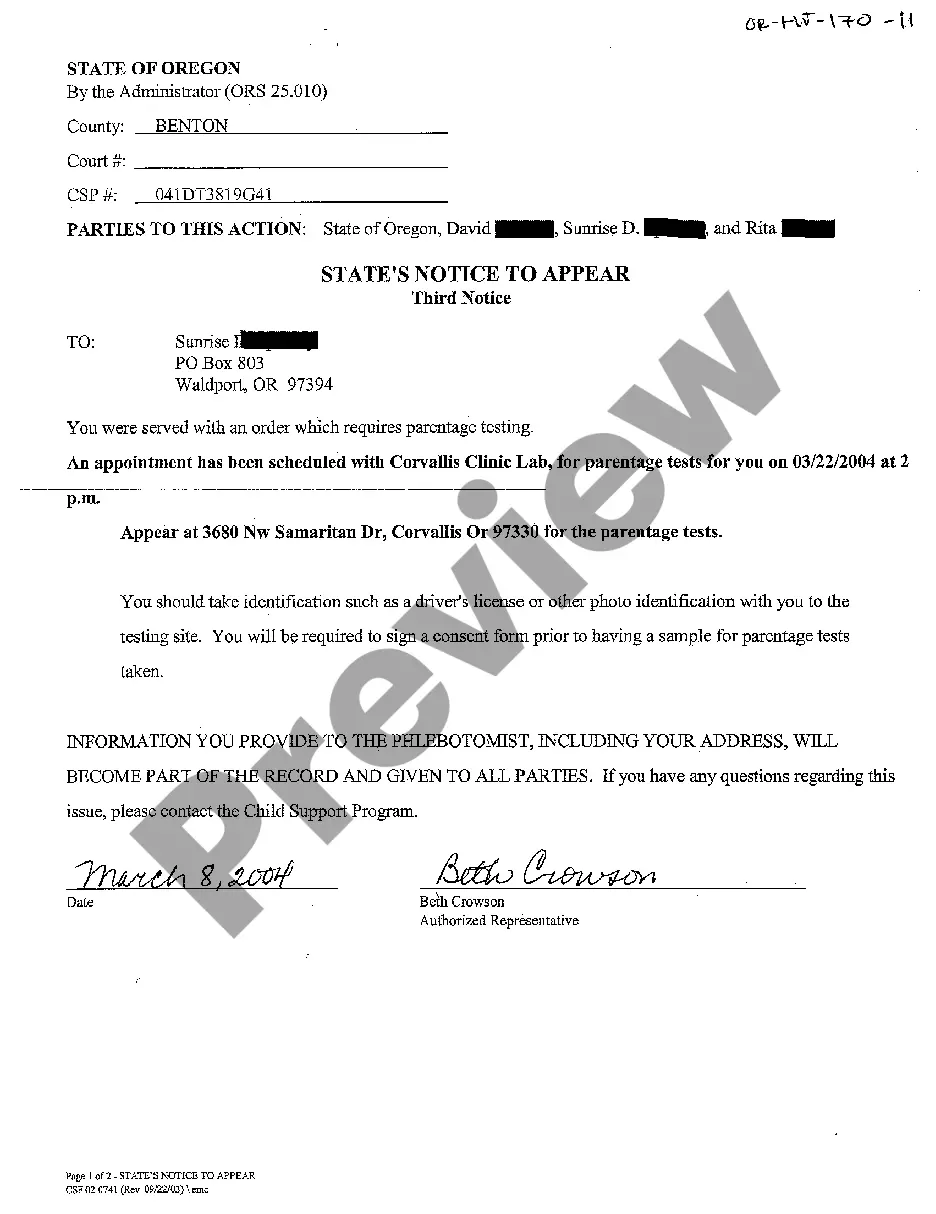

- Use the Review button to examine the form.

- Read the description to affirm that you have chosen the correct form.

- If the form is not what you require, utilize the Search field to find the form that fits your needs and requirements.

- Once you find the appropriate form, click Buy now.

Form popularity

FAQ

The automatic renewal law in the District of Columbia stipulates that businesses must provide clear notice to consumers about the renewal of any agreement. This notice should detail the terms and conditions of the renewal period. By adhering to these laws, businesses not only protect themselves legally but also build trust with their customers. Utilizing the District of Columbia Agreement to Extend Debt Payment Terms can significantly assist in drafting compliant contracts.

In the District of Columbia, auto renewal laws require written consent and clear communication before a contract automatically renews. The law mandates that businesses must inform customers about the renewal terms. Compliance ensures that customers can make informed decisions about their contracts. For those looking to navigate these regulations, the District of Columbia Agreement to Extend Debt Payment Terms provides a solid foundation.

Auto-renewal contracts must adhere to specific guidelines to remain compliant. In the District of Columbia, the parties must receive written notice about the renewal before it occurs. Additionally, terms should be transparent, allowing individuals to understand their commitment fully. A well-drafted District of Columbia Agreement to Extend Debt Payment Terms can help address these requirements effectively.

Yes, automatic renewal clauses can be enforceable under certain conditions. In the context of the District of Columbia Agreement to Extend Debt Payment Terms, it is essential that these clauses are clearly outlined in the contract. The parties involved must agree to the terms, and the language should be explicit to avoid misunderstandings. Clarity helps ensure that both parties know their obligations moving forward.

The 183-day rule in DC states that if you are outside of DC for more than 183 days, you may not be subject to certain local taxes and regulations. This rule can impact how your debts and financial obligations are managed while you are away. Using a District of Columbia Agreement to Extend Debt Payment Terms can be beneficial if you anticipate being outside of DC for an extended period, as it helps clarify your payment responsibilities.

A debt typically becomes uncollectible after the statute of limitations expires, which is three years in Washington DC for most debts. After this period, a creditor cannot sue you to collect the debt, and it is often removed from credit reports. Understanding this timeframe is crucial, especially when considering a District of Columbia Agreement to Extend Debt Payment Terms.

To file a DC extension for debt payment terms, first ensure you understand the exact terms you wish to extend. You can start by gathering all relevant documents related to the debt. Using a District of Columbia Agreement to Extend Debt Payment Terms can simplify this process, allowing you to officially request an extension with proper documentation and terms.

In Washington DC, the statute of limitations for debt collection is generally three years for most debts. This means that creditors have three years to file a lawsuit to collect a debt. After this period, a creditor cannot legally pursue you for the debt. It's essential to understand the implications of the District of Columbia Agreement to Extend Debt Payment Terms, as it may impact your ability to negotiate payments.

The 777 rule is a guideline for debt collectors that outlines communication and collection practices. In the context of a District of Columbia Agreement to Extend Debt Payment Terms, this rule ensures that debt collectors provide clear and accurate information regarding the terms of debt repayment. By adhering to the 777 rule, collectors can foster transparency and maintain compliance with applicable laws. It is crucial for individuals to understand their rights under this rule when negotiating their debt agreements.

DC law 24 154 pertains to the handling of financial obligations and the rights of debtors within the District. This law aims to regulate the practices of creditors to ensure fairness and transparency in debt collection processes. It may be helpful for individuals dealing with debt concerns, particularly when negotiating a District of Columbia Agreement to Extend Debt Payment Terms. Understanding this law can empower you to make informed decisions regarding your financial obligations.