This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

District of Columbia Agreement to Extend Debt Payment

Description

How to fill out Agreement To Extend Debt Payment?

Are you in a situation where you require documents for various business or personal purposes almost every day.

There are numerous legal document templates available online, but locating trustworthy versions can be challenging.

US Legal Forms offers a wide array of form templates, including the District of Columbia Agreement to Extend Debt Payment, which is designed to comply with federal and state regulations.

Once you find the correct form, click Buy now.

Select the pricing plan you prefer, complete the necessary information to create your account, and process your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the District of Columbia Agreement to Extend Debt Payment template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Locate the form you need and make sure it corresponds to the correct city/state.

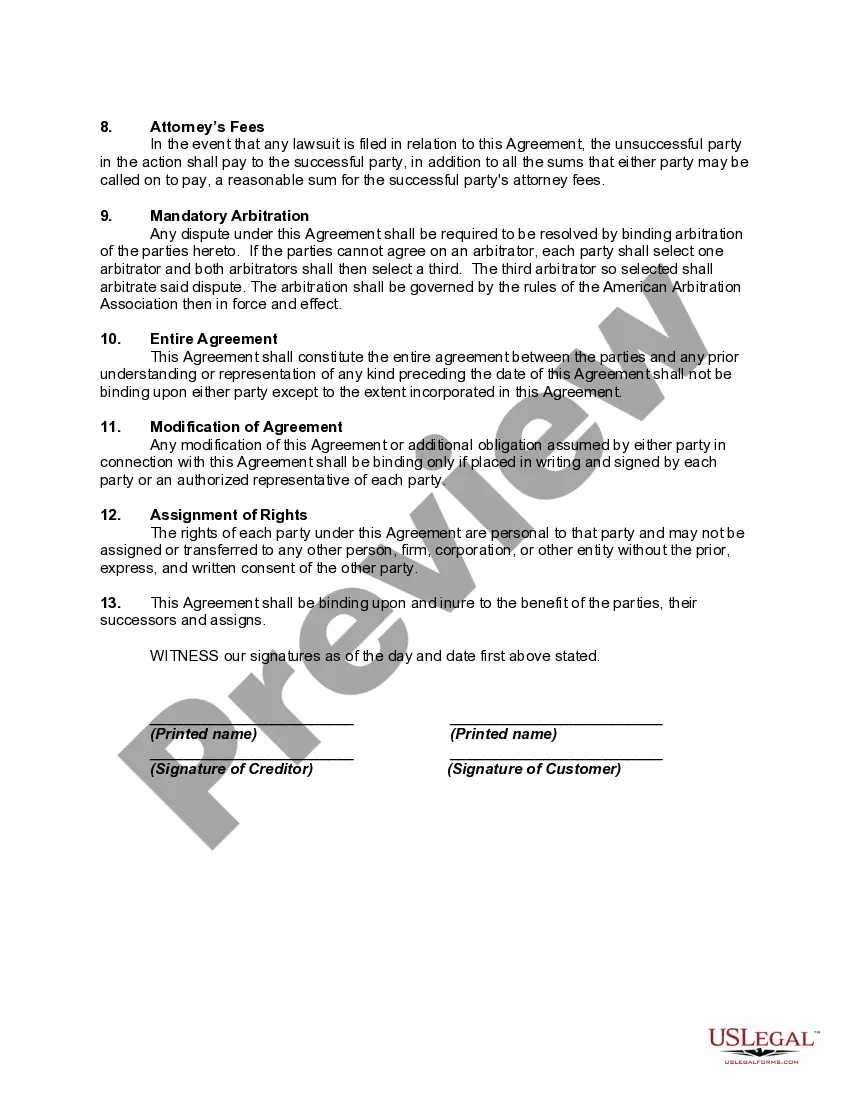

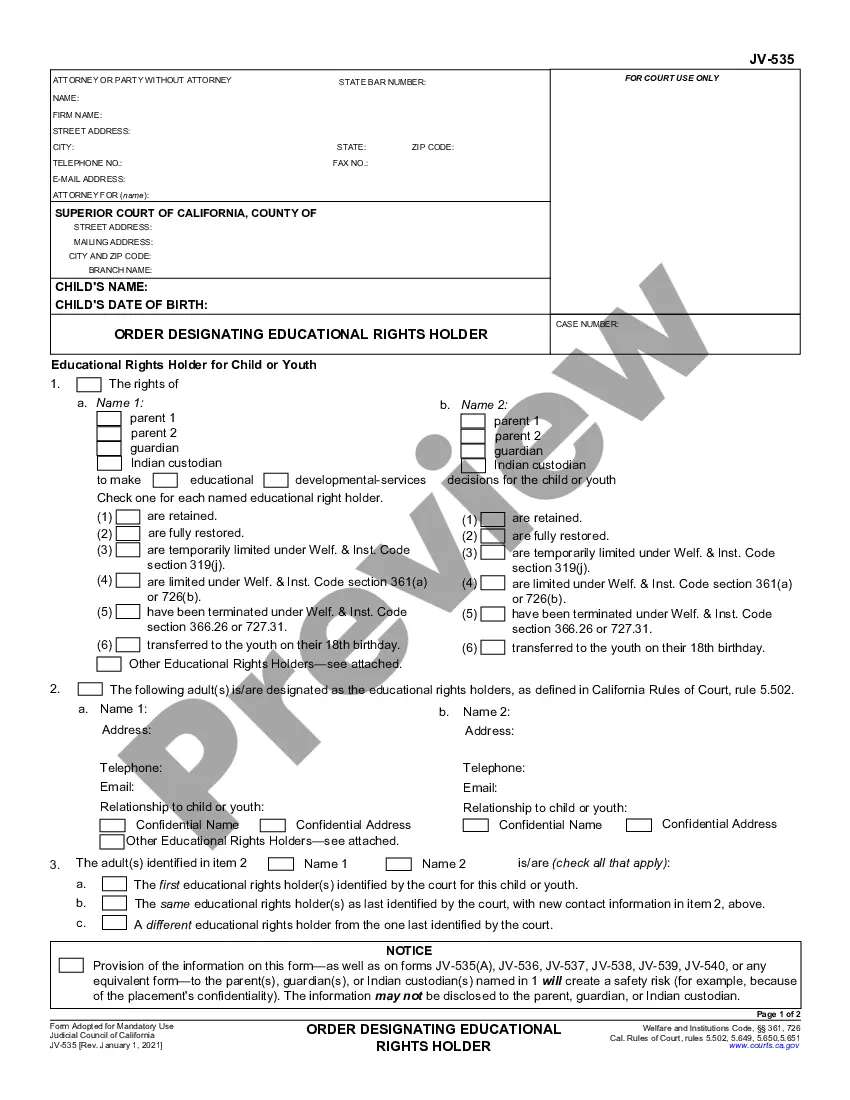

- Use the Preview button to examine the document.

- Review the details to ensure you have selected the appropriate form.

- If the form is not what you are looking for, utilize the Lookup area to find the form that meets your needs and requirements.

Form popularity

FAQ

Debts generally become uncollectible after the statute of limitations expires, which is three years in Washington DC. However, some types of debts may have different timelines. Knowing the age of your debt is crucial when looking at options, such as the District of Columbia Agreement to Extend Debt Payment, to manage your financial obligations. By acting within these time frames, you protect yourself from extended financial strain.

The 777 rule refers to a guideline used by debt collectors to determine whether debts should be reported and collected. Specifically, it suggests that if a debt has been unpaid for seven years, it may be too old to report to credit bureaus. Understanding this rule can benefit you when considering a District of Columbia Agreement to Extend Debt Payment. This knowledge helps you make informed decisions about your financial future.

In Washington DC, the statute of limitations for most debts is generally three years. This means creditors have three years to file a lawsuit for unpaid debts. After this period, debts may be uncollectible under the District of Columbia Agreement to Extend Debt Payment. Understanding this limitation can empower you to manage your debts more effectively and avoid unnecessary legal trouble.

A DC payment refers to a legal payment arrangement within the District of Columbia that allows debtors to extend their payment timelines. The District of Columbia Agreement to Extend Debt Payment offers a structured way to manage outstanding debts. This agreement can help you avoid more severe collection actions by providing relief from immediate payment pressure. Utilizing this option may foster better financial stability during challenging times.

Filing an amended tax return in the District of Columbia requires you to complete the appropriate forms to report changes. Begin by using Form D-40, and make sure to note the corrections on the form clearly. This ensures compliance and allows you to adjust your obligations under the District of Columbia Agreement to Extend Debt Payment if necessary. If you need assistance, platforms like US Legal Forms can provide the resources you need.

The 183 day rule in the District of Columbia is essential for determining residency and tax obligations. If you spend more than 183 days in DC during the year, you could be considered a resident for tax purposes. Consequently, this classification may affect your eligibility for the District of Columbia Agreement to Extend Debt Payment. Understanding this rule helps in planning and managing your tax responsibilities effectively.

Yes, the District of Columbia allows corporations to utilize a federal extension to extend their debt payment deadlines. When you file your federal extension, ensure that you also complete the necessary forms for the District of Columbia Agreement to Extend Debt Payment. This step guarantees that your corporation remains compliant. For detailed guidance, consider using legal platforms like US Legal Forms, which facilitate this process.

To file a DC extension, complete Form D-400 and submit it by the tax deadline. This form can be filed online or printed for mailing. By utilizing the District of Columbia Agreement to Extend Debt Payment, you can secure the additional time needed for managing your finances effectively and ensure you do not incur penalties.

Form DC 40B should be filed with the Office of Tax and Revenue in the District of Columbia. You can submit the form online, by mail, or in person, depending on your preference. Incorporating the guidance from the District of Columbia Agreement to Extend Debt Payment can help ensure that your filing is correct, timely, and compliant with local regulations.

The District of Columbia generally does not grant automatic extensions for tax filings. You must actively file for an extension by submitting Form D-400. However, you can utilize the provisions stated in the District of Columbia Agreement to Extend Debt Payment for more flexibility, helping you handle your financial obligations responsibly.