District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Acceptance Of Claim By Collection Agency And Report Of Experience With Debtor?

Have you ever found yourself in a situation where you require documents for either business or personal purposes nearly every day.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of document templates, including the District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor, which are designed to comply with state and federal regulations.

Once you locate the appropriate document, click on Purchase now.

Select the payment plan you prefer, complete the necessary information to create your account, and process the order using your PayPal or credit card. Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor at any time, if needed. Just click on the required document to download or print the format. Use US Legal Forms, one of the most extensive collections of legal documents, to save time and minimize errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Find the document you need and ensure it is for your specific city/state.

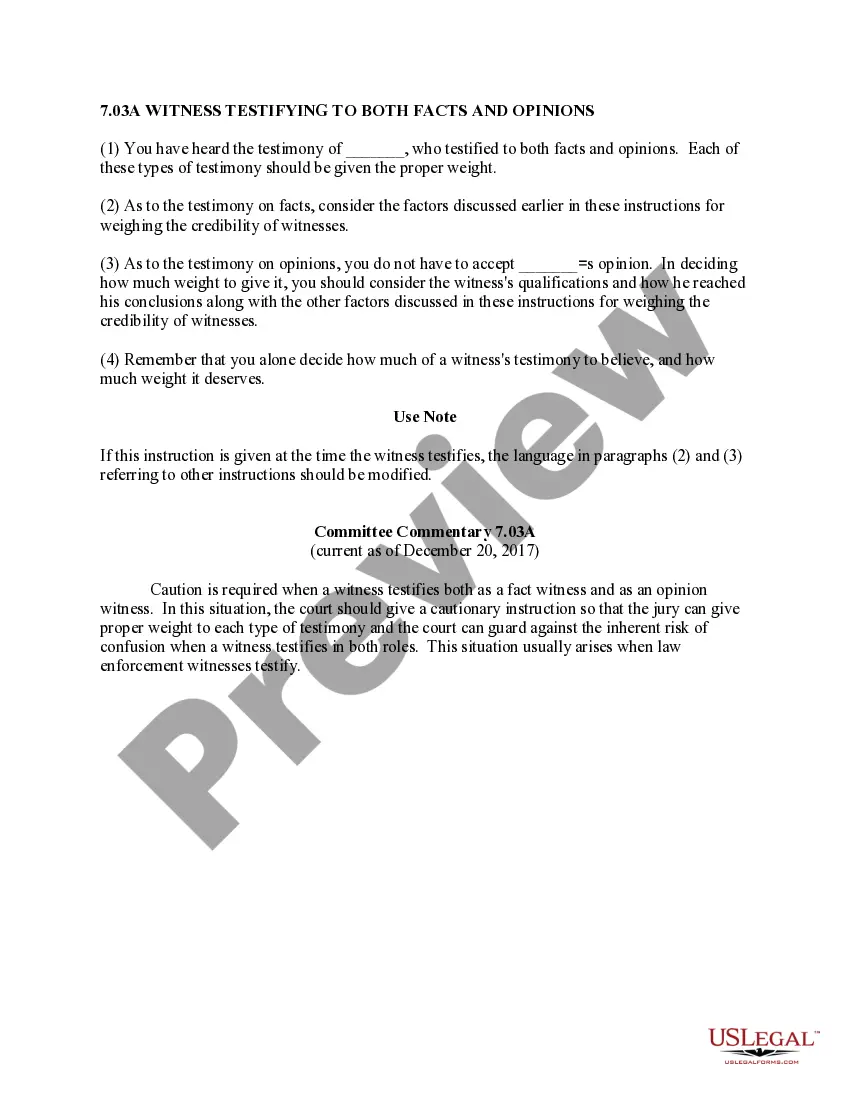

- Utilize the Preview button to examine the form.

- Check the description to confirm that you have selected the correct document.

- If the document isn't what you are looking for, use the Research field to find the template that suits your needs.

Form popularity

FAQ

Yes, collection agencies are required to provide proof of debt upon request. When a debtor asks for validation, the agency must supply documentation that confirms the debt’s legitimacy. This requirement protects consumers, ensuring they are not held responsible for debts they do not owe. Utilizing tools like the District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor can help you understand your rights and what to expect from collection agencies.

DC Code 28-3814 outlines the regulations for the conduct of collection agencies in the District of Columbia. This law provides guidelines on how agencies must handle debts, including consumer rights during collection processes. It aims to protect individuals from unfair collection practices, ensuring transparency from collection agencies. Familiarizing yourself with the District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor will give you clarity about your rights under this code.

In the District of Columbia, the statute of limitations for debt collection is typically three years. This means that creditors have three years to file a lawsuit to collect an unpaid debt. After this period, it becomes more challenging for collection agencies to collect, and the debtor can use the statute of limitations as a defense. Understanding the implications of the District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor can help you navigate your rights.

Creditors are obligated to provide proof of debt when requested. This documentation should show the total amount owed and details of the transaction. Understanding this requirement helps you navigate your rights effectively, especially in situations involving the District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor. When in doubt, use tools available through uslegalforms to get templates and guides for drafting your requests.

Yes, a debt collector must validate the debt if you request verification. This requirement falls under the Fair Debt Collection Practices Act, which protects consumers in the District of Columbia. They must provide evidence that the debt is valid and that they have the right to collect it. It's important to know your rights and ensure the agency complies with the District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

To write a letter to a collection agency requesting proof of debt, begin by addressing the agency with your name and contact information. Clearly state your request for documentation of the debt, including account numbers and relevant details. Mention your rights under the Fair Debt Collection Practices Act, specifically regarding the District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor. The more specific you are, the better.

The 777 rule outlines specific regulations that protect consumers dealing with debt collectors. It requires debt collectors to disclose important information about the debt, including its origin and any legal actions related to it. Utilizing this rule can empower you when navigating the complexities of the District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor, helping you make informed decisions regarding your financial obligations.

To ask a debt collector to validate a debt, send a written request within 30 days of their initial contact. Clearly state that you are requesting validation of the debt and include any details necessary for them to identify the account. This step is beneficial for consumers, especially in understanding the District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor accurately and effectively.

Yes, a debt collection agency must provide valid proof that you owe the debt upon your request. According to the Fair Debt Collection Practices Act, they are required to send you documentation that verifies the debt within a specific timeframe. This protection is vital in the District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor process, as it ensures you aren't held accountable for debts you don't owe.

To get a collection agency to verify your debt, you can start by sending a validation letter, requesting details about the debt, including the amount, the name of the creditor, and any supporting documents. The Fair Debt Collection Practices Act gives you the right to ask for this information. Remember to include your information and a clear request in your letter. This process is crucial when navigating the District of Columbia Acceptance of Claim by Collection Agency and Report of Experience with Debtor.