District of Columbia Credit Card Application for Unsecured Open End Credit

Description

How to fill out Credit Card Application For Unsecured Open End Credit?

It is possible to devote hours on the web attempting to find the legitimate file template that suits the state and federal requirements you want. US Legal Forms offers a huge number of legitimate kinds that happen to be evaluated by pros. You can actually down load or printing the District of Columbia Credit Card Application for Unsecured Open End Credit from the support.

If you have a US Legal Forms profile, you are able to log in and click the Down load button. Following that, you are able to full, modify, printing, or sign the District of Columbia Credit Card Application for Unsecured Open End Credit. Every legitimate file template you purchase is your own permanently. To obtain yet another duplicate for any obtained develop, visit the My Forms tab and click the corresponding button.

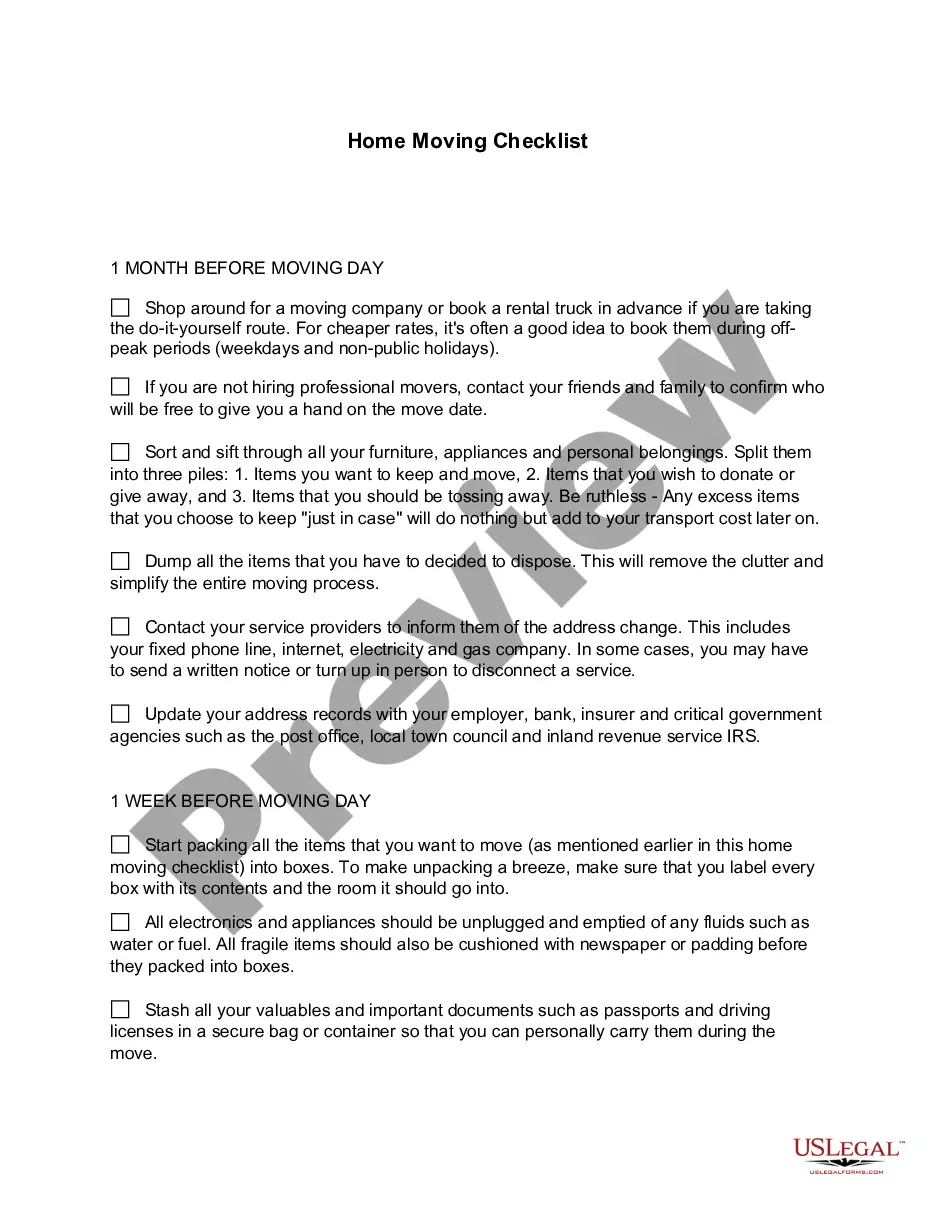

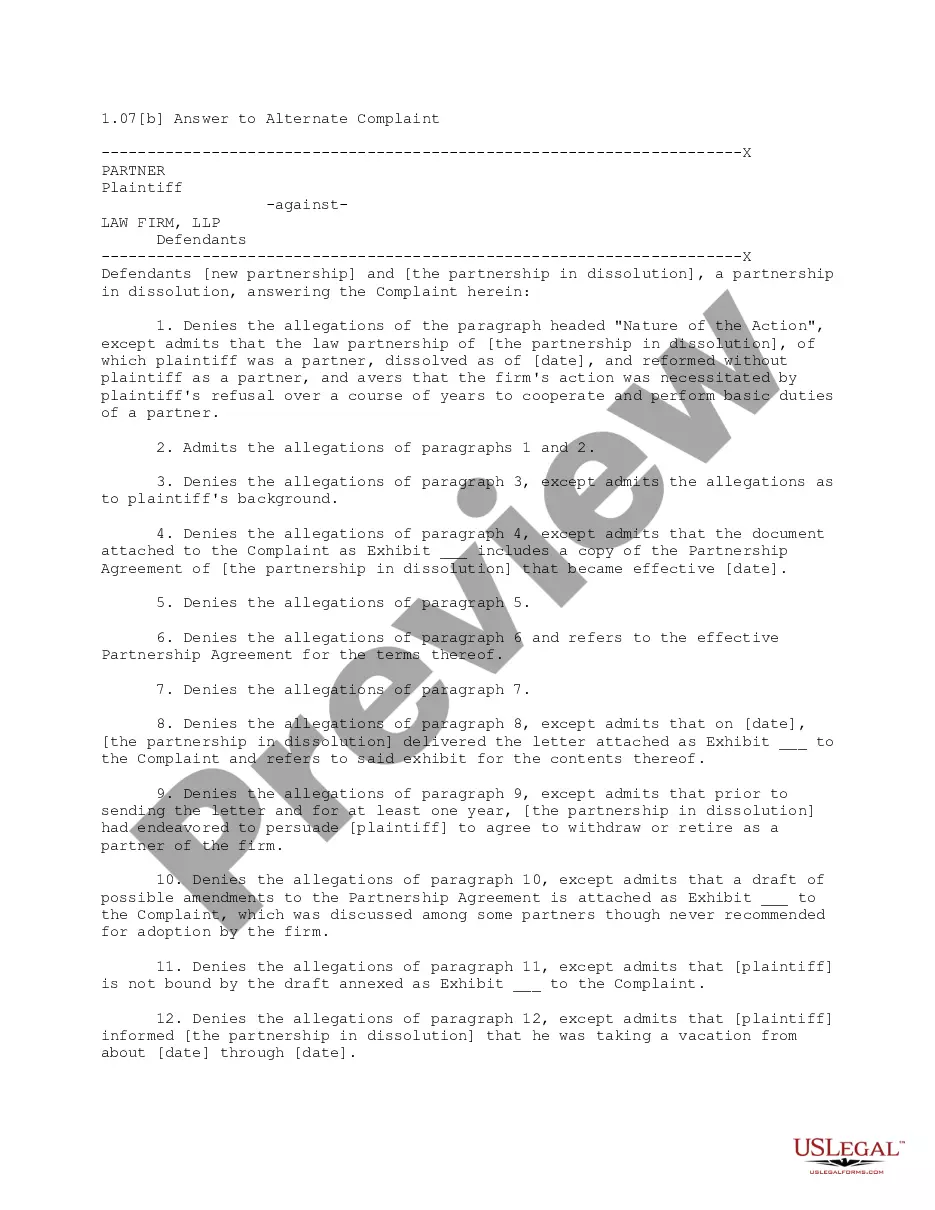

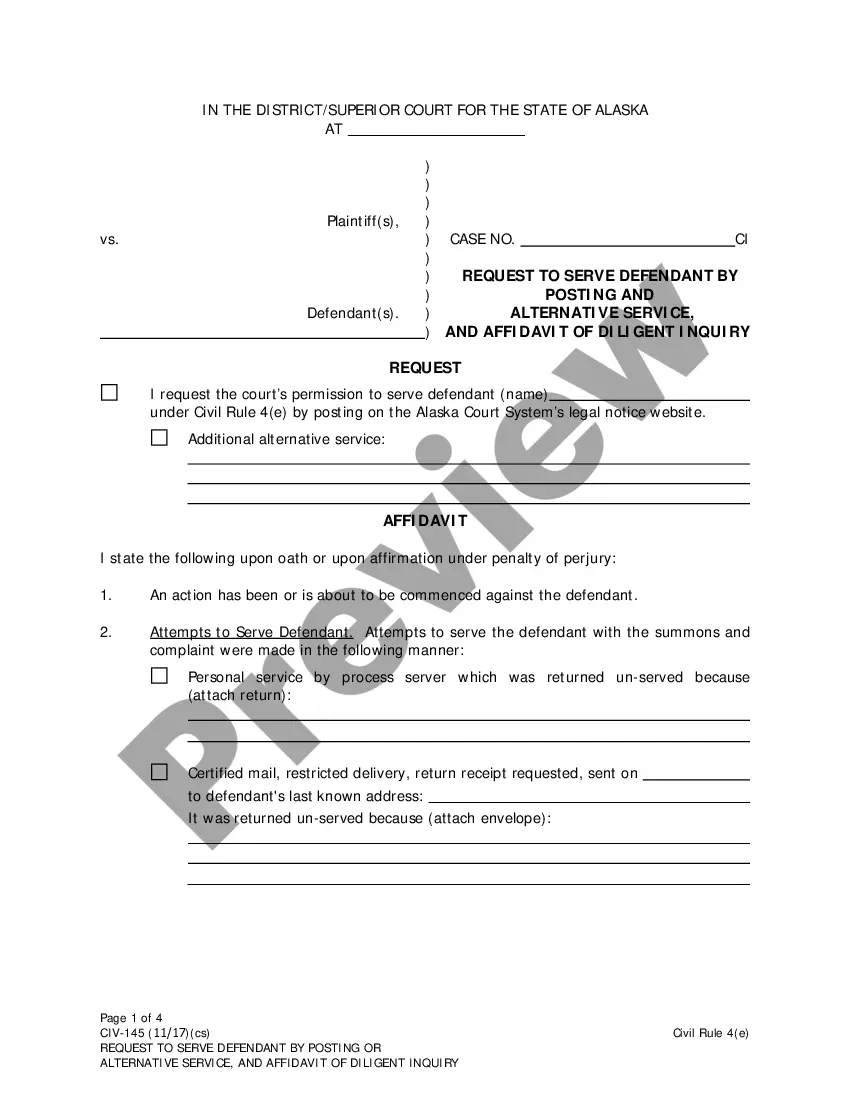

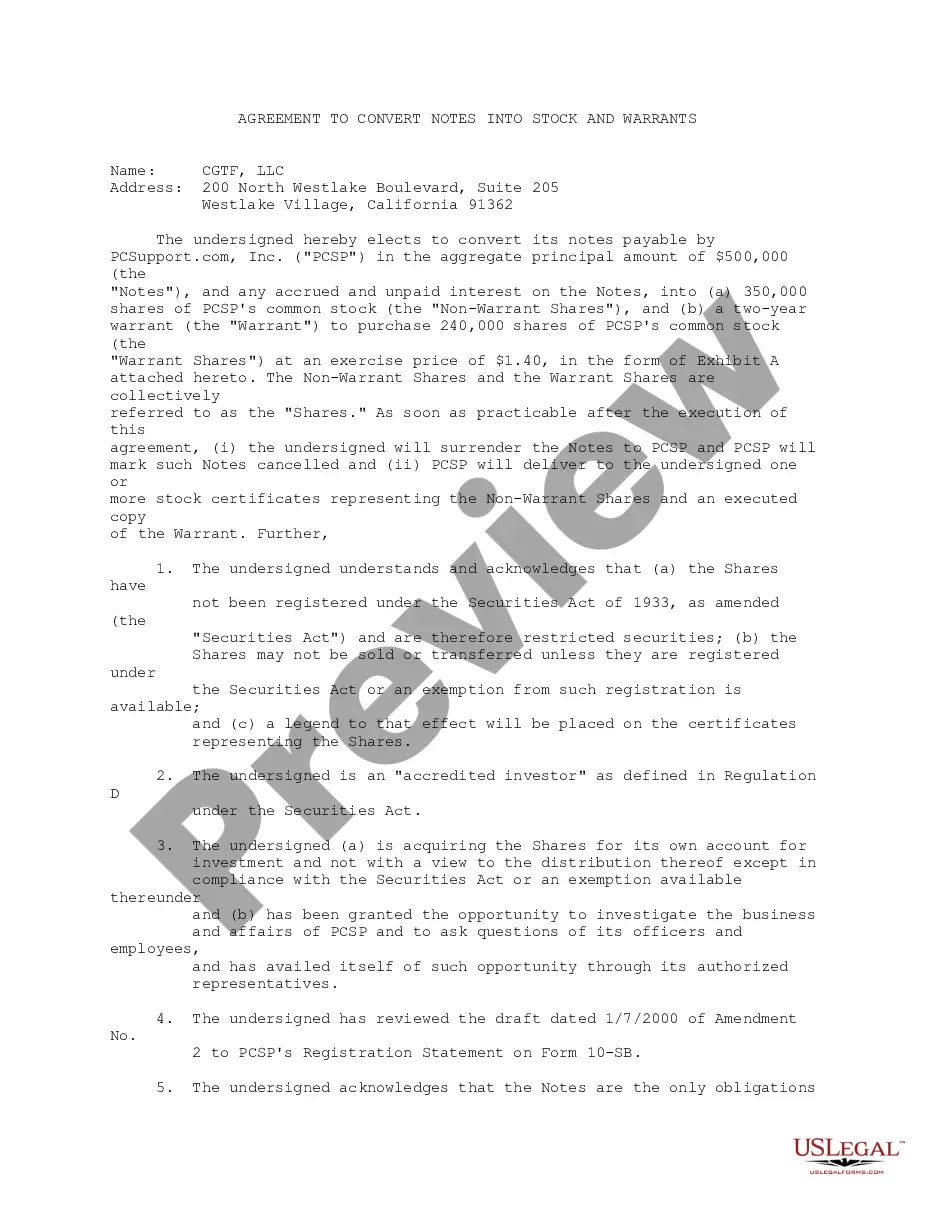

If you use the US Legal Forms website the very first time, adhere to the simple recommendations below:

- Initial, make sure that you have selected the best file template to the region/metropolis of your choosing. Browse the develop explanation to make sure you have picked the correct develop. If readily available, use the Review button to appear from the file template at the same time.

- If you want to get yet another version of the develop, use the Lookup field to get the template that meets your needs and requirements.

- When you have discovered the template you desire, click on Buy now to carry on.

- Select the costs plan you desire, type your credentials, and register for your account on US Legal Forms.

- Total the transaction. You can use your credit card or PayPal profile to fund the legitimate develop.

- Select the structure of the file and down load it to the system.

- Make adjustments to the file if required. It is possible to full, modify and sign and printing District of Columbia Credit Card Application for Unsecured Open End Credit.

Down load and printing a huge number of file templates while using US Legal Forms Internet site, which offers the most important assortment of legitimate kinds. Use professional and express-certain templates to handle your organization or person demands.

Form popularity

FAQ

TILA generally applies to creditors who regularly extend consumer credit that is primarily used for personal, family, or household purposes. The lender must extend the credit to a natural person, and the loan must be repayable with either a finance charge or by written agreement in more than four installments.

In general, this regulation applies to each individual or business that offers or extends credit when the credit is offered or extended to consumers; the credit is subject to a finance charge or is payable by a written agreement in more than four installments; the credit is primarily for personal, family or household ...

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

Open-end credit is a loan from a bank or other financial institution that the borrower can draw on repeatedly, up to a certain pre-approved amount, and that has no fixed end date for full repayment. Open-end credit is also referred to as revolving credit. Credit cards are one common example.

What loans does the Truth In Lending Act apply to? TILA's provisions cover open and closed-end credit. Open-end credit includes home equity lines of credit (HELOCs), credit cards, reverse mortgages and bank-issued cards. Closed-end credit includes home equity loans, mortgage loans and car loans.

The TILA-RESPA rule applies to most closed-end consumer credit transactions secured by real property, but does not apply to: HELOCs; ? Reverse mortgages; or ? Chattel-dwelling loans, such as loans secured by a mobile home or by a dwelling that is not attached to real property (i.e., land).

What Is Not Covered Under TILA? THE TILA DOES NOT COVER: I Student loans I Loans over $25,000 made for purposes other than housing I Business loans (The TILA only protects consumer loans and credit.) Purchasing a home, vehicle or other assets with credit and loans can greatly impact your financial security.

§ 226.3 Exempt transactions. (a) Business, commercial, agricultural, or organizational credit. (1) An extension of credit primarily for a business, commercial or agricultural purpose. (2) An extension of credit to other than a natural person, including credit to government agencies or instrumentalities.