District of Columbia Contract for Part-Time Assistance from Independent Contractor

Description

How to fill out Contract For Part-Time Assistance From Independent Contractor?

Are you currently in a location where you frequently need documents for either business or personal purposes.

There are numerous authentic document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of form templates, including the District of Columbia Contract for Part-Time Assistance from Independent Contractor, designed to comply with federal and state regulations.

Once you find the correct form, click Get now.

Choose the pricing plan you prefer, complete the required information to set up your account, and pay for the transaction using your PayPal, Visa, or Mastercard.

- If you are already familiar with the US Legal Forms website and have your account, just Log In.

- Then, you can download the District of Columbia Contract for Part-Time Assistance from Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/region.

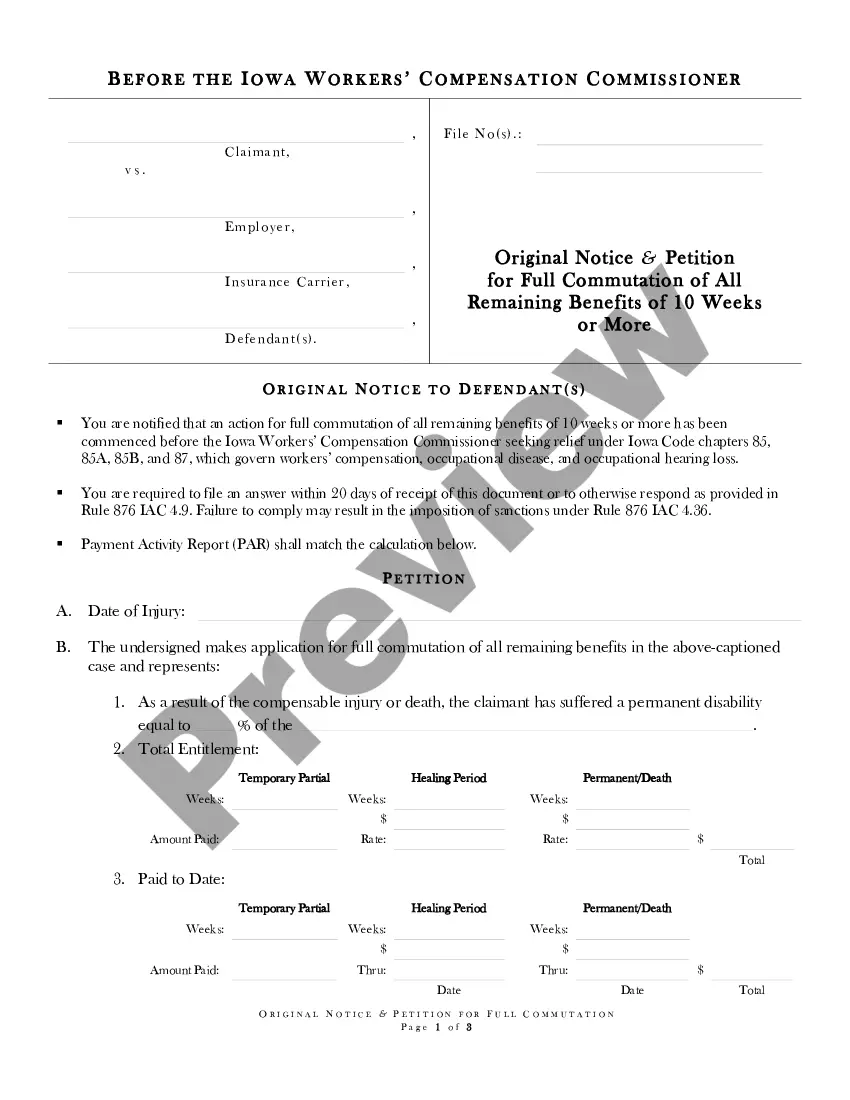

- Use the Preview feature to review the document.

- Read the description to ensure you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Yes, you can absolutely work part-time as a contractor. Many businesses seek part-time assistance, which can be formalized through a District of Columbia Contract for Part-Time Assistance from Independent Contractor. This arrangement allows you to provide valuable services while maintaining flexibility in your work schedule.

The new federal rule aims to clarify the classification of independent contractors versus employees. This regulation focuses on the control and independence that defines a contractor relationship. For those considering a District of Columbia Contract for Part-Time Assistance from Independent Contractor, understanding these rules is essential to ensure compliance and proper classification.

time employee typically cannot be classified as a 1099 independent contractor, as they usually meet the criteria for employee status. However, if the role fits the independent contractor definition, you can create a District of Columbia Contract for PartTime Assistance from Independent Contractor. This distinction is key because it affects tax obligations and benefits.

Yes, as an independent contractor, you have the freedom to set your own hours. This flexibility allows you to balance your work and personal life effectively. Under a District of Columbia Contract for Part-Time Assistance from Independent Contractor, you can negotiate your schedule based on your availability and the needs of your clients.

If you do not have a contract, you risk facing disputes and misunderstandings regarding job expectations, payments, and responsibilities. A District of Columbia Contract for Part-Time Assistance from Independent Contractor serves as a safety net, providing clarity on the terms of your agreement. Without it, proving your position in a disagreement could become complicated. It is best to secure a written contract to avoid such risks.

The 2-year contractor rule mandates that if you continuously engage an independent contractor for two years, they may be considered an employee under certain conditions. In the District of Columbia, this designation can affect your tax obligations and benefits. Therefore, maintaining a District of Columbia Contract for Part-Time Assistance from Independent Contractor can help clarify your relationship over time. Stay informed to avoid potential legal implications.

To fill out an independent contractor agreement, start by clearly stating the scope of work involved. Use a District of Columbia Contract for Part-Time Assistance from Independent Contractor as your template to ensure you cover essential details such as payment terms, timelines, and responsibilities. Provide all parties' information and ensure signatures are obtained to finalize the contract. Following this process will help establish a clear working relationship.

Independent contractors must adhere to guidelines set by the IRS and local authorities. In the District of Columbia, a valid District of Columbia Contract for Part-Time Assistance from Independent Contractor should outline your duties, payment structure, and timelines. You are responsible for your taxes and benefits, which differ from traditional employees. Understanding these rules helps maintain compliance and avoid legal issues.

While you technically can work as a 1099 employee without a written contract, it is not advisable. A District of Columbia Contract for Part-Time Assistance from Independent Contractor provides necessary clarity and can be essential if disputes arise. Without a contract, you might face challenges in proving the terms of your agreement or receiving payments. Therefore, always consider a formal contract to ensure a smooth working relationship.

Yes, having a District of Columbia Contract for Part-Time Assistance from Independent Contractor is crucial. A contract protects both the contractor and the client by clearly outlining the terms of the working relationship. It defines expectations, payment terms, and responsibilities, which can prevent disputes. This formal agreement serves as a legal safeguard for both parties involved.