This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

District of Columbia Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare

Description

How to fill out Agreement Between Professional Corporation And Non-Profit Corporation To Treat People Who Cannot Afford Healthcare?

Finding the correct legal documents template can be a challenge. Of course, there are numerous templates accessible online, but how do you obtain the legal form you require? Utilize the US Legal Forms website.

This service offers a vast array of templates, including the District of Columbia Agreement Between Professional Corporation and Non-Profit Corporation to Provide Treatment for Individuals Unable to Afford Healthcare, suitable for both business and personal use. All forms are reviewed by experts and comply with state and federal regulations.

If you are currently registered, sign in to your account and click the Download button to access the District of Columbia Agreement Between Professional Corporation and Non-Profit Corporation to Provide Treatment for Individuals Unable to Afford Healthcare. Use your account to view the legal forms you have previously acquired. Visit the My documents section of your account and download another copy of the documents you need.

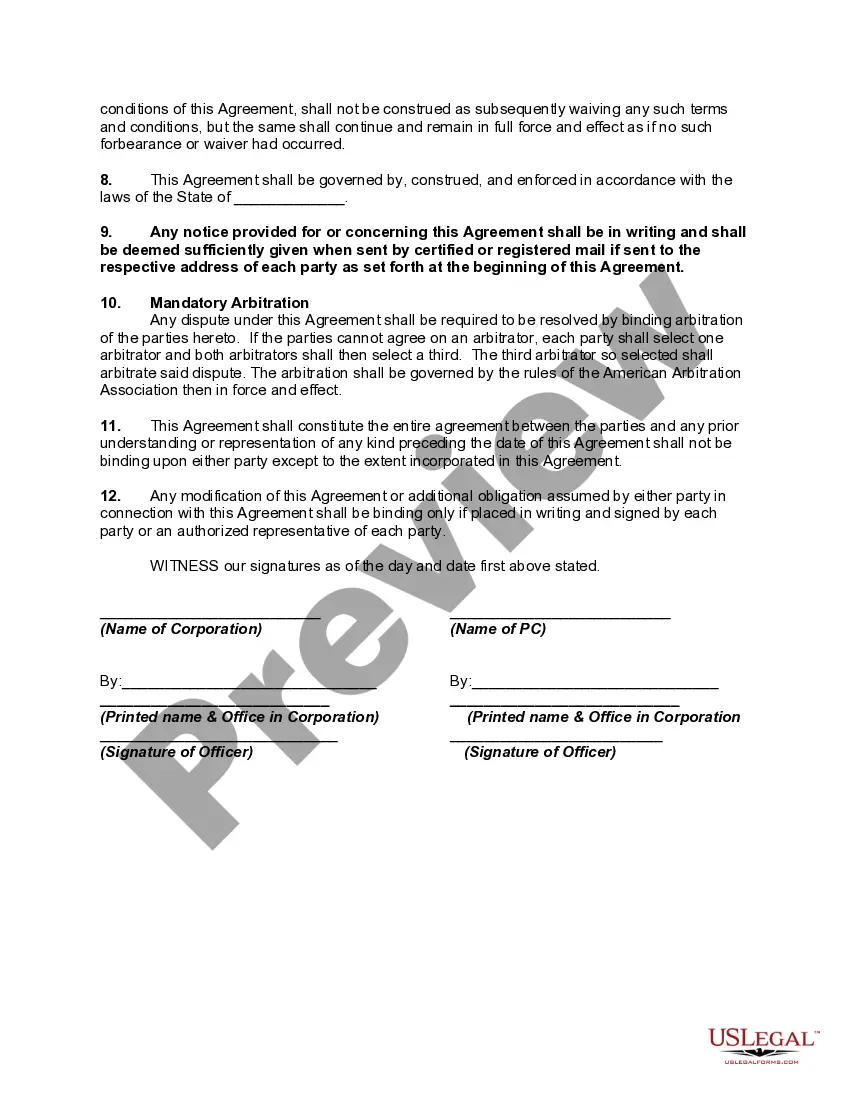

Select the document format and download the legal document template to your device. Complete, modify, print, and sign the completed District of Columbia Agreement Between Professional Corporation and Non-Profit Corporation to Provide Treatment for Individuals Unable to Afford Healthcare. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to download professionally crafted documents that meet state requirements.

- First, ensure you have selected the correct form for your city/state.

- You can review the form using the Review button and read the form summary to confirm that it is suitable for you.

- If the form does not meet your requirements, utilize the Search bar to find the appropriate form.

- Once you are confident that the form is correct, click the Get now button to obtain the form.

- Choose the pricing plan you desire and provide the required information.

- Create your account and complete your purchase using your PayPal account or credit card.

Form popularity

FAQ

Nepotism2015the hiring of family members2015should be prohibited. Nonprofit executives and board members should seek to keep personal friendships from influencing professional judgment.

How to Start a Nonprofit in Washington D.C.Name Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.More items...

O The names of the initial members of the board of directors (D.C. law provides that a nonprofit corporation must have a minimum of three directors);

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

Non Profit Pay Scale and Other Recommendations The Better Business Bureau's standards recommend that at least 65 percent of the nonprofit's total expenses should be for program expenses, including salaries.

Most businesses in Washington D.C. must register for a basic business license through the Department of Consumer and Regulatory Affairs (DCRA), which includes specific endorsements for businesses in certain professions.

No business license is required for nonprofits at the federal government level.

Every business in D.C., including nonprofit organizations, must have a Basic Business License. You must first complete the prerequisites for the license, including registration with the Office of Tax and Revenue. You may submit your application online or submit a paper application.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

The Washington State Department of Commerce requires nonprofit organizations that conduct taxable business activities to apply for a business license before they can begin doing business within the state.