District of Columbia Miller Trust Forms for Medicaid

Description

How to fill out Miller Trust Forms For Medicaid?

If you need to finish, acquire, or create approved document formats, utilize US Legal Forms, the largest assortment of legal templates, accessible online.

Take advantage of the platform's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click the Download now option. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Process the payment. You can utilize your Visa or Mastercard or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the District of Columbia Miller Trust Forms for Medicaid with just a few clicks.

- If you are an existing US Legal Forms client, Log In to your account and click the Download option to find the District of Columbia Miller Trust Forms for Medicaid.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the steps below.

- Step 1. Ensure you have selected the form for the correct region/state.

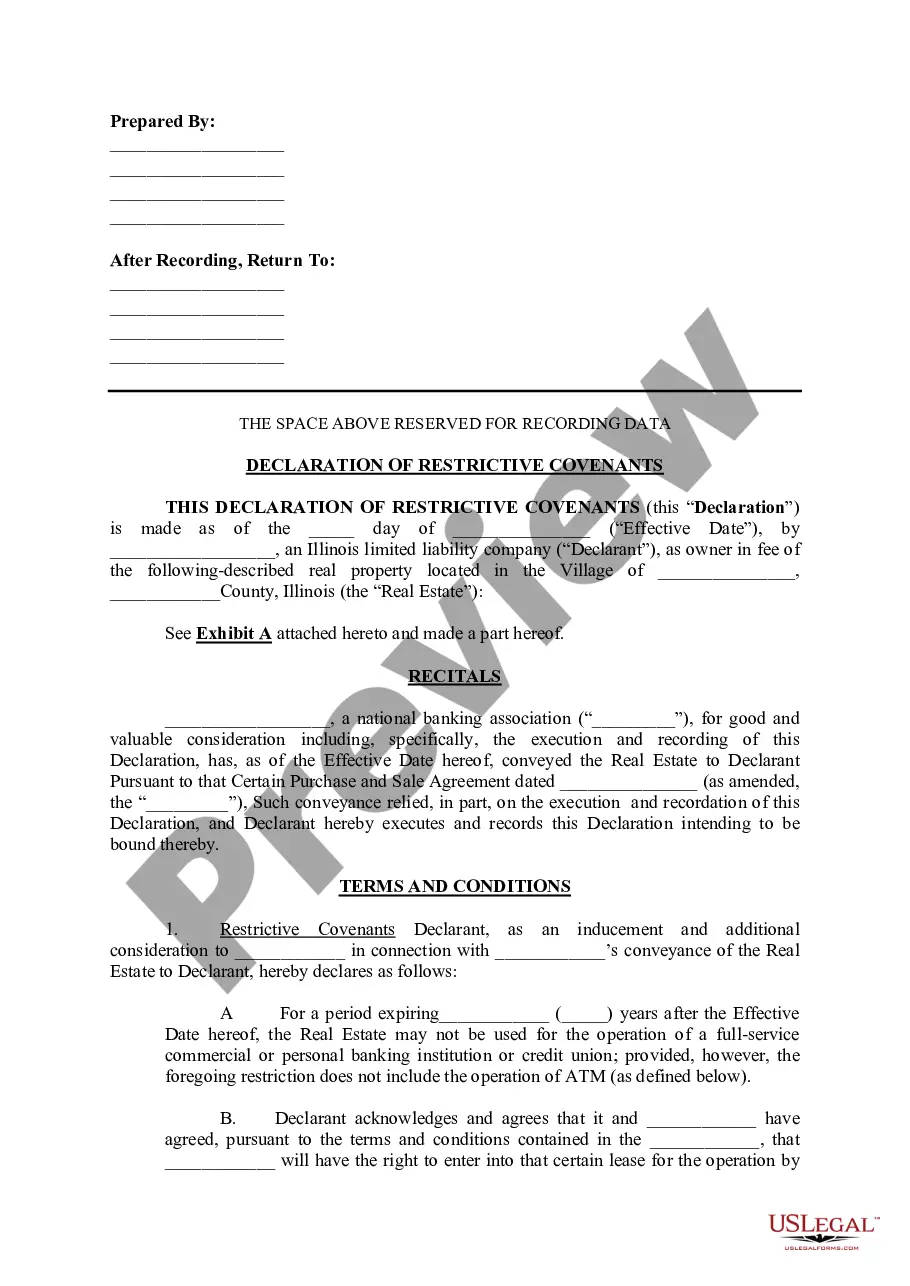

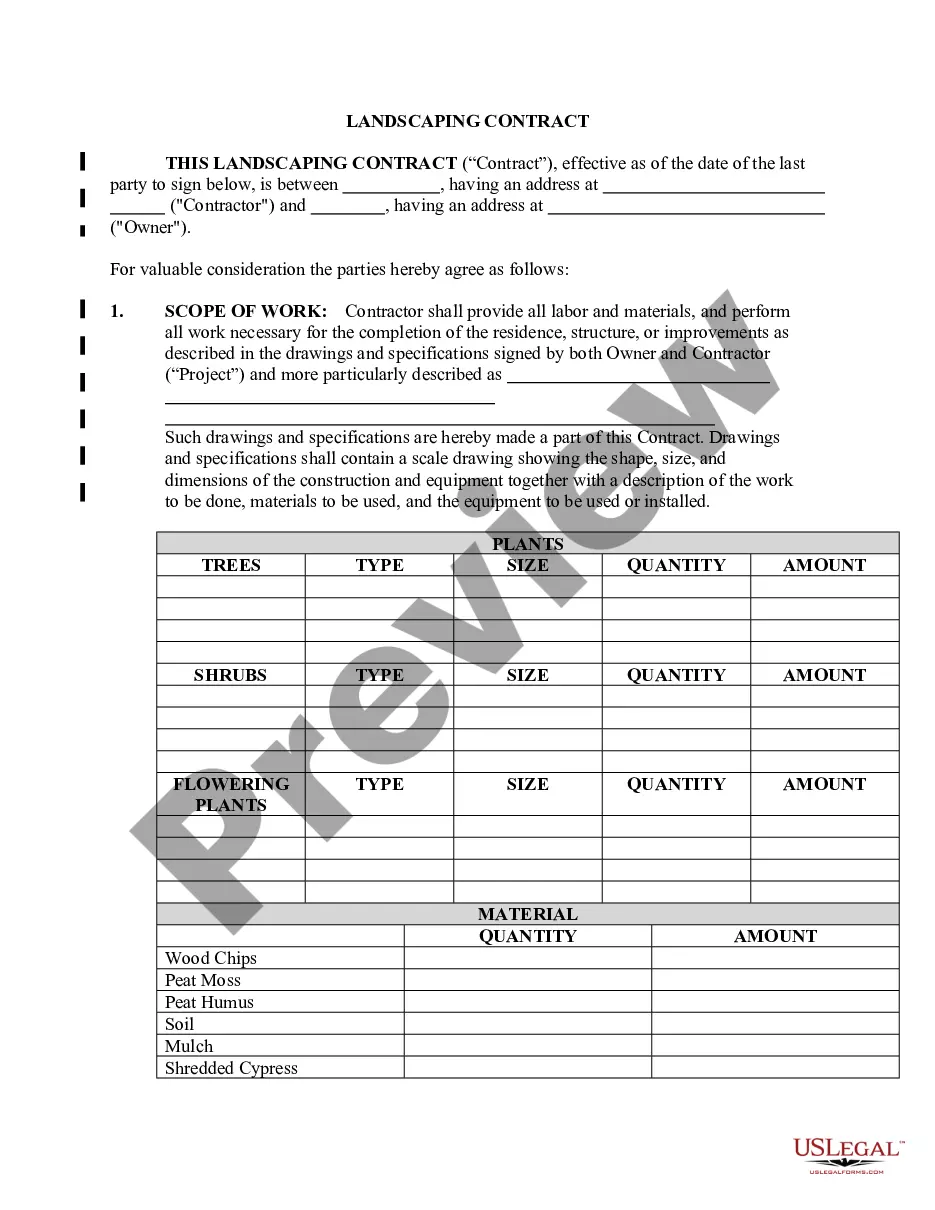

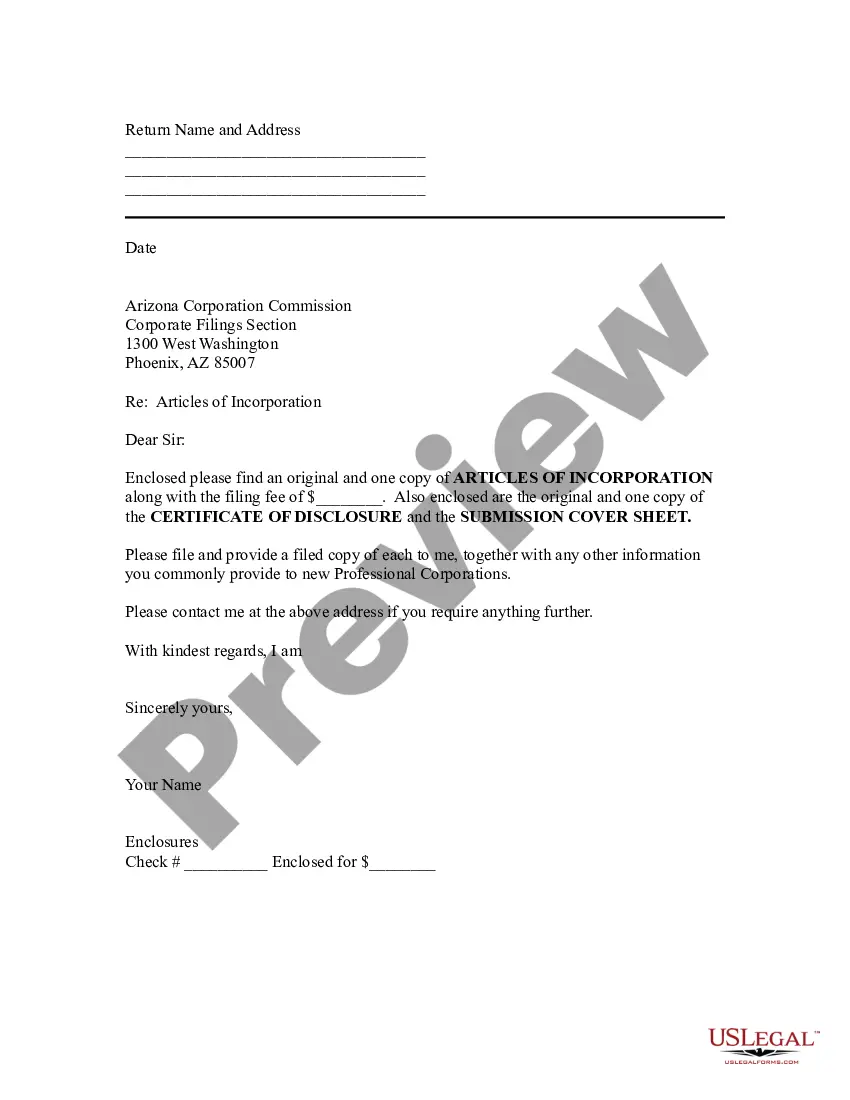

- Step 2. Use the Preview option to examine the form's content. Be sure to review the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In the District of Columbia, the maximum income limit for Medicaid varies based on household size and specific eligibility criteria. Generally, to qualify for Medicaid, an individual must earn less than 138% of the federal poverty level. It's important to note that these limits can change, so always check the latest guidelines. Utilizing District of Columbia Miller Trust Forms for Medicaid can help manage income over these limits.

The income requirement for DC Medicaid varies depending on individual circumstances, such as household size and program type. Generally, applicants must demonstrate that their income falls below a specific threshold. Understanding these limits is crucial for securing benefits. Using District of Columbia Miller Trust Forms for Medicaid can help you navigate these regulations, ensuring you meet the necessary criteria to qualify.

Yes, a Miller trust can be utilized to help individuals qualify for Medicaid, particularly those whose income exceeds allowable limits. By directing excess income into the trust, applicants can adjust their income calculations effectively. This strategy proves beneficial for those on the edge of Medicaid eligibility. By filling out District of Columbia Miller Trust Forms for Medicaid, you can efficiently manage this aspect of your planning.

To apply for DC Medicaid, you can visit the Department of Health Care Finance website or go to a local service center. The application process can typically be completed online, by mail, or in person, depending on your preference. Utilizing District of Columbia Miller Trust Forms for Medicaid may help you understand how your financial situation aligns with the eligibility requirements during the application. Don't hesitate to seek guidance at any step.

In general, certain trusts may not count as assets when determining Medicaid eligibility. However, the specifics depend on the type of trust established. If you create a trust that complies with Medicaid regulations, like a Miller trust, it helps you maintain eligibility. Therefore, using District of Columbia Miller Trust Forms for Medicaid can clarify whether your trust counts against your asset limits.

A Miller trust, also known as a qualified income trust, allows individuals to allocate excess income that would otherwise disqualify them from Medicaid eligibility. By placing income into the trust, you can meet Medicaid's income limits while still accessing necessary medical care. Utilizing District of Columbia Miller Trust Forms for Medicaid ensures that you comply with state regulations, making the process smoother and more efficient.

Using a trust in Medicaid planning can provide strategic benefits. You can set up a trust to hold your assets, which can help you meet eligibility requirements for Medicaid. By utilizing District of Columbia Miller Trust Forms for Medicaid, you ensure that income above certain limits does not disqualify you from receiving benefits. These forms help streamline the process of preserving your assets while obtaining necessary care.

While a Medicaid trust can help protect assets, it also has some disadvantages. Establishing a trust may involve costs, including legal fees and maintenance expenses. Additionally, the rules surrounding Medicaid trusts can be complex, and improper management might lead to denial of benefits. Therefore, consider using District of Columbia Miller Trust Forms for Medicaid to navigate these challenges effectively.

Miller trust funds can be utilized to cover a range of expenses that help individuals qualify for Medicaid in Indiana. These funds primarily assist with paying for medical care, personal care services, and other costs that may arise. By utilizing District of Columbia Miller Trust Forms for Medicaid, you can effectively manage your funds while ensuring compliance with state regulations. This flexibility allows beneficiaries to enjoy a more secure financial future while accessing essential healthcare services.

To qualify for Medicaid, the income limit varies based on the household size and specific state rules. In the District of Columbia, the income threshold typically aligns with federal guidelines. For those interested in the District of Columbia Miller Trust Forms for Medicaid, it is essential to understand how income can be structured to meet eligibility requirements effectively. Ensuring your income falls within the set limits allows you to securely receive the necessary Medicaid benefits.