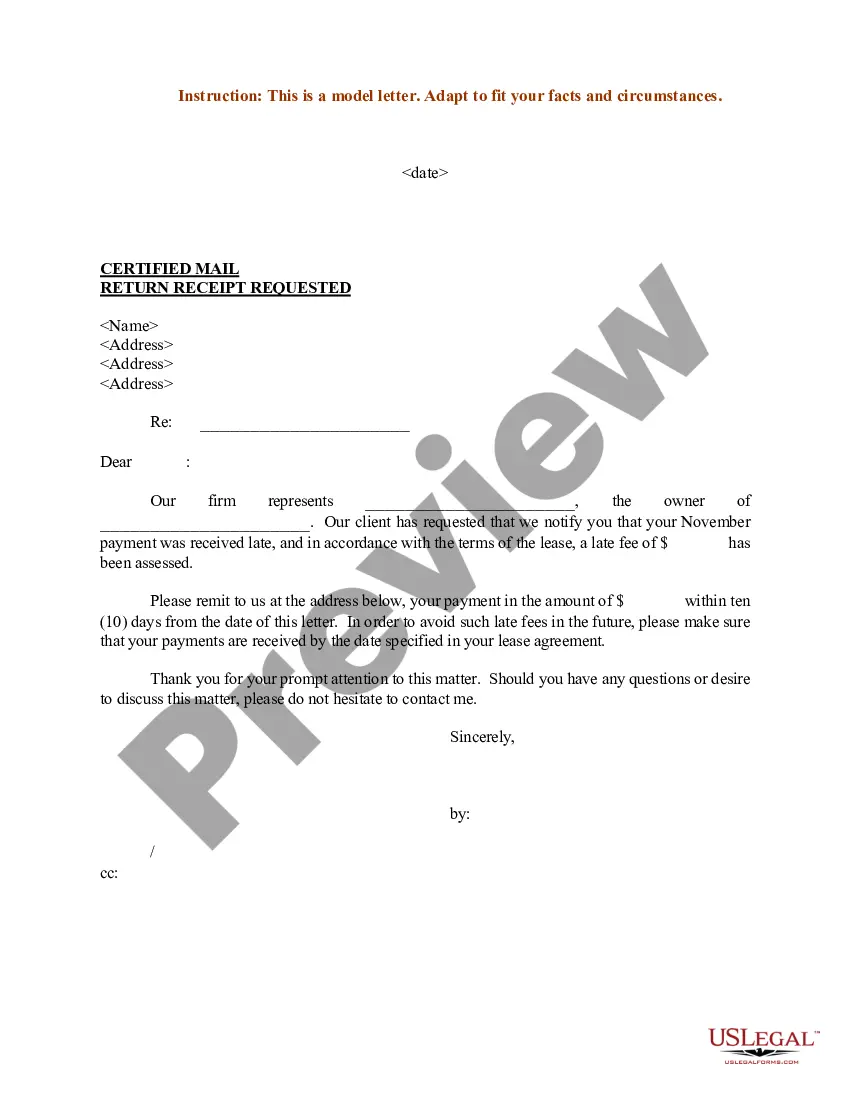

District of Columbia Sample Letter for Late Fees

Description

How to fill out Sample Letter For Late Fees?

You can spend hours online attempting to locate the valid document format that meets the federal and state requirements you need. US Legal Forms offers a wide array of valid forms that are examined by experts.

It is easy to download or print the District of Columbia Sample Letter for Late Fees from our service. If you already have a US Legal Forms account, you may Log In and click the Acquire button. After that, you can complete, modify, print, or sign the District of Columbia Sample Letter for Late Fees.

Every valid document format you purchase is yours permanently. To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button. If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document format for the county/town of your choice. Review the document outline to confirm you have chosen the right form. If available, use the Review button to browse through the document format as well.

- If you wish to find another version of the form, use the Research field to locate the format that suits your needs and specifications.

- Once you have located the format you want, click Acquire now to proceed.

- Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the valid document.

- Select the format of your document and download it to your device.

- Make modifications to your document if needed. You can complete, modify, sign, and print the District of Columbia Sample Letter for Late Fees.

- Obtain and print numerous document templates using the US Legal Forms website, which offers the largest selection of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

A DC Resident is an individual that maintains a place of abode within DC for 183 days or more. If the individual is domiciled in the state at anytime, you are considered to be a DC resident. A DC Nonresident is an individual that did not spend any time domiciled in the state.

(a) A resident of the District of Columbia is one who is living in the District of Columbia voluntarily and not for a temporary purpose; that is, one with no intention of presently removing himself or herself therefrom. A child is residing in the District if he or she is making his or her home in the District.

(A resident is an individual domiciled in DC at any time during the taxable year); You maintained a place of abode in DC for a total of 183 days or more even if your permanent home was outside of DC; You were a part-year resident of DC (see instructions for part-year residents);

Who must file Form D-30? Generally, an unincorporated business, with gross income (Line 11) more than $12,000 must file a D 30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

Under Section 47-1801.04(17) of the DC Official Code, also known as the ?183-Day Rule,? anyone who maintains a home in the District of Columbia for at least 183 days a year is considered a legal Washington, DC resident and must pay DC income taxes. Nonresidents do not have to pay this tax.

Authorized fees for the payment of rent beyond 5 days after the rent payment is due. "(a) Pursuant to subsection (b) of this section, a housing provider may charge a late fee of no more than 5% of the full amount of rent due by a tenant.

FR-500 New Business Registration (new registrations only)

To satisfy the 183-day requirement, count: All of the days you were present in the current year, One-third of the days you were present in the first year before the current year, and. One-sixth of the days you were present in the second year before the current year.