A Legacy is a gift of property or money under the terms of the will of a person who has died. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

District of Columbia Assignment of Legacy in Order to Pay Indebtedness

Description

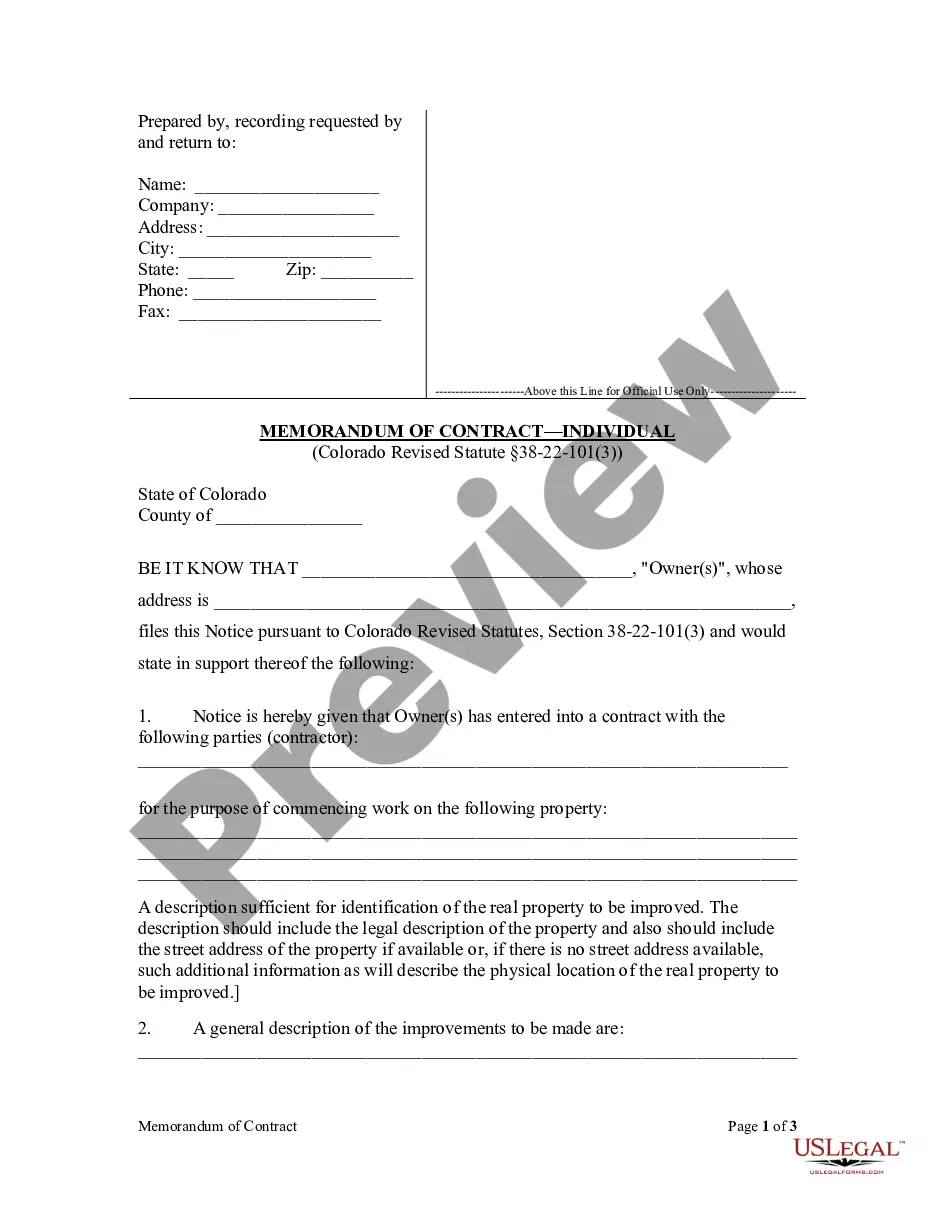

How to fill out Assignment Of Legacy In Order To Pay Indebtedness?

Choosing the right authorized record format can be a struggle. Naturally, there are a lot of themes available on the net, but how would you discover the authorized type you want? Utilize the US Legal Forms site. The support provides thousands of themes, such as the District of Columbia Assignment of Legacy in Order to Pay Indebtedness, which can be used for enterprise and personal demands. All of the forms are examined by specialists and fulfill federal and state specifications.

Should you be already registered, log in in your bank account and click the Down load key to get the District of Columbia Assignment of Legacy in Order to Pay Indebtedness. Make use of your bank account to search with the authorized forms you might have acquired in the past. Visit the My Forms tab of the bank account and have another copy from the record you want.

Should you be a new customer of US Legal Forms, here are basic directions so that you can follow:

- Initially, ensure you have chosen the right type for your town/region. You can look over the shape while using Preview key and read the shape explanation to ensure it is the right one for you.

- In the event the type fails to fulfill your expectations, make use of the Seach area to discover the correct type.

- When you are positive that the shape is proper, select the Buy now key to get the type.

- Pick the pricing strategy you want and type in the required information and facts. Design your bank account and pay for an order using your PayPal bank account or Visa or Mastercard.

- Choose the data file structure and acquire the authorized record format in your product.

- Comprehensive, modify and print and indication the attained District of Columbia Assignment of Legacy in Order to Pay Indebtedness.

US Legal Forms is definitely the largest library of authorized forms for which you will find various record themes. Utilize the service to acquire professionally-created papers that follow condition specifications.

Form popularity

FAQ

The will should be filed within 90 days after the death of the deceased person with a Certificate of Filing Will. There is no cost to file a will. An Affidavit of Witness may be filed to explain any irregularity contained in the will.

Next, file the Will by taking it to the D.C. Superior Court Probate Division. Under D.C. law, the Will must be filed within 90 days of the death of the decedent.

§ 20?909. Any person with a valid unbarred claim or with a valid unbarred judgment who has not been paid within the 8 month period may petition the Court for an order directing the personal representative to pay the claim to the extent that funds of the estate are available for such payment.

Statute of limitations in contracts for sale. (1) An action for breach of any contract for sale must be commenced within four years after the cause of action has accrued. By the original agreement the parties may reduce the period of limitation to not less than one year but may not extend it.

Probate is a legal process that takes place after someone's death. It usually involves proving that the deceased's will is valid, identifying the deceased person's property and having it appraised, paying outstanding debts and taxes, and distributing the property per the will or state law.

Is Probate Required in Washington, DC? Probate is required in many cases in the District of Columbia. If the property value is under $40,000, you can settle under small estate administration.

Find the Will and file it with the D.C. Superior Court Probate Division; obtain D.C. Superior Court appointment of the Personal Representative. 2. Gather and Appraise the Assets. Make an inventory of the assets the decedent owned at death and determine the value of each asset.

20-906, tangible personalty or other personalty not exceeding the value of $10,000 is allowed to the surviving spouse/domestic partner and if none, to the decedent's surviving children jointly as exempt property.

The appointment of the personal representative remains active for three years from date of appointment unless extended. However, it is possible to terminate the appointment sooner by filing a request to the court. The administration process may not be active for three years. Many estates are active for about one year.