This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

District of Columbia Notice of Default in Payment Due on Promissory Note

Description

How to fill out Notice Of Default In Payment Due On Promissory Note?

Are you in a scenario where you need to obtain documents for either business or personal purposes almost daily.

There are numerous legitimate document templates available online, but locating versions you can trust is challenging.

US Legal Forms offers thousands of template documents, such as the District of Columbia Notice of Default in Payment Due on Promissory Note, that are designed to comply with state and federal standards.

Once you find the correct document, simply click Acquire now.

Choose the pricing plan you prefer, complete the required information to create your account, and pay for your order using your PayPal or Visa/MasterCard. Select a suitable document format and download your copy. Access all the document templates you have purchased from the My documents section. You can obtain a new copy of the District of Columbia Notice of Default in Payment Due on Promissory Note anytime, if needed. Just click the necessary form to download or print the document template. Use US Legal Forms, one of the most extensive collections of legitimate forms, to save time and avoid mistakes. This service provides professionally crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the District of Columbia Notice of Default in Payment Due on Promissory Note template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is for the correct city/county.

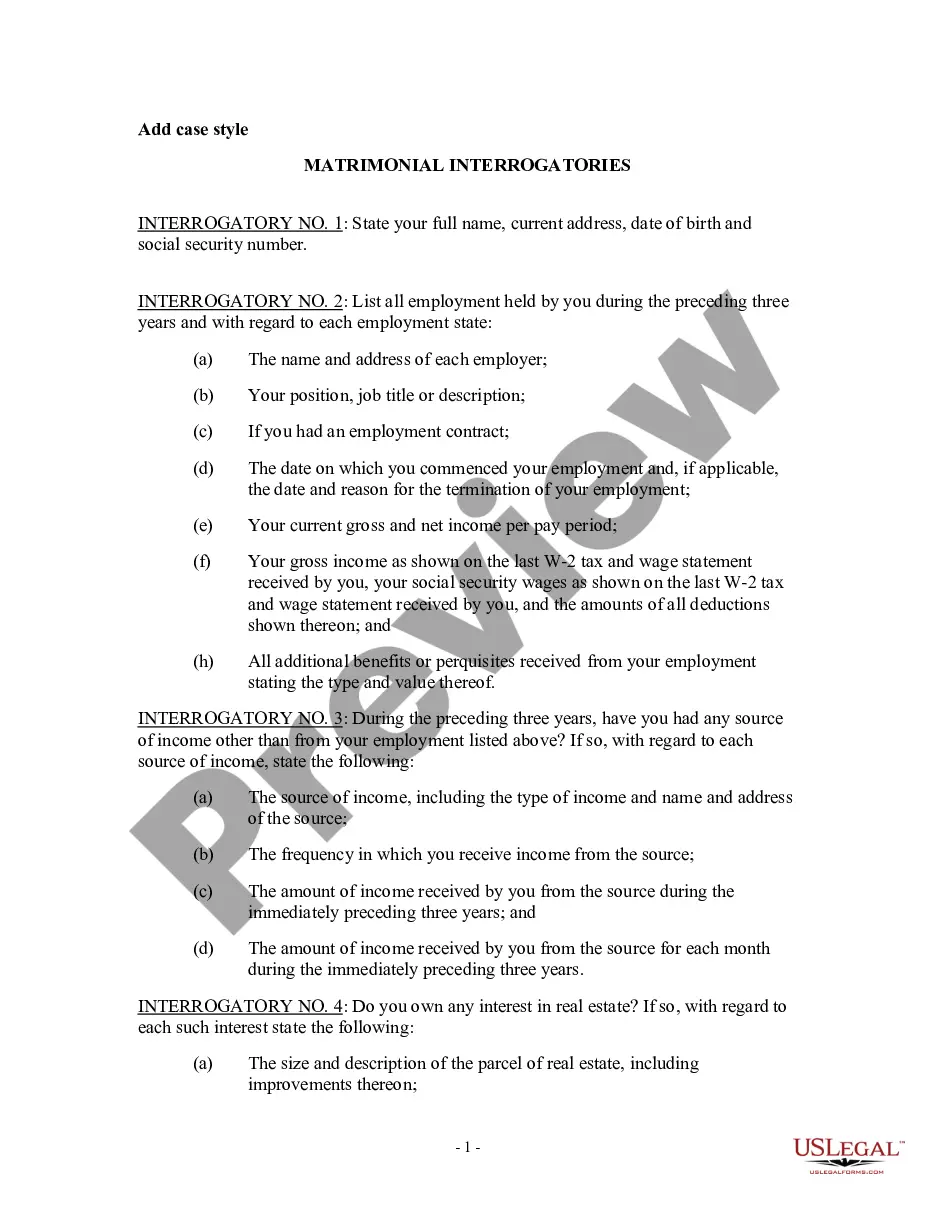

- Utilize the Preview function to review the form.

- Check the outline to confirm that you have selected the right document.

- If the document is not what you are searching for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Defaulting on a promissory note means you have failed to meet the payment terms as agreed upon in the document. This could lead to legal actions initiated by the lender, which may include a District of Columbia Notice of Default in Payment Due on Promissory Note. Understanding this term is crucial, as it can significantly affect your financial standing and credit rating.

If you default on a promissory note, the lender may take several actions to recover the owed amount. Typically, they will issue a District of Columbia Notice of Default in Payment Due on Promissory Note, giving you a formal warning. This notice is an important step before potential legal action, which may disrupt your credit score and result in asset repossession.

A written notice of default is a documented communication from a lender to a borrower specifying missed payments. This written notice is critical for legal purposes, as it provides a paper trail of the default. Knowing how to handle such notices can help you avoid the escalation of this issue.

If you receive a District of Columbia Notice of Default in Payment Due on Promissory Note, it means immediate action is necessary. Typically, this notice grants you a specific timeframe to address the missed payments. Failing to respond may lead to more severe financial consequences, including potential foreclosure.

A notice of default on a promissory note is an official notification regarding missed payments. It details the borrower's failure to comply with the payment schedule and may outline the next steps for both parties. Receiving such a notice should motivate borrowers to act quickly in order to mitigate further repercussions.

A notice of default of promissory note is a formal statement issued by the lender when the borrower fails to make scheduled payments. This notice signifies that the borrower has not adhered to the terms outlined in the promissory note. Understanding this notice is crucial for borrowers to avoid potential foreclosure or other legal consequences.

When someone defaults on a promissory note, you should first verify the terms of the agreement to ensure the default is legitimate. Subsequently, sending a District of Columbia Notice of Default in Payment Due on Promissory Note can promote resolution and underscore the importance of the matter. Should the borrower continue to neglect payment, you may need to consider further legal action. Utilizing resources like US Legal Forms can guide you through the necessary steps to protect your interests.

If someone defaults on a promissory note, the first step is to communicate with the borrower to discuss the situation. If the matter cannot be resolved, you should consider sending a District of Columbia Notice of Default in Payment Due on Promissory Note. This notice formally outlines the default, implying the seriousness of the situation and your intention to enforce the terms of the note. Platforms like US Legal Forms can streamline the process of creating this essential document.

Yes, foreclosure can occur on a promissory note when it is secured by a lien on a property. If a borrower defaults, the lender may invoke the provisions of the promissory note to pursue foreclosure. By filing a District of Columbia Notice of Default in Payment Due on Promissory Note, you can formally notify the borrower of the default and initiate the foreclosure process. This action solidifies your intentions to collect and protects your investment.

Yes, a promissory note can hold up in court if it is properly executed and meets all legal standards. Courts typically uphold written agreements as long as both parties have clearly agreed to the terms outlined in the document. Therefore, issuing a District of Columbia Notice of Default in Payment Due on Promissory Note can strengthen your position if legal action becomes necessary. Ensure your documentation is thorough to improve your chances of a favorable outcome.