An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

District of Columbia Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage

Description

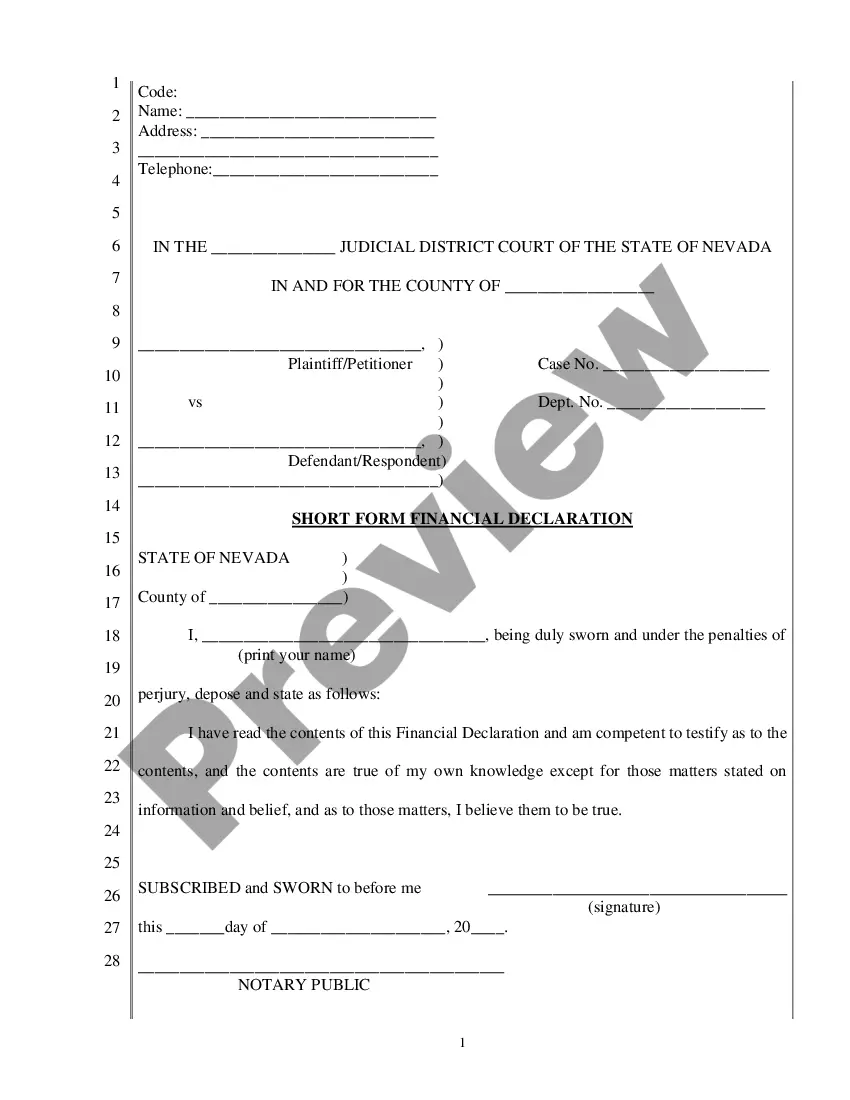

How to fill out Agreement To Modify Interest Rate On Promissory Note Secured By A Mortgage?

If you want to complete, download, or produce legitimate papers web templates, use US Legal Forms, the biggest collection of legitimate forms, that can be found on the web. Take advantage of the site`s easy and handy lookup to discover the files you want. Various web templates for enterprise and individual uses are sorted by classes and suggests, or keywords. Use US Legal Forms to discover the District of Columbia Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage with a couple of click throughs.

In case you are already a US Legal Forms buyer, log in for your accounts and then click the Down load button to obtain the District of Columbia Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage. Also you can entry forms you formerly delivered electronically from the My Forms tab of your own accounts.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for the correct town/land.

- Step 2. Make use of the Preview method to look through the form`s articles. Do not overlook to read the explanation.

- Step 3. In case you are unhappy with all the kind, make use of the Look for industry near the top of the display screen to find other variations of the legitimate kind format.

- Step 4. Upon having located the shape you want, click the Purchase now button. Pick the costs plan you prefer and include your credentials to sign up for an accounts.

- Step 5. Process the purchase. You can utilize your Мisa or Ьastercard or PayPal accounts to complete the purchase.

- Step 6. Choose the file format of the legitimate kind and download it on the device.

- Step 7. Total, change and produce or indication the District of Columbia Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage.

Every single legitimate papers format you buy is the one you have forever. You might have acces to each kind you delivered electronically within your acccount. Click the My Forms area and pick a kind to produce or download once again.

Contend and download, and produce the District of Columbia Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage with US Legal Forms. There are thousands of expert and state-specific forms you can use for the enterprise or individual demands.

Form popularity

FAQ

Typically, promissory notes are securities. They must be registered with the SEC, a state securities regulator, or be exempt from registration.

What Is Loan Modification? Loan modification is a change made to the terms of an existing loan by a lender. It may involve a reduction in the interest rate, an extension of the length of time for repayment, a different type of loan, or any combination of the three.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.

A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

An amendment to a promissory note is a legal document that makes changes to the original promissory note in a legal manner. The original contract may be restated in order to include the new changes that were made by the amendment to the promissory note.

Mortgage, Trust Deed. A security instrument that secures for the repayment of a debt is a : Unsecured Note. If a promissory NOTE is NOT SECURED by a mortgage it is called ::: Usury.

There are three types of promissory notes: unsecured, secured and demand. An unsecured promissory note is one that is not backed by any type of collateral. ... A secured promissory note is one that is backed by some type of collateral. ... A demand promissory note does not have a specific due date for repayment.

Extending the term of the loan. For example, your 30-year mortgage may change to a 40-year mortgage. This gives you longer to repay the amount, so your payments would be lower, but you'll also pay more in interest over the life of your loan.