District of Columbia Agreement to Arbitrate Disputed Open Account

Description

How to fill out Agreement To Arbitrate Disputed Open Account?

Have you found yourself in a situation where you require documents for either organizational or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is not straightforward.

US Legal Forms offers thousands of form templates, including the District of Columbia Agreement to Arbitrate Disputed Open Account, designed to meet both state and federal requirements.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using PayPal or a Visa or Mastercard.

Choose a preferred document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the District of Columbia Agreement to Arbitrate Disputed Open Account anytime if needed. Click on the specific form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the District of Columbia Agreement to Arbitrate Disputed Open Account template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need, ensuring it is for the correct city/state.

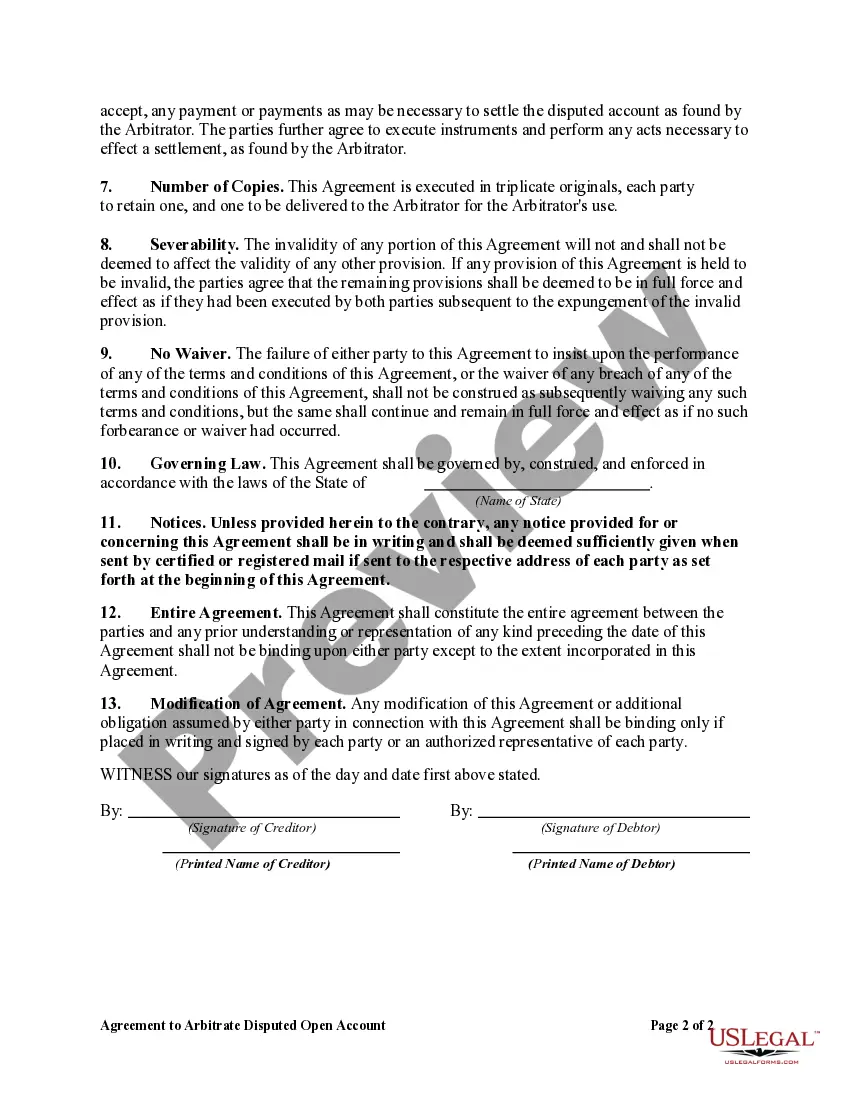

- Use the Review button to examine the form.

- Check the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Lookup field to find the form that fits your needs.

- If you find the right form, click Purchase now.

Form popularity

FAQ

If you signed a District of Columbia Agreement to Arbitrate Disputed Open Account, your ability to sue may be limited. Usually, arbitration agreements require parties to resolve disputes through arbitration instead of in court. However, there are exceptions where you may still pursue legal action, particularly if the arbitration process fails. It’s important to understand the specific terms before assuming your legal rights.

Agreeing to an arbitration agreement is a significant decision. A District of Columbia Agreement to Arbitrate Disputed Open Account often provides benefits, such as expedited resolution and reduced legal fees. However, this agreement may also limit your rights to pursue certain legal actions in court. Weigh the pros and cons carefully to ensure the choice aligns with your needs.

Opting out of an arbitration agreement can depend on your personal situation and preferences. If a District of Columbia Agreement to Arbitrate Disputed Open Account restricts your legal options, it may be wise to consider opting out. On the other hand, arbitration can offer a faster resolution for disputes. Ultimately, assess the potential benefits and drawbacks related to your unique circumstances.

Choosing whether to opt out of an arbitration agreement with your bank requires careful consideration. A District of Columbia Agreement to Arbitrate Disputed Open Account may limit your ability to bring a lawsuit in the future. If you have concerns about your rights or potential disputes, it may be worth reviewing the implications before deciding to opt out. Ensure you understand the terms before making a choice.

Your company may send you a District of Columbia Agreement to Arbitrate Disputed Open Account to outline the procedure for resolving disputes outside of court. This agreement aims to streamline conflict resolution and avoid lengthy legal battles. By agreeing to arbitration, both parties often have a quicker and more efficient process to follow. Thus, companies use this approach to promote clarity and reduce legal costs.

To attempt to bypass a District of Columbia Agreement to Arbitrate Disputed Open Account, you typically need valid legal grounds, such as evidence of coercion or a violation of public policy. Another strategy may involve negotiating with the other party for a waiver of arbitration. This path, however, may require legal assistance to navigate effectively. Always consider the potential consequences before moving forward.

Yes, you can compel a party to arbitrate if a District of Columbia Agreement to Arbitrate Disputed Open Account exists and is enforceable. This process usually involves filing a motion in court to enforce the arbitration agreement. The court will assess the validity of the agreement before making a decision. It is advisable to gather relevant documentation and legal representation to support your motion.

Bypassing a District of Columbia Agreement to Arbitrate Disputed Open Account might be possible under specific circumstances. For example, if the agreement was deemed unconscionable or if both parties consent to litigation, you may have that option. However, be cautious, as courts may uphold arbitration agreements, restricting your ability to litigate. Seeking professional legal advice can help you explore your options.

Several factors can void a District of Columbia Agreement to Arbitrate Disputed Open Account, such as fraud or duress during its creation. If one party was misled about the terms, the agreement may become unenforceable. Additionally, agreements that are unconscionable often do not hold up in court. It's crucial to understand the terms before agreeing to arbitration in the first place.

To invoke a District of Columbia Agreement to Arbitrate Disputed Open Account, you typically need to notify the other party in writing. This notification should reference the arbitration clause in your agreement and specify the dispute at hand. Providing this notice formally sets in motion the arbitration process. You may also want to check the rules governing the arbitration organization selected.