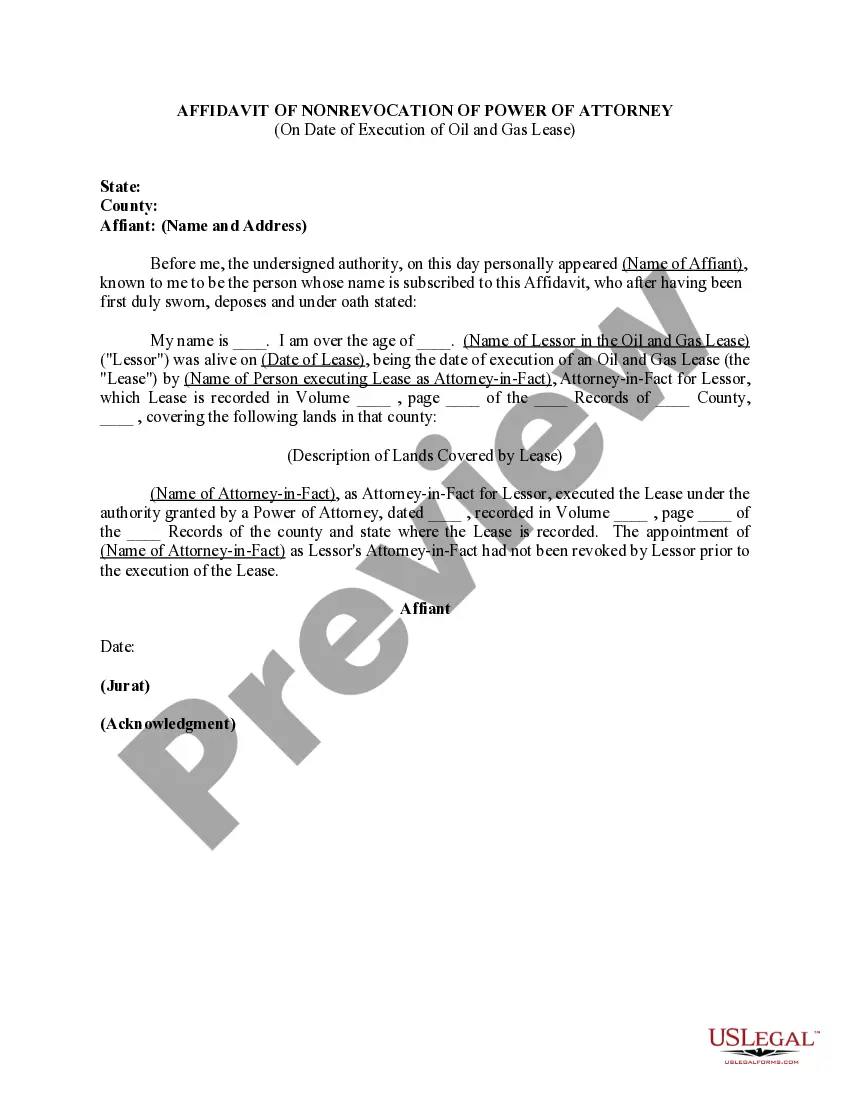

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

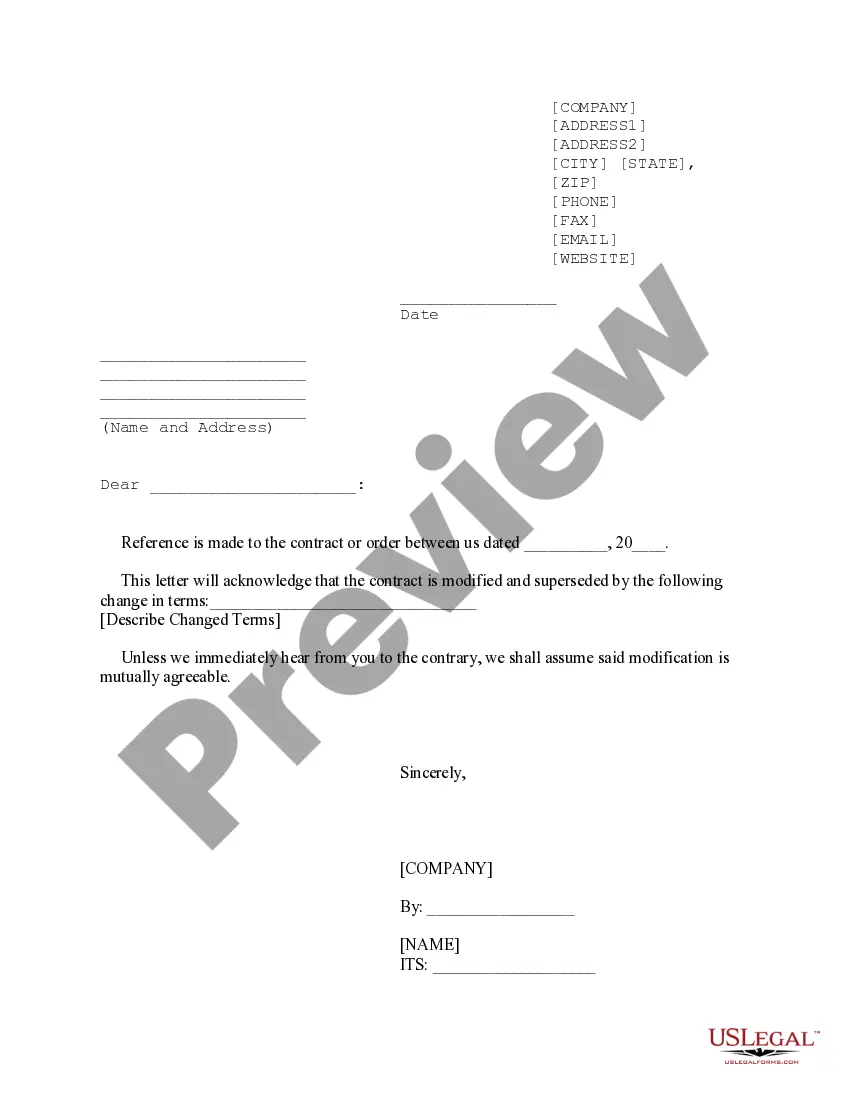

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

If you need to thorough, download, or print authorized document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's user-friendly and convenient search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and then click the Download button to get the District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust.

- You can also access documents you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Make sure you have selected the form for your specific city/state.

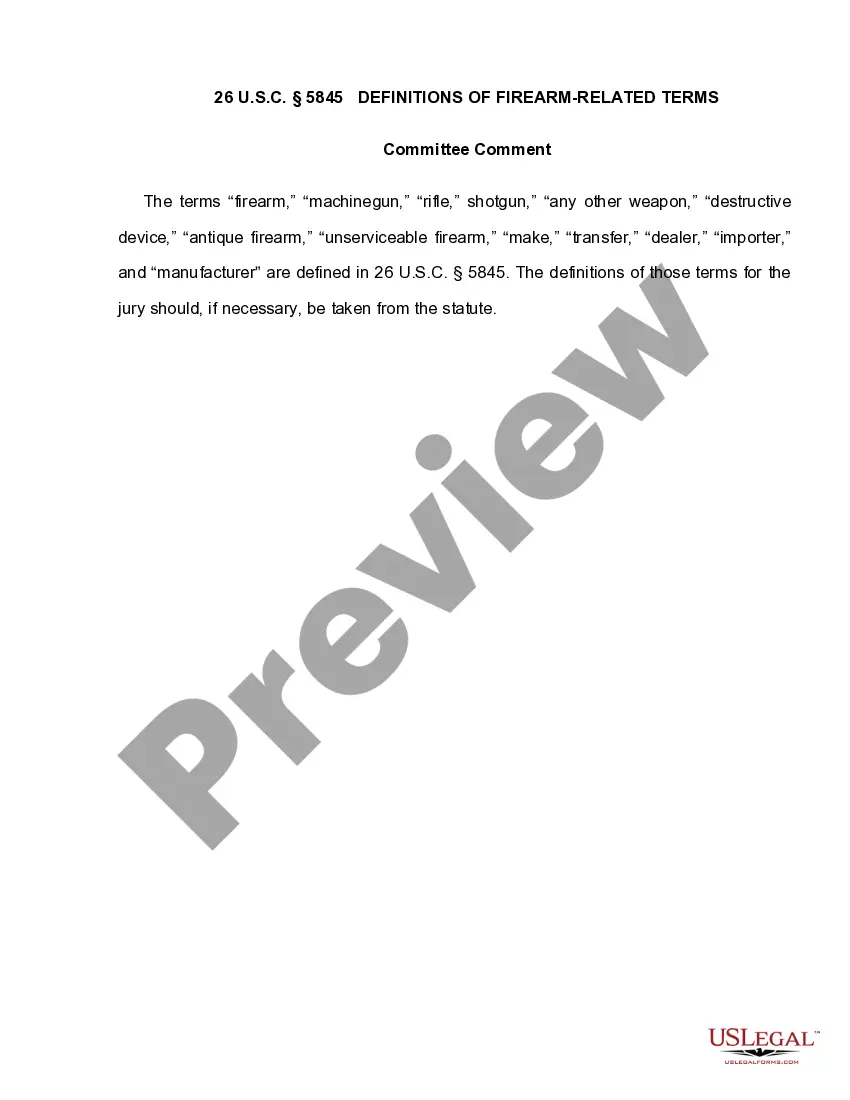

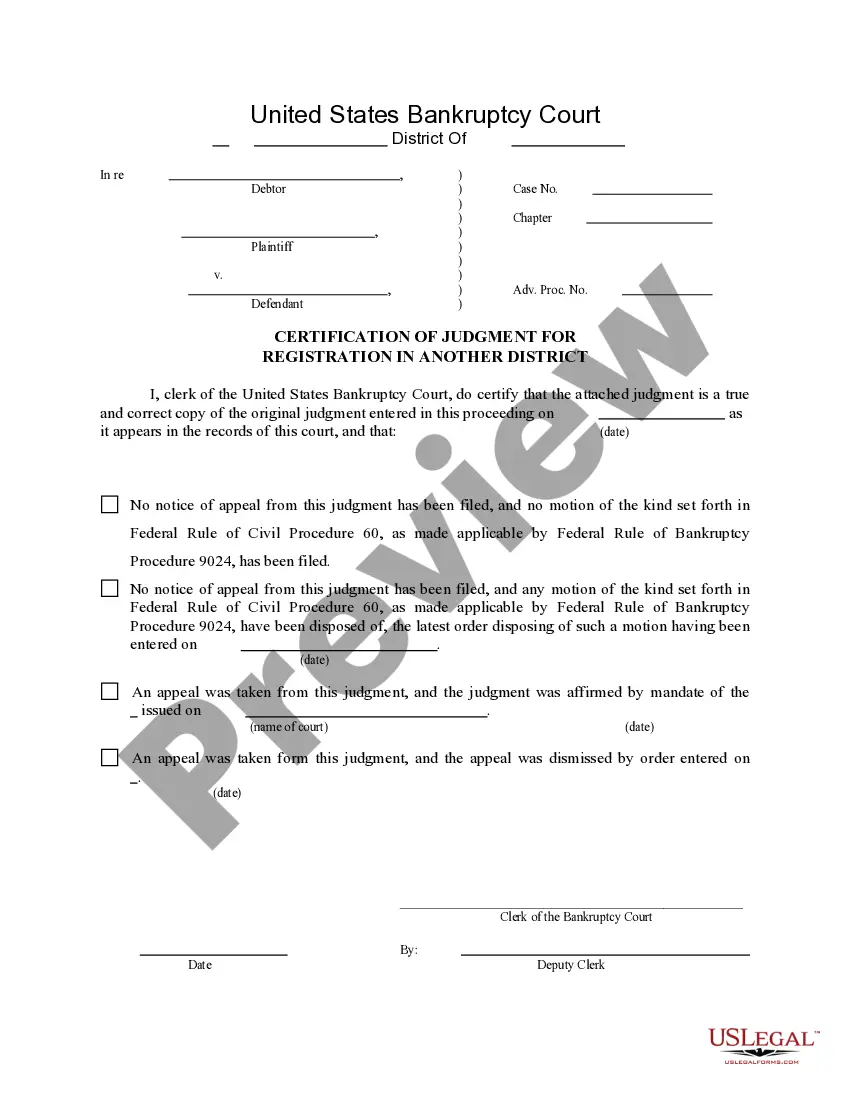

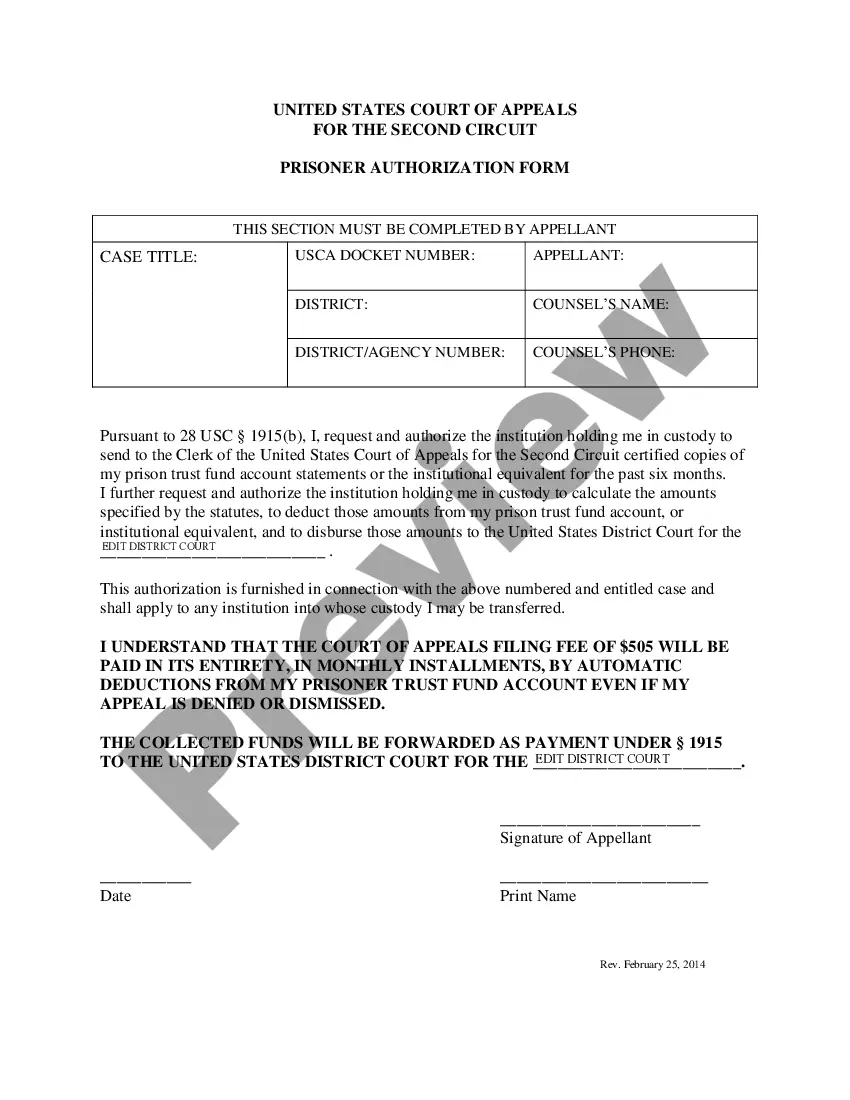

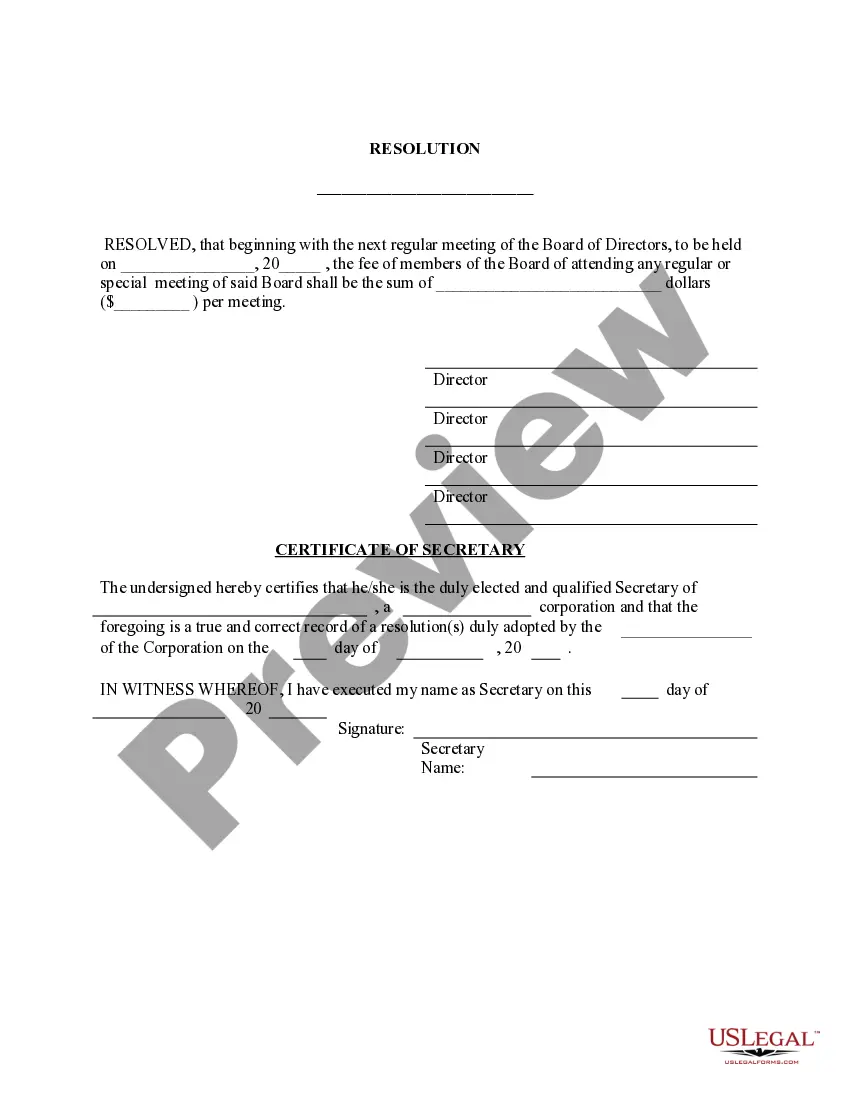

- Step 2. Use the Preview feature to review the content of the form. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

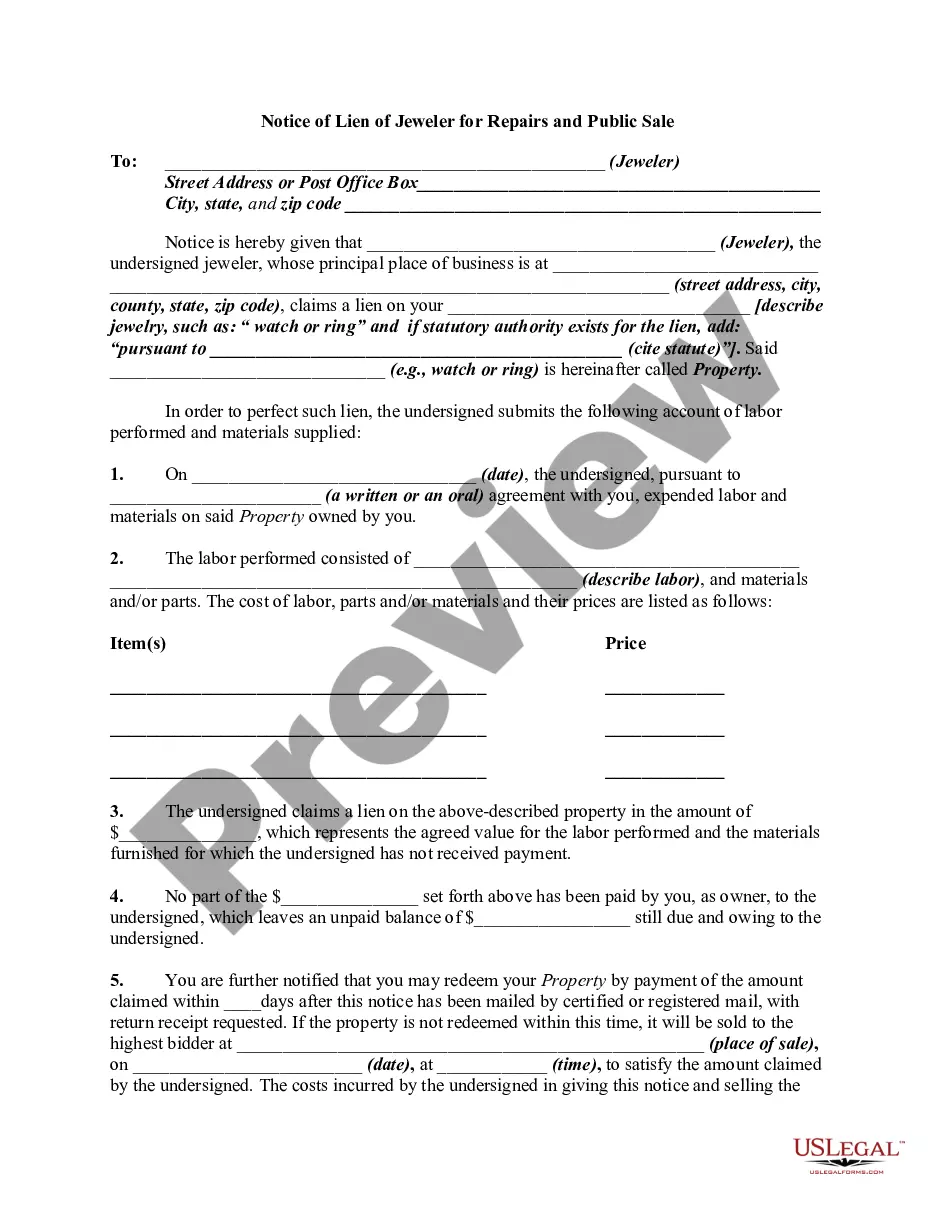

In Washington, D.C., there is no state inheritance tax; however, the federal estate tax may apply if the estate exceeds a certain value. If you're dealing with a trust, the income may still be taxable. By utilizing the District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust, you ensure that you understand your tax responsibilities, helping you manage any potential taxes effectively.

Yes, generally, income distributed from a trust to a beneficiary is taxable. Beneficiaries must report this income on their individual tax returns. The District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust provides a framework guiding these tax obligations, ensuring that beneficiaries understand their tax liabilities clearly and can plan accordingly.

Inheritance laws in Washington, D.C. dictate how assets are distributed among heirs and beneficiaries when a person passes away. If someone dies intestate, meaning without a will, the laws prioritize spouses, children, and parents. Understanding the District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust can help ensure your intentions regarding asset distribution are honored and legally recognized.

In the United States, you can inherit up to $12.92 million without incurring federal estate taxes as of 2023. However, specific laws in the District of Columbia can vary. It’s crucial to understand that while the District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust may not incur taxes on inheritance, proper planning is essential for maximizing your benefits and minimizing any potential tax liabilities.

To report beneficiary income from a trust, start by gathering necessary documents such as the trust agreement and relevant financial statements. The income should be reported on IRS Form 1040, Schedule E, as well as the appropriate state forms. Using the District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust, you can accurately determine how much income needs to be reported. Taking these steps ensures compliance with tax regulations and peace of mind.

The distribution of income from a trust refers to how the income generated by the trust is allocated to its beneficiaries. In a District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust, the income may be distributed based on predetermined percentages outlined in the trust document. This distribution can provide a steady income stream for beneficiaries while fostering financial stability. Understanding the specifics of these distributions can be enhanced through resources available at uslegalforms.

Yes, trust income is generally taxable to the beneficiaries who receive it. For those involved in a District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust, this means that any distribution received must be reported as income on individual tax returns. The trust itself may also be taxed, but with distributions flowing to beneficiaries, careful tax planning is advisable. Utilizing tools or services from uslegalforms can help simplify the understanding of tax implications.

A current income beneficiary of a trust is an individual entitled to receive income generated by the trust during their lifetime. In the context of a District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust, the beneficiary can access these income distributions based on the specified percentage. It's important for beneficiaries to understand their rights and the implications of receiving trust income. Additionally, legal guidance can clarify any responsibilities attached to these distributions.

Trust income is typically taxed to the beneficiary based on how the distribution is structured. In the case of a District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust, beneficiaries may receive a portion of the trust's income directly. The IRS requires beneficiaries to report this income on their tax returns, as it may increase their taxable income. It's essential to consult a tax professional for specific guidance related to your circumstances.

Allocating trust income involves assessing the income produced from the trust's investments and assets. The trustee then distributes this income in accordance with the trust document, ensuring that allocations align with the stated percentages or amounts. For those navigating a District of Columbia Assignment by Beneficiary of a Percentage of the Income of a Trust, it is essential to work closely with a knowledgeable trustee or platform like uslegalforms, which can provide clarity and support during the allocation process. This approach not only clarifies income distribution but also enhances trust among beneficiaries.