District of Columbia Partial Assignment of Life Insurance Policy as Collateral

Description

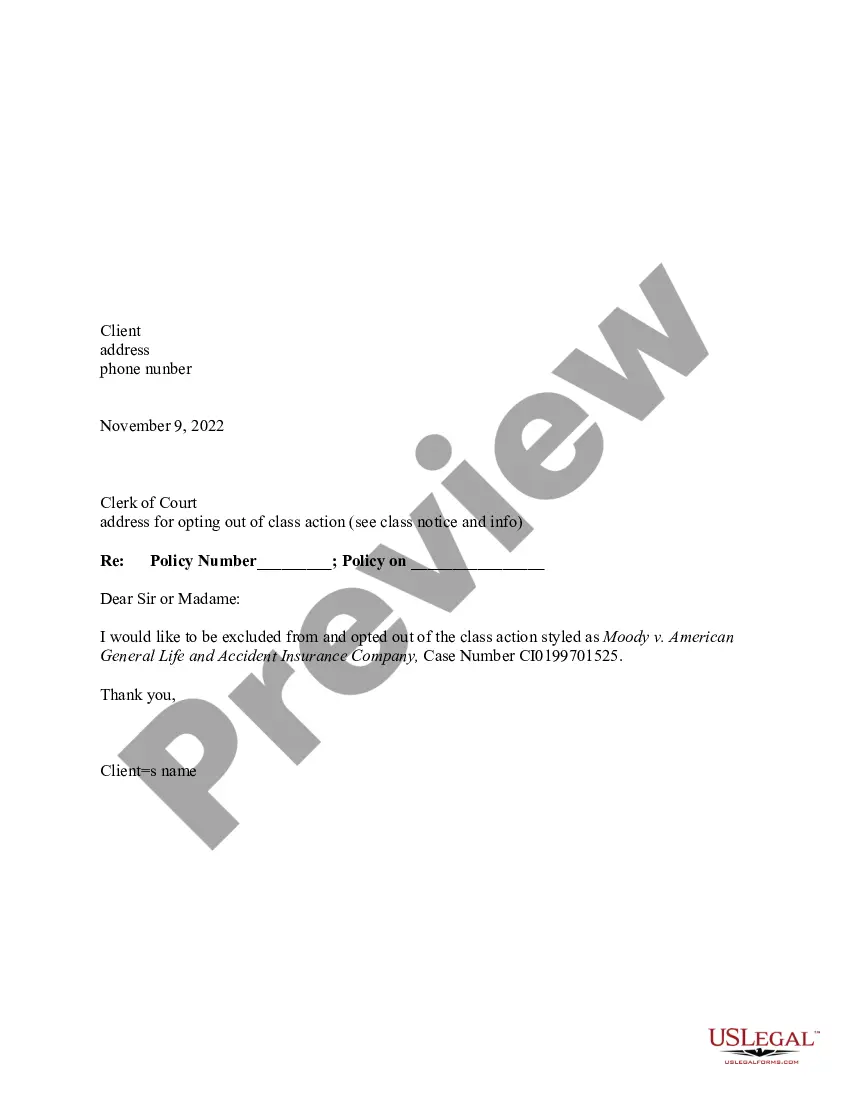

How to fill out Partial Assignment Of Life Insurance Policy As Collateral?

If you have to total, down load, or print out authorized document web templates, use US Legal Forms, the largest variety of authorized types, which can be found on the web. Take advantage of the site`s simple and hassle-free lookup to get the documents you want. A variety of web templates for business and specific uses are categorized by categories and states, or search phrases. Use US Legal Forms to get the District of Columbia Partial Assignment of Life Insurance Policy as Collateral in a few click throughs.

In case you are presently a US Legal Forms client, log in to the account and click the Acquire button to have the District of Columbia Partial Assignment of Life Insurance Policy as Collateral. You can even access types you previously downloaded inside the My Forms tab of the account.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have chosen the shape for your proper town/country.

- Step 2. Take advantage of the Review option to look over the form`s content. Don`t forget about to read through the explanation.

- Step 3. In case you are not satisfied with the develop, make use of the Lookup field on top of the display screen to find other versions from the authorized develop template.

- Step 4. Upon having identified the shape you want, click on the Purchase now button. Opt for the pricing strategy you favor and add your credentials to sign up for an account.

- Step 5. Approach the financial transaction. You can utilize your credit card or PayPal account to accomplish the financial transaction.

- Step 6. Find the file format from the authorized develop and down load it on the product.

- Step 7. Complete, modify and print out or signal the District of Columbia Partial Assignment of Life Insurance Policy as Collateral.

Each authorized document template you purchase is the one you have permanently. You possess acces to each develop you downloaded with your acccount. Click the My Forms segment and pick a develop to print out or down load once more.

Be competitive and down load, and print out the District of Columbia Partial Assignment of Life Insurance Policy as Collateral with US Legal Forms. There are millions of specialist and condition-distinct types you may use for the business or specific demands.

Form popularity

FAQ

A collateral assignment pledges a permanent life insurance policy's cash value and death benefits to another party and is most commonly used to secure a loan taken out by the policyowner. A collateral assignment primarily serves to protect the repayment interest of the lender.

A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to some or all of the death benefit until the loan is repaid. The death benefit is used as collateral for a loan.

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.

If one already has a life insurance policy with a face value greater than the loan amount, he can collaterally assign that policy by requesting the paperwork from the insurer. If one doesn't have a life insurance policy or needs additional coverage, he will need to apply for life insurance and go through underwriting.

Right to Transfer Ownership If the policy has an irrevocable beneficiary, then the owner must obtain his/her written consent for the change. The owner must submit a written request to the insurance company to change ownership of the policy.

Which of the following is an example of a collateral assignment? A collateral assignment is typically used when an insurance policy is used as collateral for a loan. This is a temporary assignment until the debt is paid in full.

Collateral assignment, on the other hand, is a temporary and often revocable arrangement. The policyholder retains ownership and control over the policy but agrees that the lender has a claim to a part of the death benefit if the loan is not repaid.

If you have a life insurance policy, you're in luck, because most businesses typically accept life insurance as collateral as they can guarantee funds if the borrower dies or defaults.

Under partial assignment, only the designated amount is paid to the assignee. Rest of the proceeds are paid to the nominee. If your expected insurance proceeds are more than the loan amount, you should opt for partial assignment.

A life insurance policy can be assigned when rights of one person are transferred to another. The rights to your insurance policy can be transferred to someone else for various reasons. The process is known as assignment.