District of Columbia Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral

Description

How to fill out Assignment Of Life Insurance Proceeds To A Funeral Director For The Purpose Of Arranging A Funeral?

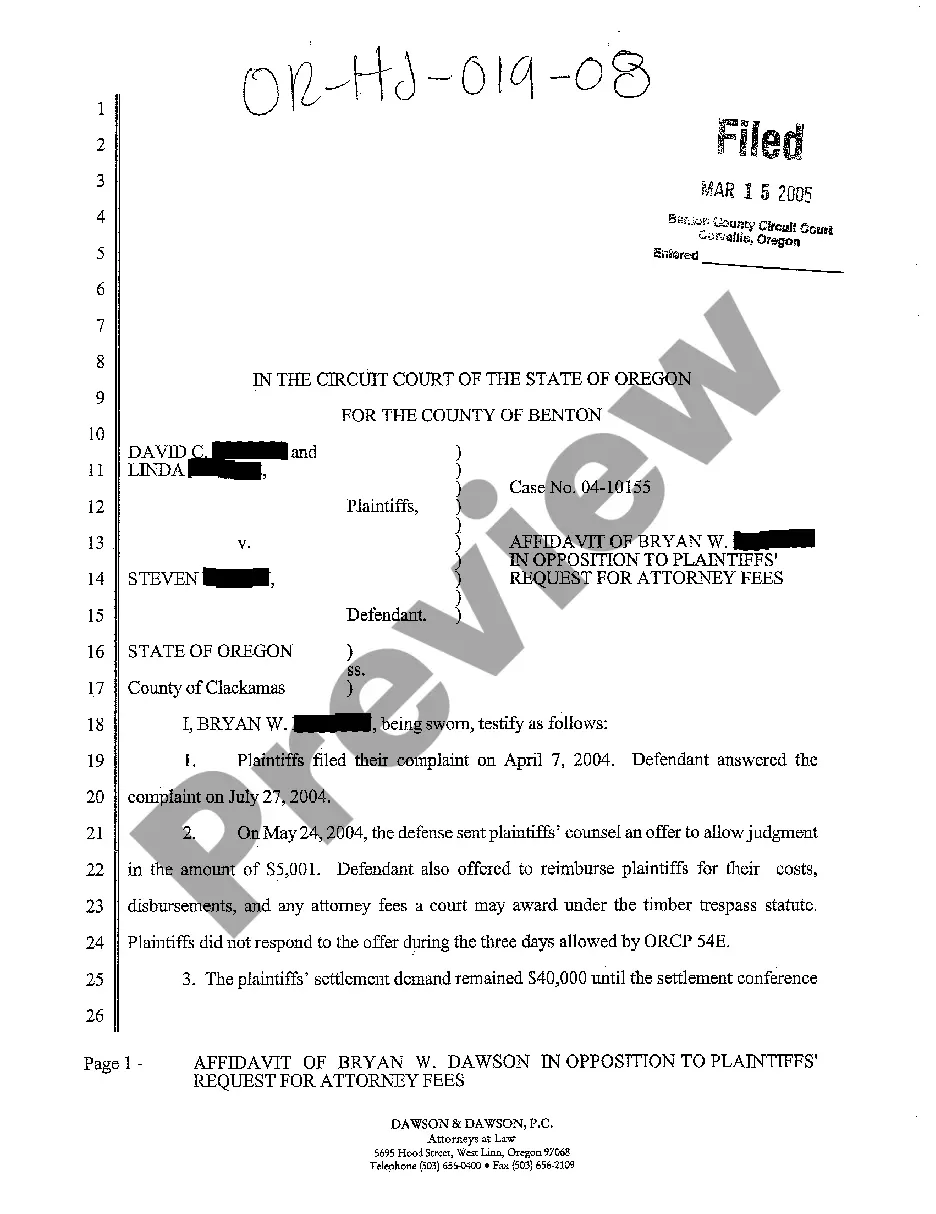

Have you been in a situation in which you require files for both business or individual uses just about every day time? There are a lot of lawful record themes available on the Internet, but discovering ones you can rely on is not simple. US Legal Forms gives a huge number of develop themes, like the District of Columbia Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral, that are created to satisfy federal and state specifications.

Should you be previously familiar with US Legal Forms website and have an account, merely log in. Following that, you are able to download the District of Columbia Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral format.

If you do not come with an accounts and wish to start using US Legal Forms, abide by these steps:

- Obtain the develop you will need and make sure it is to the appropriate city/state.

- Utilize the Preview button to review the form.

- Browse the information to actually have chosen the proper develop.

- In the event the develop is not what you are looking for, make use of the Lookup discipline to find the develop that meets your requirements and specifications.

- When you obtain the appropriate develop, click Purchase now.

- Pick the rates program you would like, complete the required info to create your money, and buy the transaction with your PayPal or charge card.

- Pick a handy data file formatting and download your backup.

Discover all the record themes you might have bought in the My Forms menu. You can obtain a further backup of District of Columbia Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral at any time, if needed. Just go through the required develop to download or print out the record format.

Use US Legal Forms, the most considerable selection of lawful types, to conserve efforts and stay away from faults. The assistance gives skillfully made lawful record themes which you can use for a range of uses. Generate an account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

Lesson Summary. In a life insurance assignment, a policy owner transfers his ownership rights of the policy to another party. The original owner is the assignor and the second party is the assignee. Life Insurance Assignments: Definition & Parties - Study.com study.com ? academy ? lesson ? life-insurance-ass... study.com ? academy ? lesson ? life-insurance-ass...

Embalming for a fee without permission; requiring the purchase of a casket for direct cremation; requiring consumers to buy certain funeral goods or services as a condition for furnishing other funeral goods or services; and. engaging in other deceptive or unfair practices.

Does life insurance cover burial costs? Yes, life insurance policies will pay a lump sum when you die to a beneficiary of your choice. That money can be used to pay for your funeral or for any other general financial needs of your survivors.

A life insurance policy can be assigned when rights of one person are transferred to another. The rights to your insurance policy can be transferred to someone else for various reasons. The process is known as assignment. What is Assignment and Nomination in Life Insurance? futuregenerali.in ? life-insurance-made-simple futuregenerali.in ? life-insurance-made-simple

The recipient will complete a form to designate the benefits directly to the funeral provider or a third party, who then files a claim with the life insurance company. Policyholders can choose this option when pre-planning a funeral by naming the funeral home as the primary beneficiary.

The recipient will complete a form to designate the benefits directly to the funeral provider or a third party, who then files a claim with the life insurance company. Policyholders can choose this option when pre-planning a funeral by naming the funeral home as the primary beneficiary. How to Use Life Insurance to Pay for Funeral Expenses Funeralocity ? blog ? how-to-use-life... Funeralocity ? blog ? how-to-use-life...

A Funeral Assignment is an agreement that is signed by a beneficiary of a life insurance policy. The beneficiary assigns all or a portion of the life insurance benefits at the Funeral Home which allows payment for funeral expenses to be made directly to the funeral home. Yes, NYL GBS does accept Funeral Assignments.

Funeral homes are disallowed by law in most areas to be the beneficiary because the cost can vary and you may change locations. You can request assignment papers from the insurance company and request a certain amount of your death benefit be paid to a funeral home. Can a funeral home be a life insurance beneficiary? LifeInsuranceTypes.com ? can-funeral-hom... LifeInsuranceTypes.com ? can-funeral-hom...