District of Columbia General Form of Receipt

Description

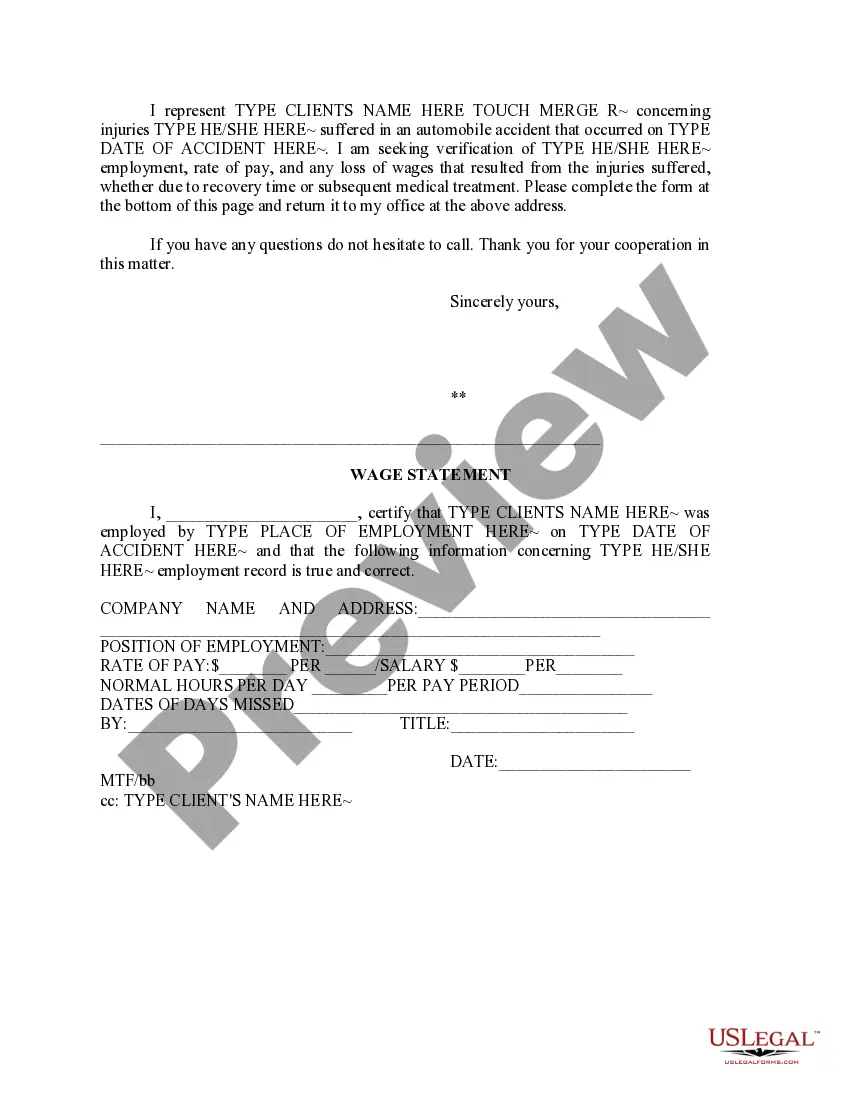

How to fill out General Form Of Receipt?

Selecting the optimal sanctioned document template can be a challenge.

Of course, there are countless templates accessible on the internet, but how do you find the authorized form you seek.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the District of Columbia General Form of Receipt, which can be utilized for both business and personal purposes.

- Each of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the District of Columbia General Form of Receipt.

- Use your account to view the authorized forms you have previously purchased.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions to follow.

- First, ensure you have selected the correct form for your city/state. You can browse the form using the Preview button and review the form description to confirm it is the right one for you.

Form popularity

FAQ

To file for a tax exemption in Washington, D.C., you must complete a specific application form based on the type of exemption you are seeking. Common exemptions include those for nonprofit organizations or certain business activities. It's crucial to provide all required documentation to support your claim. The District of Columbia General Form of Receipt can assist you in compiling the necessary information to present a strong case for your exemption.

Form D-30 is the District of Columbia's tax form for unincorporated businesses. This form is specifically used to report business income and calculate taxes owed. Businesses must ensure accurate completion of this form to meet tax obligations in D.C. You may find the District of Columbia General Form of Receipt helpful for organizing your information when filing Form D-30.

Restaurants in Washington, D.C. are subject to the sales tax, which varies based on the types of goods sold. For most food and beverages, the sales tax is typically around 10 percent. Additionally, restaurants may need to consider the unincorporated business tax. Understanding how to navigate these taxes is crucial, and utilizing the District of Columbia General Form of Receipt can help streamline your tax compliance.

Any business operating in the District of Columbia that is not incorporated is required to file the unincorporated business franchise tax. This includes partnerships and sole proprietorships. Essentially, if your business conducts operations within Washington, D.C., you need to file. Using the District of Columbia General Form of Receipt can aid in managing your filing process efficiently.

DC tax refers to various taxes levied by the District of Columbia government, including income tax, property tax, and business tax. It is important to be aware of these taxes as they influence how businesses and individuals operate in the area. Uslegalforms provides essential resources to help you manage your tax obligations effectively, including the District of Columbia General Form of Receipt that you may need when filing.

The DC unincorporated business franchise tax form is necessary for businesses operating not as a corporation but still earning income in D.C. This tax applies to all unincorporated businesses and helps ensure you're compliant with local tax laws. For a smoother filing process, uslegalforms offers useful resources to help you understand the District of Columbia General Form of Receipt and related requirements.

The Schedule D tax form is designed for reporting capital gains and losses in your federal tax return. While it is primarily for federal use, understanding how it interacts with local tax forms like the District of Columbia General Form of Receipt can help you in accurate tax preparation. For clear instructions and forms, check uslegalforms in conjunction with your tax planning.

The DC D 30 tax form is used for reporting unincorporated business income in Washington, D.C. This form allows businesses to calculate their taxable income and the tax owed accordingly. To simplify the process, you can rely on uslegalforms to access a complete guide on filling out the District of Columbia General Form of Receipt, ensuring compliance with local regulations.

Any individual or business owning personal property in the District of Columbia must file a DC personal property tax return. This includes various items such as furniture, machinery, and equipment. If you are unsure whether you need to file, consult our resources at uslegalforms for guidance tailored to your situation and to help you navigate the District of Columbia General Form of Receipt.

The DC tax return, specifically the District of Columbia General Form of Receipt, can be found on the official Office of Tax and Revenue website. If you need assistance locating the form, consider visiting uslegalforms. We provide a user-friendly platform to access necessary tax forms, ensuring you have what you need when filing your taxes.